Arizona Sample Letter to Foreclosure Attorney - After Foreclosure - Did not Receive Notice

Description

How to fill out Sample Letter To Foreclosure Attorney - After Foreclosure - Did Not Receive Notice?

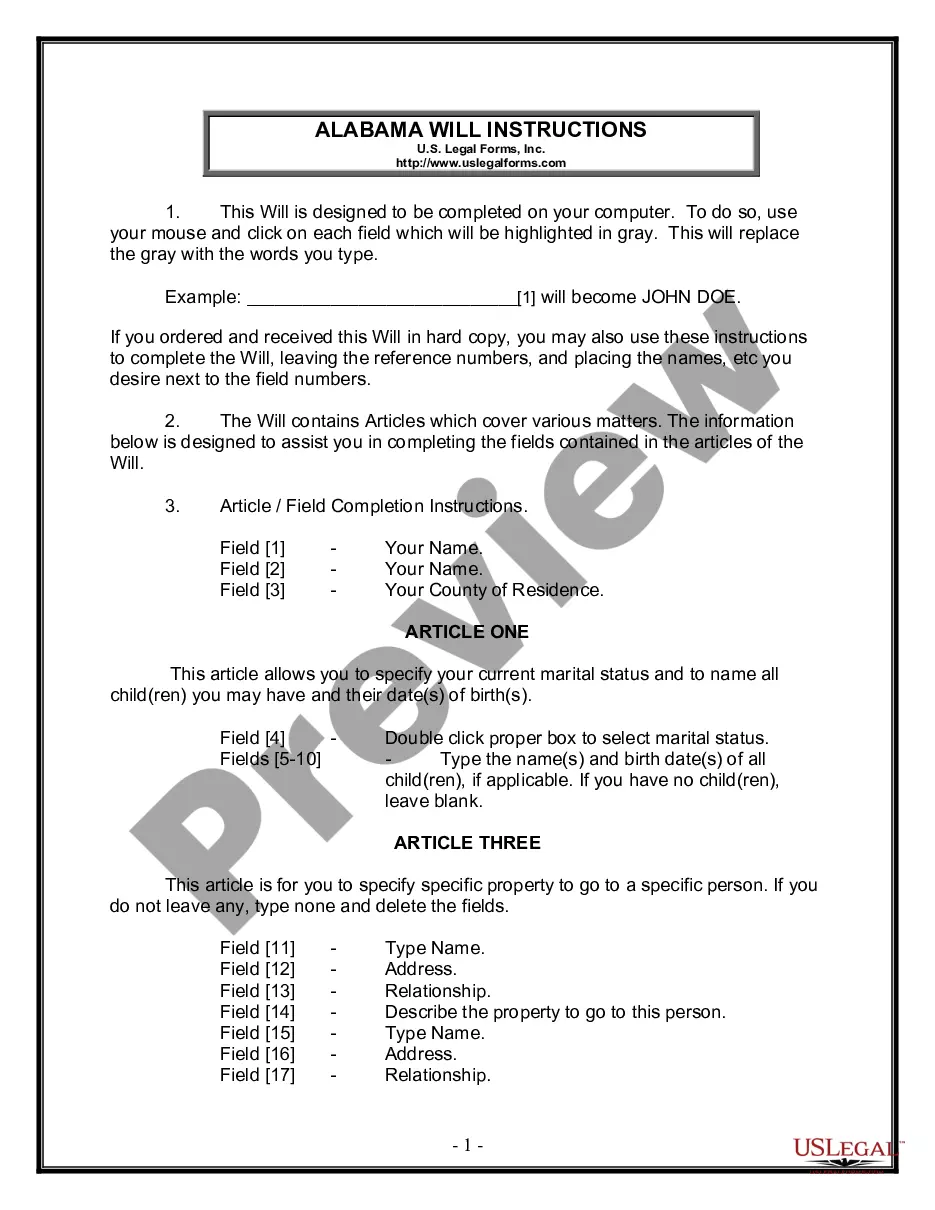

Choosing the right legal record template can be quite a struggle. Naturally, there are a variety of templates available on the Internet, but how can you discover the legal kind you will need? Utilize the US Legal Forms web site. The assistance offers 1000s of templates, including the Arizona Sample Letter to Foreclosure Attorney - After Foreclosure - Did not Receive Notice, that you can use for enterprise and personal demands. Every one of the varieties are examined by pros and meet state and federal specifications.

If you are presently listed, log in to your accounts and click on the Obtain button to find the Arizona Sample Letter to Foreclosure Attorney - After Foreclosure - Did not Receive Notice. Make use of accounts to appear from the legal varieties you have acquired formerly. Proceed to the My Forms tab of your accounts and obtain yet another version from the record you will need.

If you are a brand new consumer of US Legal Forms, listed below are basic directions so that you can stick to:

- Initially, make certain you have selected the correct kind for your personal town/area. It is possible to look over the shape making use of the Preview button and browse the shape description to ensure it is the right one for you.

- In case the kind fails to meet your preferences, utilize the Seach discipline to find the right kind.

- When you are certain that the shape would work, select the Acquire now button to find the kind.

- Pick the costs strategy you would like and type in the needed information. Build your accounts and purchase the order with your PayPal accounts or credit card.

- Pick the document file format and acquire the legal record template to your gadget.

- Comprehensive, revise and produce and signal the acquired Arizona Sample Letter to Foreclosure Attorney - After Foreclosure - Did not Receive Notice.

US Legal Forms is the biggest library of legal varieties in which you can find various record templates. Utilize the service to acquire professionally-manufactured paperwork that stick to express specifications.

Form popularity

FAQ

Most mortgages have a power of sale clause, so lenders can foreclose without going to court (non-judicial). These are the most common type of foreclosures in California.

Power of Sale. Non-judicial foreclosure auctions are often more expedient, though they may be subject to judicial review to ensure the legality of the proceedings.

Put your name, address, phone number, loan number, and date on the top of the letter. List the name and address of your lender. information about any money you have saved for a workout agreement. Tell the lender you are working with a foreclosure counselor and include their name and agency.

Foreclosure Laws in Arizona A notice of sale must be published in a newspaper located in the county where the property is located. The notice must be placed on the property 20 days before the sale date and it must be recorded in the recorder's office in the county where the property is located.

In Arizona, a lender must foreclose its lien within six-years of the date of the borrower's default (A.R.S. § 12-548).

Your mortgage servicer might offer the following options as an alternative to foreclosure: Forbearance. This option temporarily suspends payments, allowing you time to make up the shortfall. ... Repayment Plan. ... Loan Modification. ... Refinance. ... Partial Claim. ... Forgiving a Payment.

Which state has the quickest foreclosure process? The state with the quickest foreclosure process is Montana, followed by Mississippi, West Virginia, Wyoming, and Minnesota.

Nonjudicial foreclosures can be a faster process than judicial foreclosures as they do not involve having to go to court.