Arizona Sample Letter for Policy on Vehicle Expense Reimbursement

Description

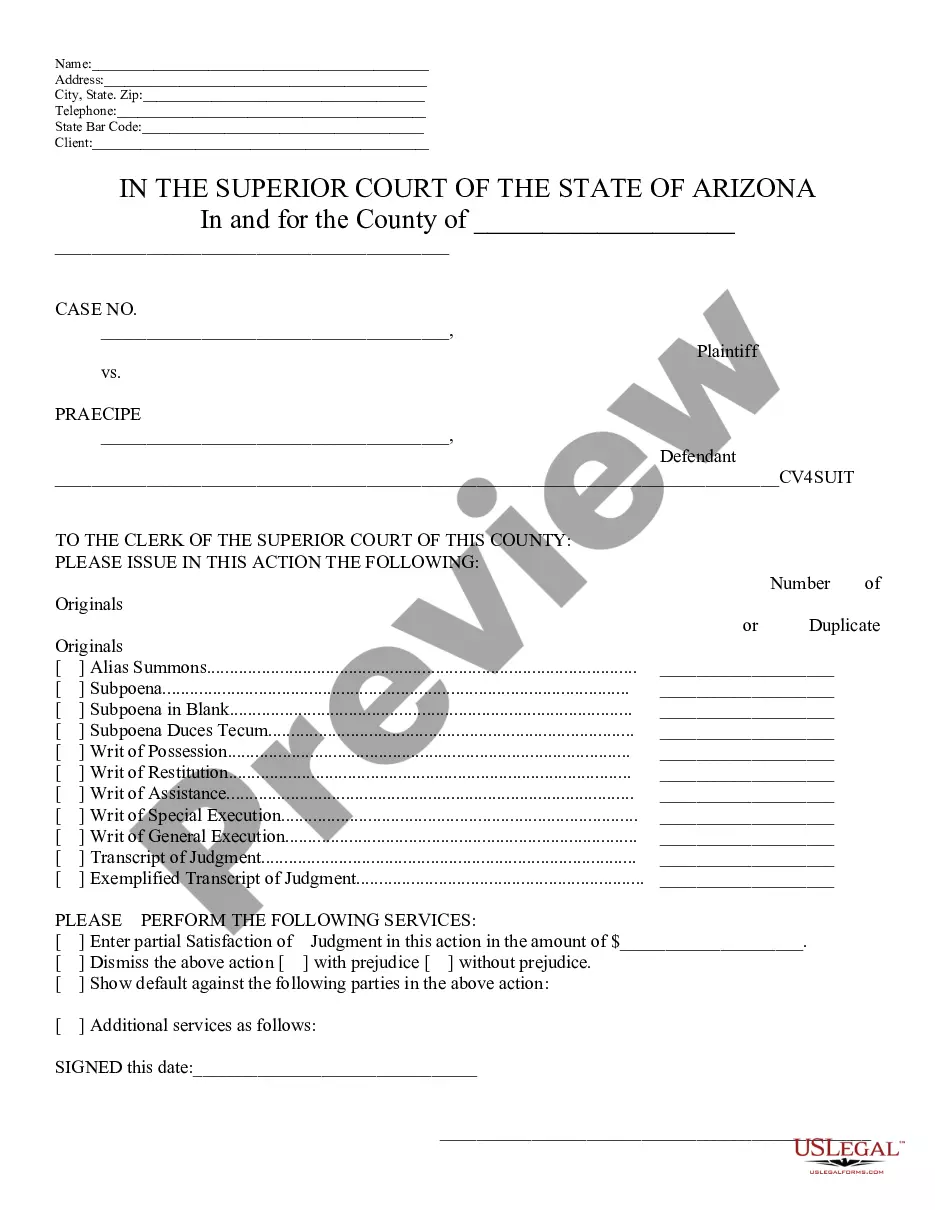

How to fill out Sample Letter For Policy On Vehicle Expense Reimbursement?

If you need extensive, acquire, or printing official document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Make use of the website's straightforward and convenient search to locate the documents you need.

Numerous templates for business and personal purposes are organized by categories and states, or keywords.

Step 5. Complete the purchase. You can use your credit card or PayPal account to finalize the transaction.

Step 6. Select the format of the legal form and download it to your device. Step 7. Complete, edit and print or sign the Arizona Sample Letter for Policy on Vehicle Expense Reimbursement.

- Utilize US Legal Forms to locate the Arizona Sample Letter for Policy on Vehicle Expense Reimbursement with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to access the Arizona Sample Letter for Policy on Vehicle Expense Reimbursement.

- You can also access forms you previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, refer to the guidelines below.

- Step 1. Ensure you selected the form for your appropriate city/state.

- Step 2. Use the Preview option to review the form's content. Remember to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search area at the top of the screen to find alternative versions of the legal form template.

- Step 4. After locating the form you want, click the Purchase now button. Choose the pricing plan you prefer and enter your details to register for an account.

Form popularity

FAQ

Proof of payment for reimbursement usually includes receipts, bank statements, or any documentation that verifies the transaction. It's essential to keep these records organized to ensure smooth processing of your request. Referring to the Arizona Sample Letter for Policy on Vehicle Expense Reimbursement can help format your proof effectively when submitting it.

In writing a letter for a refund request, begin with a formal greeting and briefly explain the situation leading to your refund necessity. Be sure to mention the amount and relate it to the Arizona Sample Letter for Policy on Vehicle Expense Reimbursement for context. Conclude with a clear call to action, requesting a timely resolution.

Recording reimbursement involves entering the reimbursed amounts into your accounting system or expense tracking software. You should categorize these entries by type of expense for future reference. Utilizing the Arizona Sample Letter for Policy on Vehicle Expense Reimbursement can ensure that the reason for each entry is clear, aiding in future reviews.

Reporting reimbursed expenses typically requires filling out a specific form or submitting a report to your finance department. Make sure to include all necessary documentation, such as receipts, to substantiate your expense claims. Following the protocol set forth in the Arizona Sample Letter for Policy on Vehicle Expense Reimbursement can simplify this process.

A formal letter for reimbursement should include your contact details, the date, and the recipient's information at the top. Clearly articulate your reimbursement request, supporting it with specific details of the expenses as guided by the Arizona Sample Letter for Policy on Vehicle Expense Reimbursement. Ensure you format the letter professionally, with a suitable closing statement.

To politely request reimbursement, express appreciation for the review of your previous expenses. Use respectful language and frame your request by stating the amount and referencing the Arizona Sample Letter for Policy on Vehicle Expense Reimbursement. Additionally, a courteous closing can enhance the tone of your request.

Writing a reimbursement request involves clearly stating the purpose of the communication, itemizing the expenses, and including supporting documents. Utilizing the Arizona Sample Letter for Policy on Vehicle Expense Reimbursement as a template can guide you in framing your request. Make sure to sign off professionally to convey seriousness.

Documentation for reimbursement should include receipts, invoices, and any relevant correspondence. It’s beneficial to create a summary table that lists each item alongside its corresponding receipt. This organized approach aligns with the Arizona Sample Letter for Policy on Vehicle Expense Reimbursement, ensuring complete clarity in your request.

To write an effective email for reimbursement, start with a clear subject line that specifies your request, such as 'Reimbursement Request for Vehicle Expenses.' In the body, state the purpose of your email, detail the expenses incurred, and reference the relevant Arizona Sample Letter for Policy on Vehicle Expense Reimbursement. End with your contact information and a polite closing.

When writing a request for reimbursement, start with a polite greeting and briefly state your intention. Clearly outline the expenses, including dates and amounts, along with any relevant receipts or documentation. The Arizona Sample Letter for Policy on Vehicle Expense Reimbursement can be an excellent resource to help structure your request effectively, ensuring that it meets all necessary requirements and facilitates a smoother approval process.