Arizona Sample Letter for Notice of Estate Disbursement Plan - Waiver to Entry of Judgment

Description

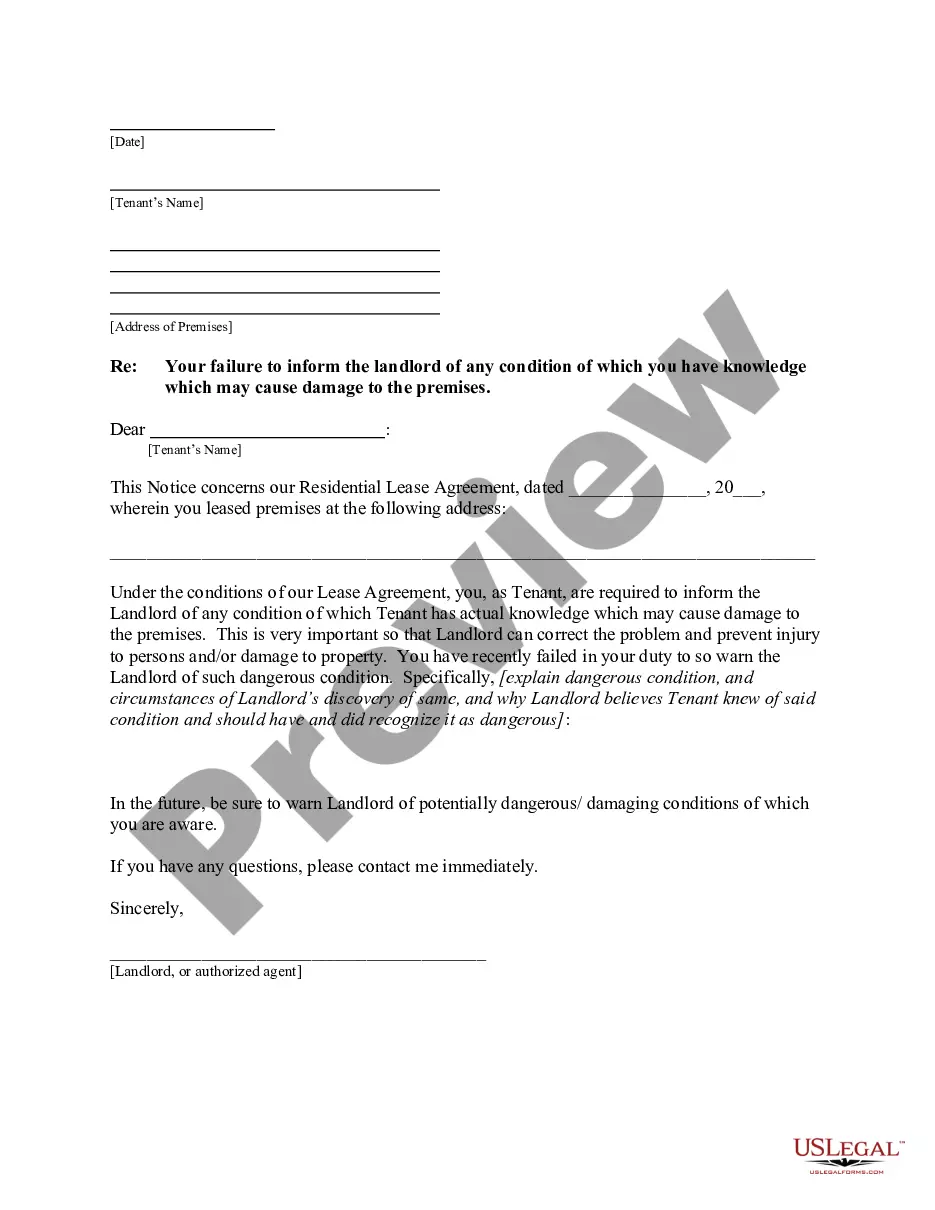

How to fill out Sample Letter For Notice Of Estate Disbursement Plan - Waiver To Entry Of Judgment?

If you want to complete, obtain, or produce lawful record layouts, use US Legal Forms, the greatest variety of lawful forms, which can be found on the Internet. Take advantage of the site`s simple and easy convenient look for to discover the documents you need. Various layouts for organization and person functions are sorted by categories and claims, or search phrases. Use US Legal Forms to discover the Arizona Sample Letter for Notice of Estate Disbursement Plan - Waiver to Entry of Judgment with a couple of clicks.

Should you be previously a US Legal Forms buyer, log in in your accounts and click the Acquire switch to get the Arizona Sample Letter for Notice of Estate Disbursement Plan - Waiver to Entry of Judgment. You may also accessibility forms you previously delivered electronically within the My Forms tab of the accounts.

Should you use US Legal Forms initially, follow the instructions beneath:

- Step 1. Ensure you have chosen the form for that right city/country.

- Step 2. Utilize the Review method to examine the form`s articles. Don`t neglect to read the outline.

- Step 3. Should you be unhappy together with the form, take advantage of the Research discipline at the top of the monitor to find other variations from the lawful form format.

- Step 4. Upon having discovered the form you need, click the Purchase now switch. Opt for the costs strategy you like and add your references to sign up on an accounts.

- Step 5. Approach the financial transaction. You can use your charge card or PayPal accounts to complete the financial transaction.

- Step 6. Find the structure from the lawful form and obtain it on your product.

- Step 7. Total, change and produce or sign the Arizona Sample Letter for Notice of Estate Disbursement Plan - Waiver to Entry of Judgment.

Each lawful record format you purchase is the one you have forever. You possess acces to each and every form you delivered electronically with your acccount. Select the My Forms area and choose a form to produce or obtain once more.

Remain competitive and obtain, and produce the Arizona Sample Letter for Notice of Estate Disbursement Plan - Waiver to Entry of Judgment with US Legal Forms. There are millions of professional and state-specific forms you may use for your organization or person needs.

Form popularity

FAQ

The following states have enacted in whole or in part the UPC: Idaho (1971) Alaska (1972) Arizona (1973)

To open probate proceedings, a family member or friend will need to file a petition with the county court. If the family members are in agreement, the court can appoint one of them to serve as the estate's executor or personal representative.

These might include: Court and filing fees. Attorney fees (if you use a probate lawyer) Executor compensation (averaging anywhere from around $25 - $50/hour; Arizona is a reasonable compensation state)

If you are survived by descendants but no spouse, your descendants will inherit all of your estate. If you die with no surviving spouse or descendants, your parents will inherit all of your estate. If you die with no surviving spouse, descendants or parents, your siblings will inherit all of your estate.

Once all the property has been distributed, the liquidator publishes a notice of closure confirming the estate has been settled.

Holding a last will does not suffice as a comprehensive measure to skip the probate process in Arizona. The execution of a will necessitates the requisite approval from a court of law. Thereby initiating the subsequent probate proceedings through which the decedent's assets shall duly pass.

However, there is a bright line limit in the amount of time when an estate should be closed and some form of Probate can proceed. In Arizona, a Probate case must be commenced within two years after a decedent's death. A.R.S. § 14-3108.

If the decedent has properly positioned all of their property as non-probate assets, probate will not be required. That said, even if all of your assets are positioned to bypass probate, it may still be wise to draft a will, so it's important to discuss your needs with a qualified estate planning attorney.