The Arizona Loan Agreement for Property is a legal contract that outlines the terms and conditions between a lender and a borrower regarding a loan secured by a property in the state of Arizona. This agreement is commonly used in real estate transactions where funds are provided by a lender to a borrower for the purchase or refinancing of a property. This loan agreement includes several key elements such as the loan amount, interest rate, repayment terms, collateral, and other provisions specific to the property and borrower. It serves as a binding document that protects the rights and obligations of both parties involved. There are different types of Arizona Loan Agreements for Property that vary based on the specific purpose or type of loan. Some common types include: 1. Mortgage Loan Agreement: This type of loan agreement is used when the borrower needs funding for purchasing a property. It entails details about the loan amount, interest rate, payment schedule, and the property being purchased as collateral. 2. Refinance Loan Agreement: This agreement is utilized when the borrower intends to replace an existing loan on the property with a new loan. It outlines the terms of the new loan, including the amount, interest rate, repayment terms, and any fees associated with the refinancing process. 3. Home Equity Loan Agreement: In this scenario, the borrower uses the equity built up in their property as collateral to obtain a loan. The loan agreement specifies the amount, interest rate, repayment schedule, and the rights of the lender regarding the property's equity. 4. Construction Loan Agreement: This agreement is applicable when funds are provided to finance the construction or renovation of a property. It incorporates terms such as loan disbursement schedule based on project milestones, interest rate, repayment terms, and construction-related provisions. 5. Bridge Loan Agreement: A bridge loan agreement is used when a borrower requires temporary financing to bridge the gap between the purchase of a new property and the sale of an existing property. It includes details about the loan amount, repayment time frame, and the property being used as collateral. It is important for both lenders and borrowers to thoroughly review and understand the terms and conditions outlined in an Arizona Loan Agreement for Property. Seeking legal advice and conducting due diligence is highly recommended ensuring compliance with state laws and to protect the rights and interests of both parties involved in the transaction.

Arizona Loan Agreement for Property

Description

How to fill out Arizona Loan Agreement For Property?

If you wish to comprehensive, down load, or produce authorized record themes, use US Legal Forms, the biggest selection of authorized types, which can be found on-line. Make use of the site`s easy and practical research to discover the paperwork you will need. Different themes for company and person purposes are categorized by classes and says, or keywords. Use US Legal Forms to discover the Arizona Loan Agreement for Property within a few mouse clicks.

In case you are currently a US Legal Forms buyer, log in in your bank account and click on the Download key to obtain the Arizona Loan Agreement for Property. You may also gain access to types you earlier saved inside the My Forms tab of the bank account.

If you are using US Legal Forms initially, refer to the instructions listed below:

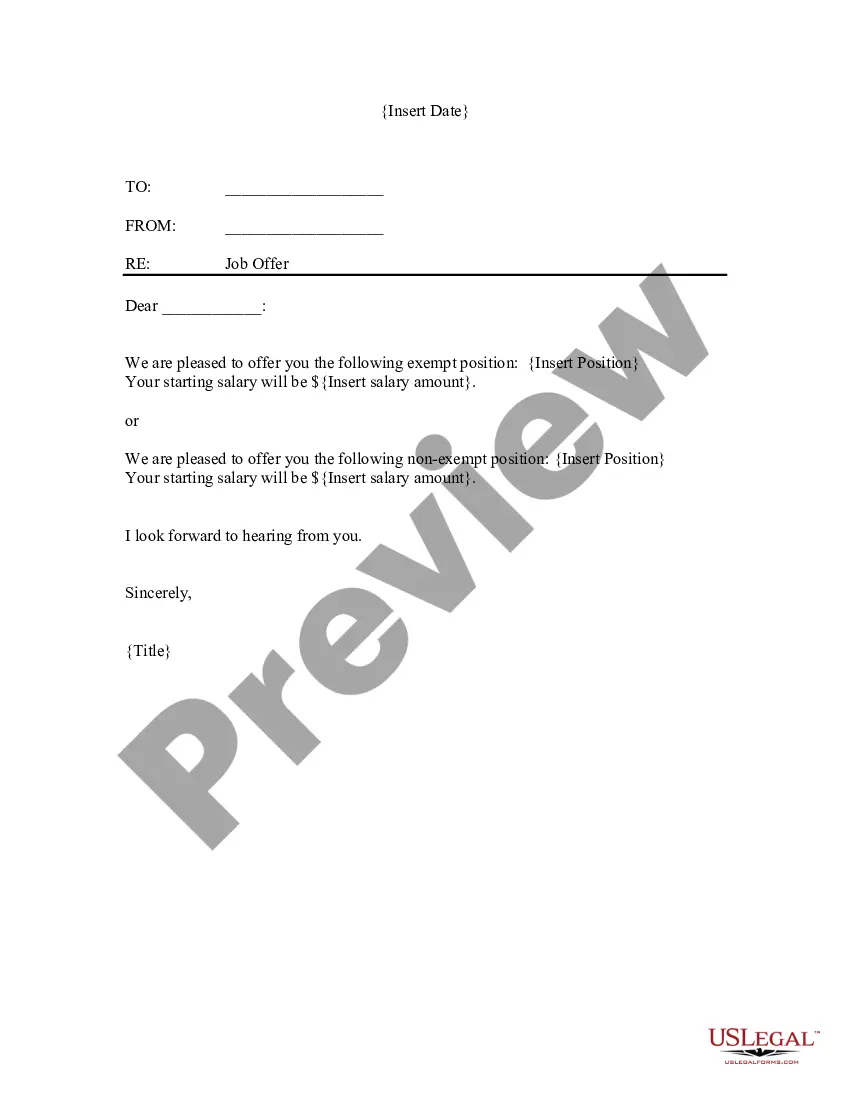

- Step 1. Make sure you have chosen the shape for your appropriate city/country.

- Step 2. Utilize the Review option to look through the form`s content. Don`t neglect to learn the information.

- Step 3. In case you are unhappy together with the form, use the Lookup discipline towards the top of the screen to locate other variations of the authorized form format.

- Step 4. When you have identified the shape you will need, click on the Buy now key. Opt for the prices plan you like and put your references to sign up for the bank account.

- Step 5. Method the financial transaction. You may use your charge card or PayPal bank account to perform the financial transaction.

- Step 6. Select the formatting of the authorized form and down load it on your product.

- Step 7. Full, edit and produce or indication the Arizona Loan Agreement for Property.

Each and every authorized record format you buy is your own forever. You might have acces to each and every form you saved inside your acccount. Click the My Forms area and pick a form to produce or down load once again.

Remain competitive and down load, and produce the Arizona Loan Agreement for Property with US Legal Forms. There are thousands of skilled and condition-specific types you can utilize for the company or person demands.

Form popularity

FAQ

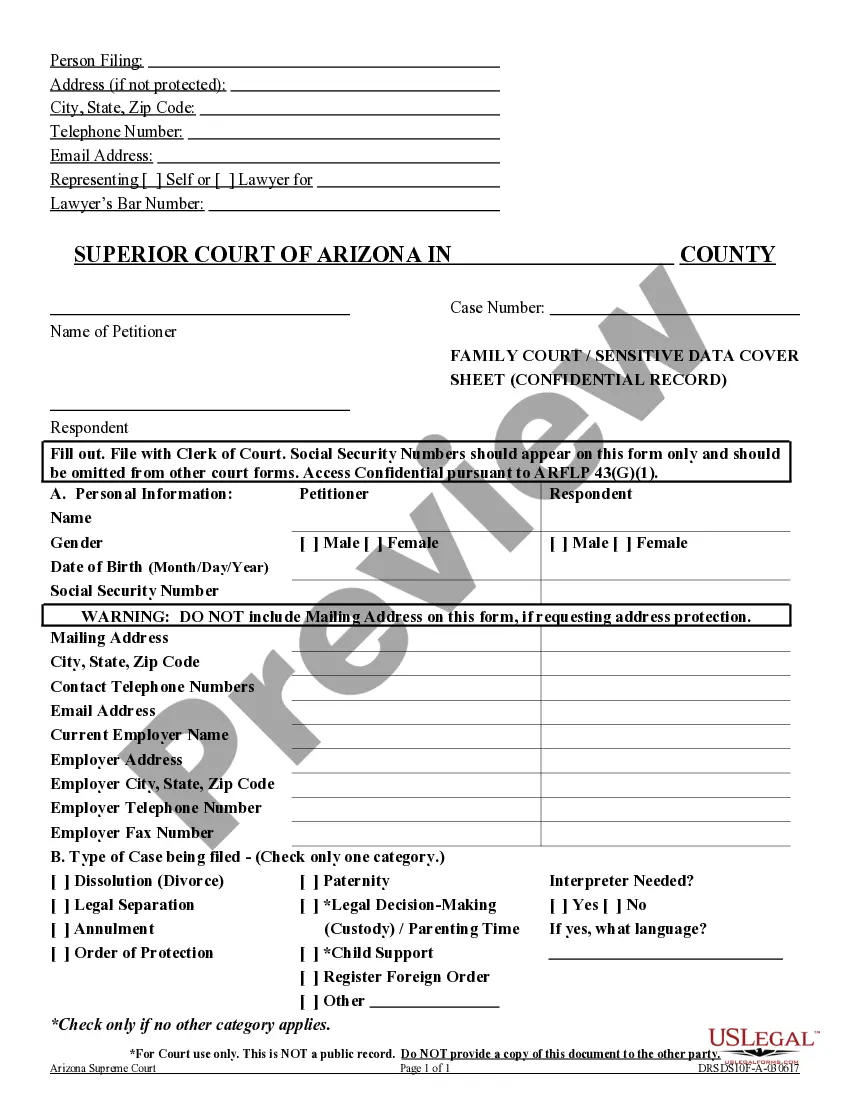

For a personal loan agreement to be enforceable, it must be documented in writing, as well as signed and dated by all parties involved. It's also a good idea to have the document notarized or signed by a witness.

In most cases, a contract does not have to be notarized since the signed contract itself is enforceable and legally binding in state or federal courts. Many types of written contracts don't require a notary public to be valid.

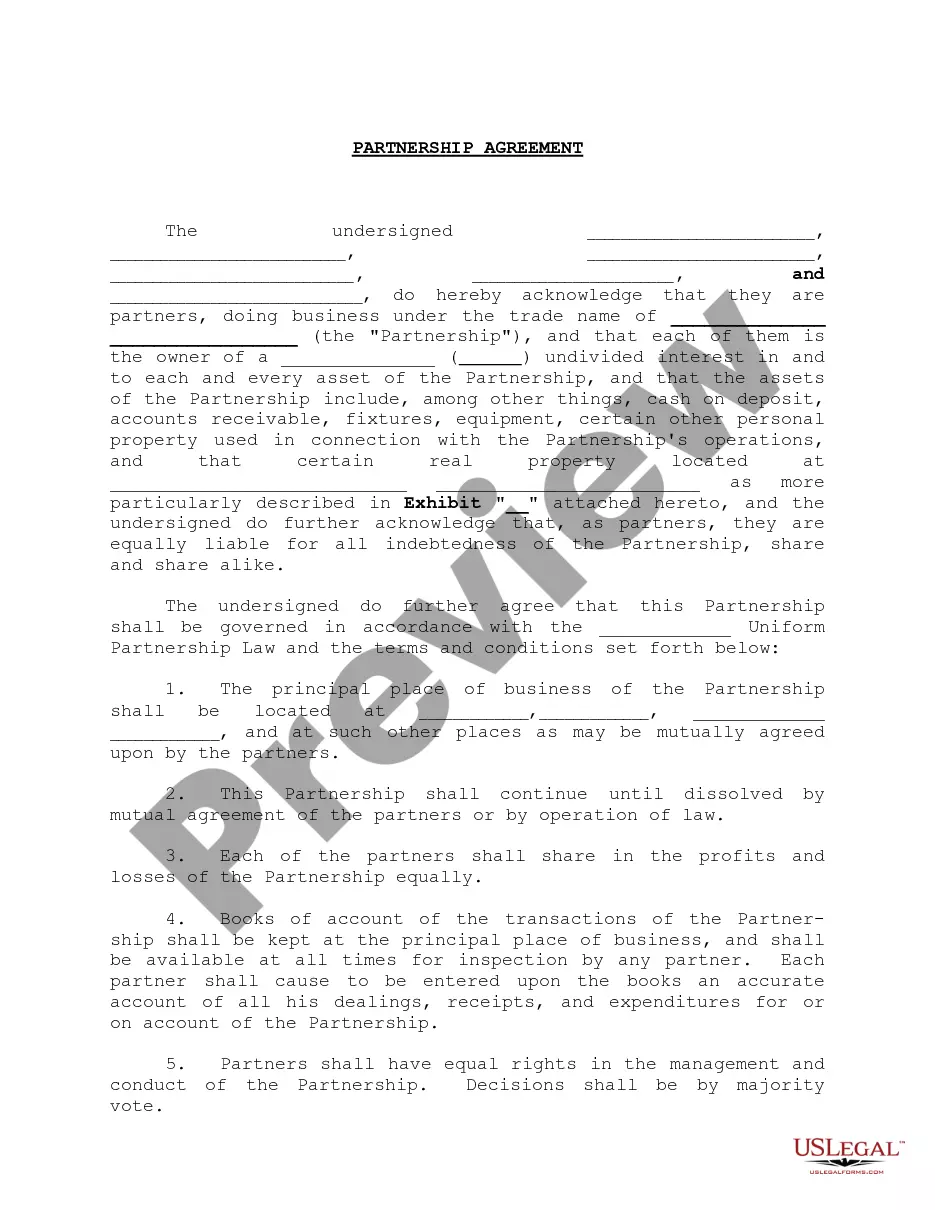

Loan agreements typically include covenants, value of collateral involved, guarantees, interest rate terms and the duration over which it must be repaid.

There are 10 basic provisions that should be in a loan agreement. Identity of the parties. The names of the lender and borrower need to be stated. ... Date of the agreement. ... Interest rate. ... Repayment terms. ... Default provisions. ... Signatures. ... Choice of law. ... Severability.

First and foremost, understand that personal loan agreements fall into the classification of contracts. Technically, you don't have to notarize these documents. But if you want to make this document legally binding, then notarization is the best course of action.

What should be in a personal loan contract? Names and addresses of the lender and the borrower. Information about the loan co-borrower or cosigner, if it's a joint personal loan. Loan amount and the method for disbursement (lump sum, installments, etc.) Date the loan was provided. Expected repayment date.

Promissory notes don't have to be notarized in most cases. You can typically sign a legally binding promissory note that contains unconditional pledges to pay a certain sum of money. However, you can strengthen the legality of a valid promissory note by having it notarized.

You can write up a personal loan agreement by hand, with pen and paper, or draft it on your computer. Once the document looks good, it can be printed out and signed by both parties.