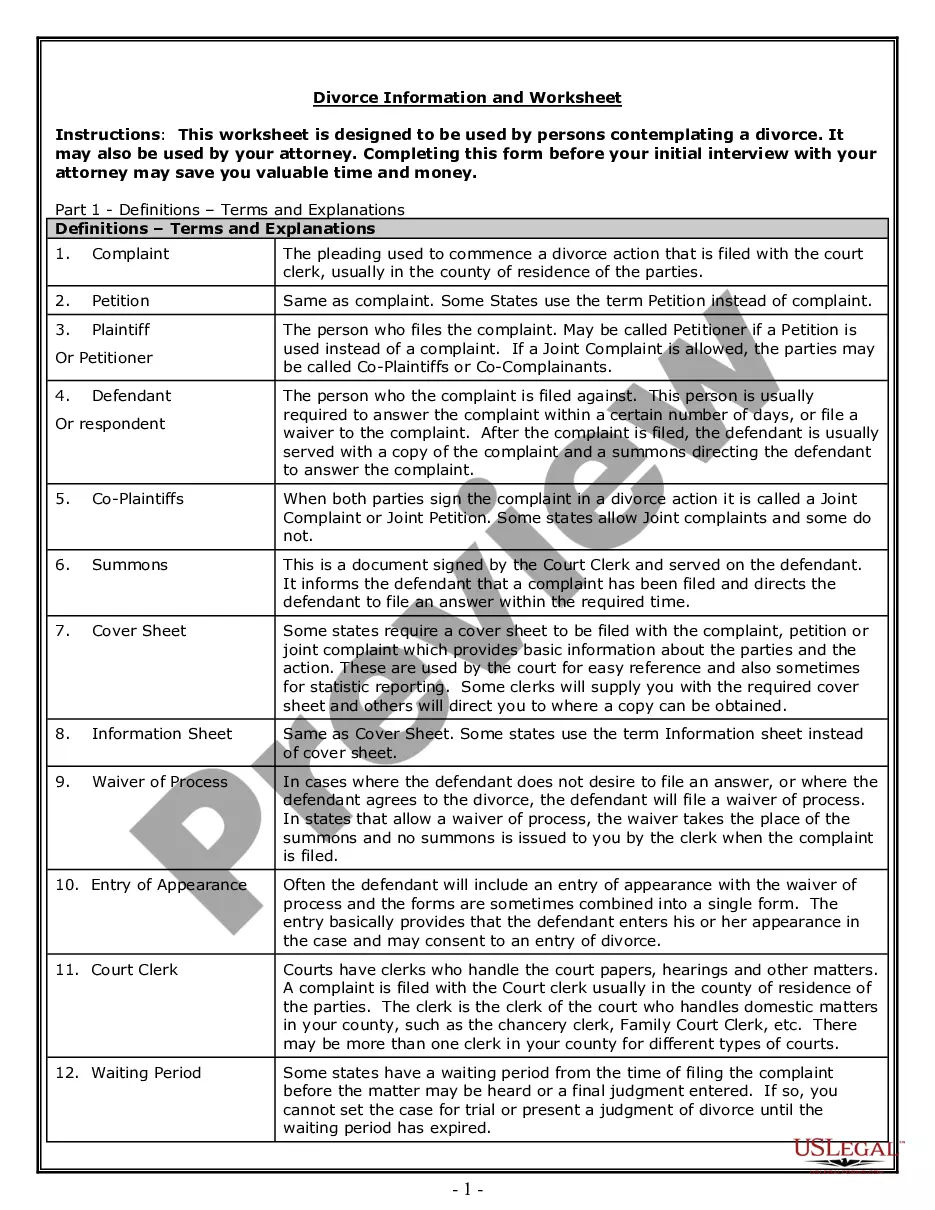

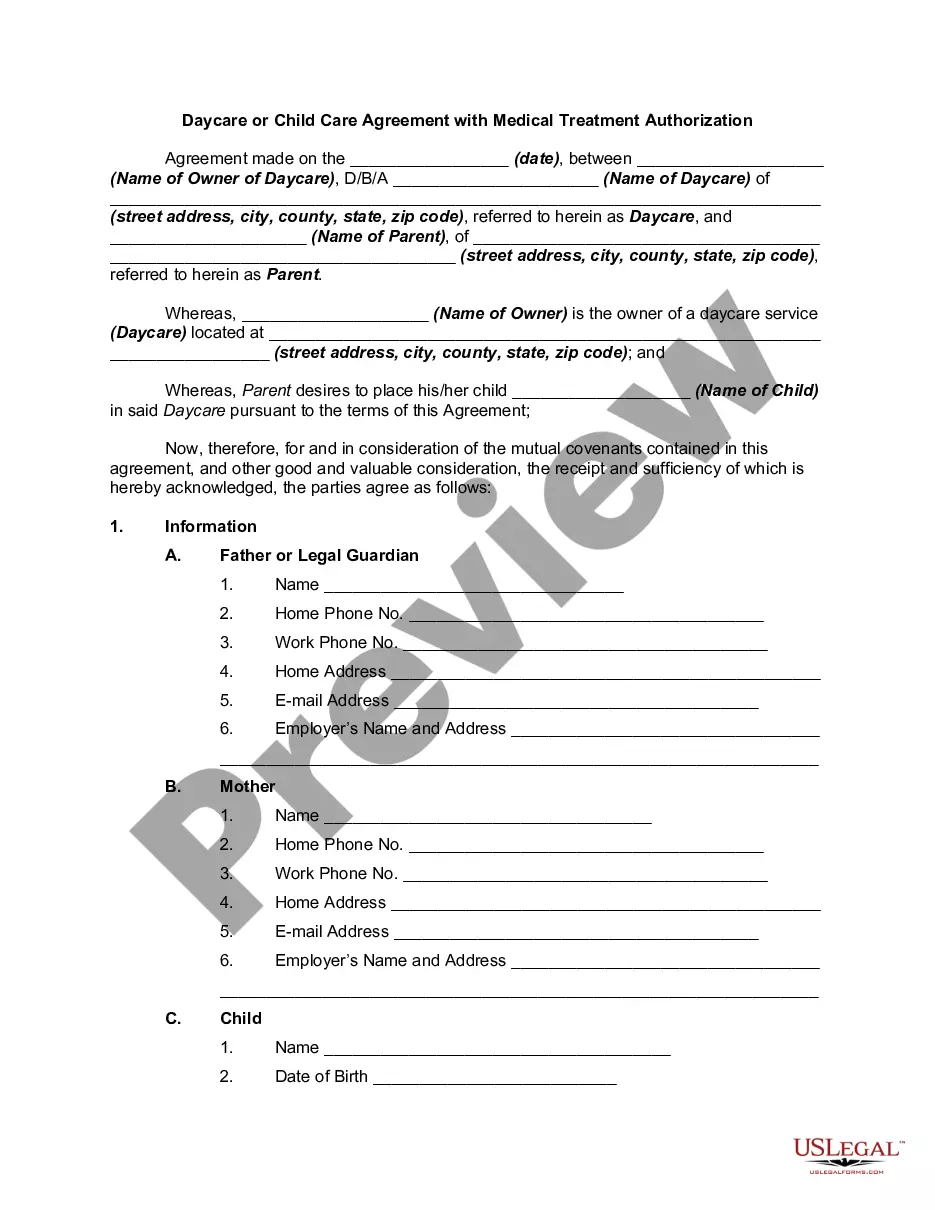

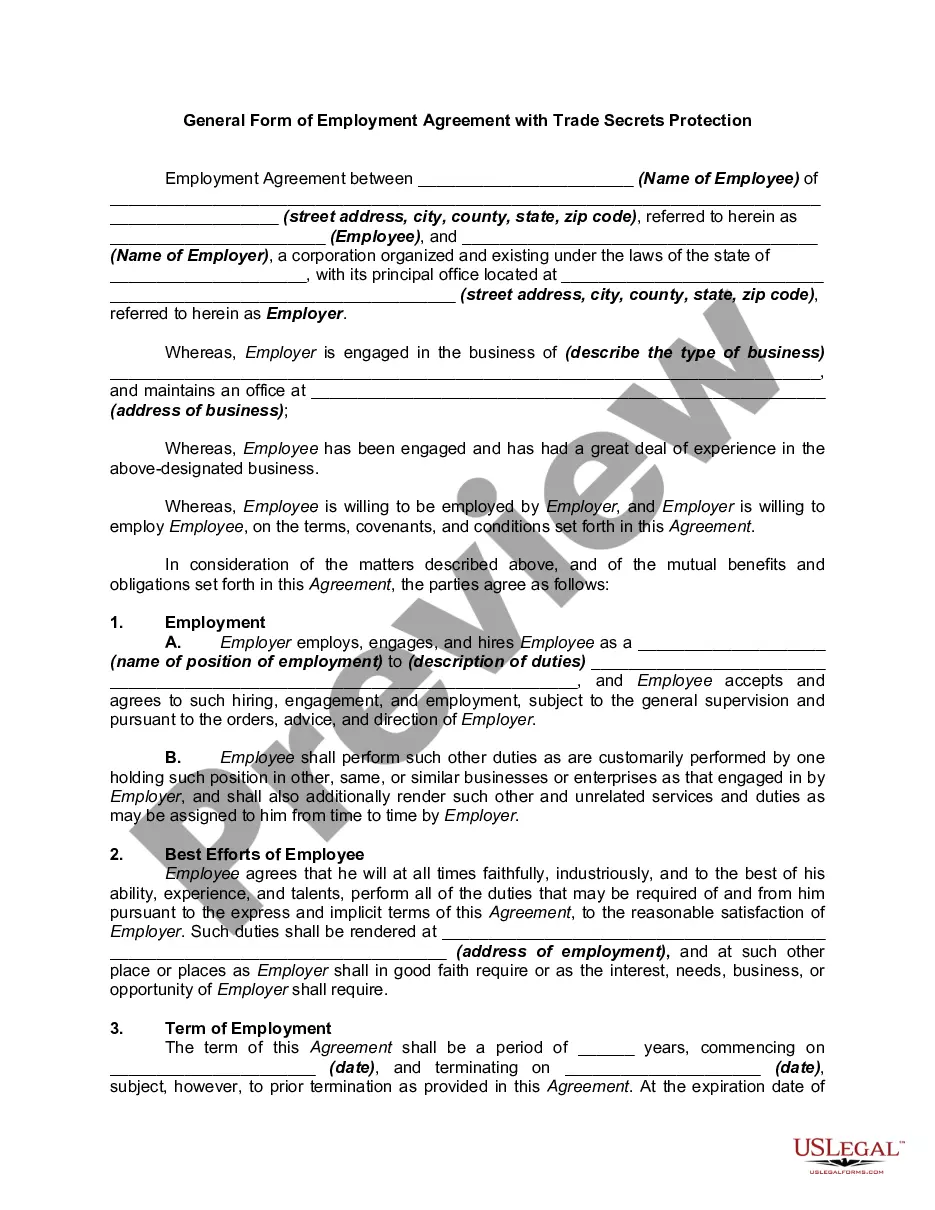

The Arizona Gift Agreement with Institution is a legal document that establishes the terms and conditions under which a gift is made to an educational institution or nonprofit organization in the state of Arizona. This agreement ensures that the donor's intentions are accurately documented and that the institution is legally bound to fulfill its obligations. There are several types of Arizona Gift Agreements with Institutions, each catering to different aspects and intentions of the donation: 1. Cash Gift Agreement: This agreement outlines the terms for a donation made in the form of cash. It details the amount of the gift, the payment schedule, and any conditions or restrictions associated with the donation. 2. Endowment Gift Agreement: Endowments are a form of donation that provide long-term financial support to an institution. This agreement specifies the terms for establishing and managing an endowment fund, including the investment strategy, the annual distribution rate, and any naming opportunities associated with the endowment. 3. Real Estate Gift Agreement: Donors often choose to contribute real estate properties, such as land or buildings, to institutions. This agreement lays out the terms for the transfer of ownership, including any appraisals, environmental assessments, and legal obligations associated with the property. 4. Charitable Remainder Trust Agreement: Through this agreement, donors can establish a trust that provides them with designated income for a specified period, after which the remaining assets are transferred to the institution. The agreement outlines the terms of the trust, including the income payout rate and the distribution of remaining assets. 5. Testamentary Gift Agreement: This agreement is designed for individuals who include the institution as a beneficiary in their will or estate plan. It establishes the terms and conditions under which the gift will be made upon the donor's passing, including any specific instructions or restrictions. Regardless of the type, all Arizona Gift Agreements with Institutions share the common objective of facilitating and formalizing the philanthropic act of giving. These agreements provide a framework for collaboration between the donor and the institution, ensuring that the gift aligns with the donor's intentions and that the institution will utilize the resources effectively and responsibly. Safeguarding the interests of both parties, an Arizona Gift Agreement with Institution establishes a transparent and legally binding relationship, strengthening the philanthropic landscape in the state while supporting the missions and endeavors of educational institutions and nonprofit organizations.

Arizona Gift Agreement with Institution

Description

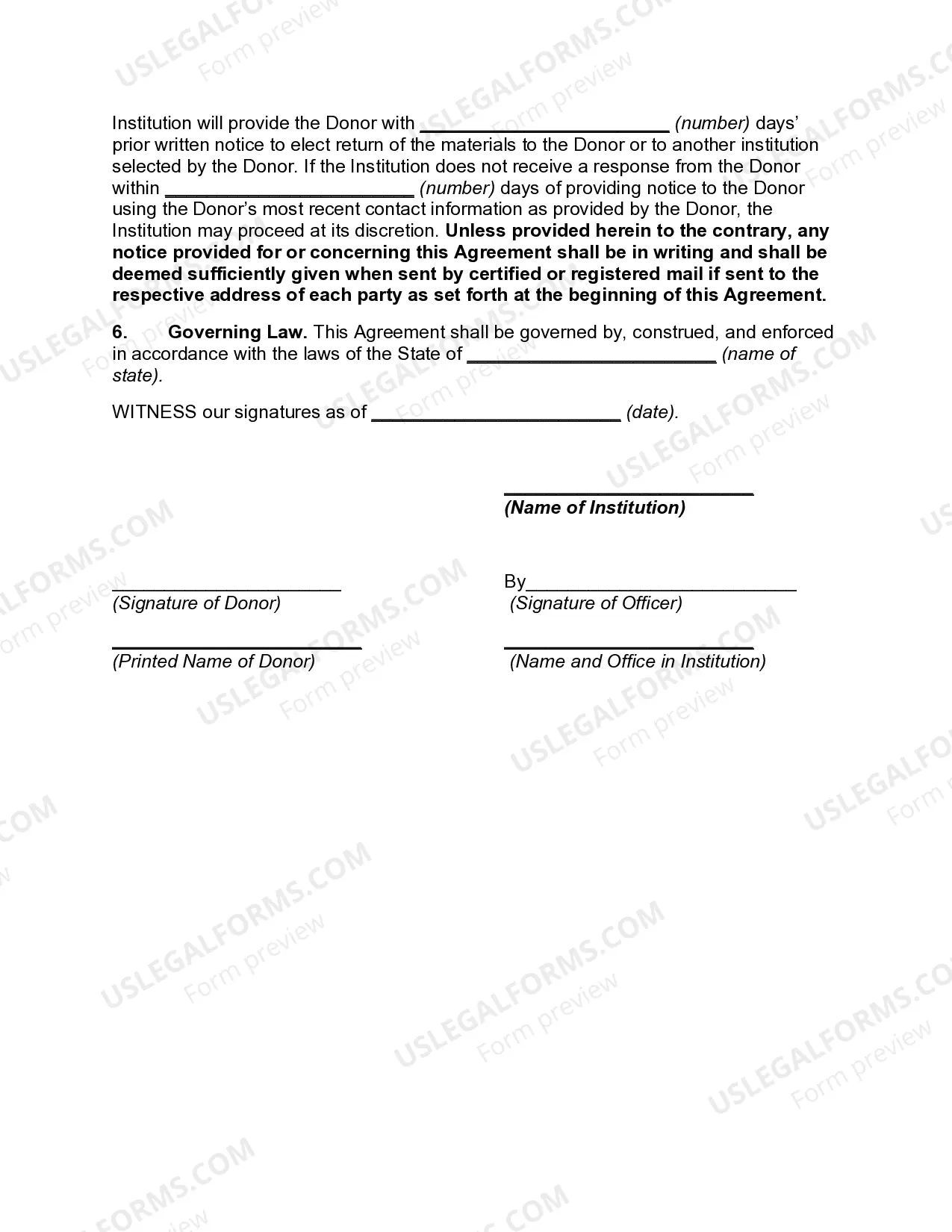

How to fill out Arizona Gift Agreement With Institution?

You are able to devote several hours on the Internet trying to find the authorized file format which fits the federal and state requirements you want. US Legal Forms offers a large number of authorized forms which can be analyzed by pros. It is simple to download or print the Arizona Gift Agreement with Institution from my service.

If you have a US Legal Forms profile, you are able to log in and then click the Download option. Following that, you are able to full, revise, print, or signal the Arizona Gift Agreement with Institution . Each authorized file format you get is your own permanently. To get another backup for any purchased develop, visit the My Forms tab and then click the corresponding option.

If you use the US Legal Forms internet site the very first time, follow the basic recommendations under:

- Very first, ensure that you have selected the right file format for the area/city of your choice. Look at the develop information to make sure you have picked out the right develop. If available, use the Review option to appear throughout the file format as well.

- If you want to get another version from the develop, use the Look for field to find the format that suits you and requirements.

- Upon having identified the format you want, just click Get now to proceed.

- Choose the prices plan you want, key in your qualifications, and sign up for your account on US Legal Forms.

- Comprehensive the financial transaction. You may use your charge card or PayPal profile to purchase the authorized develop.

- Choose the formatting from the file and download it to the product.

- Make modifications to the file if necessary. You are able to full, revise and signal and print Arizona Gift Agreement with Institution .

Download and print a large number of file layouts using the US Legal Forms Internet site, that offers the largest assortment of authorized forms. Use expert and condition-certain layouts to tackle your organization or individual requirements.

Form popularity

FAQ

Each year, a portion of the endowment is paid out as an annual distribution to support the University's budget, while any appreciation in excess of this annual distribution is retained in the endowment so it can grow and support future generations.

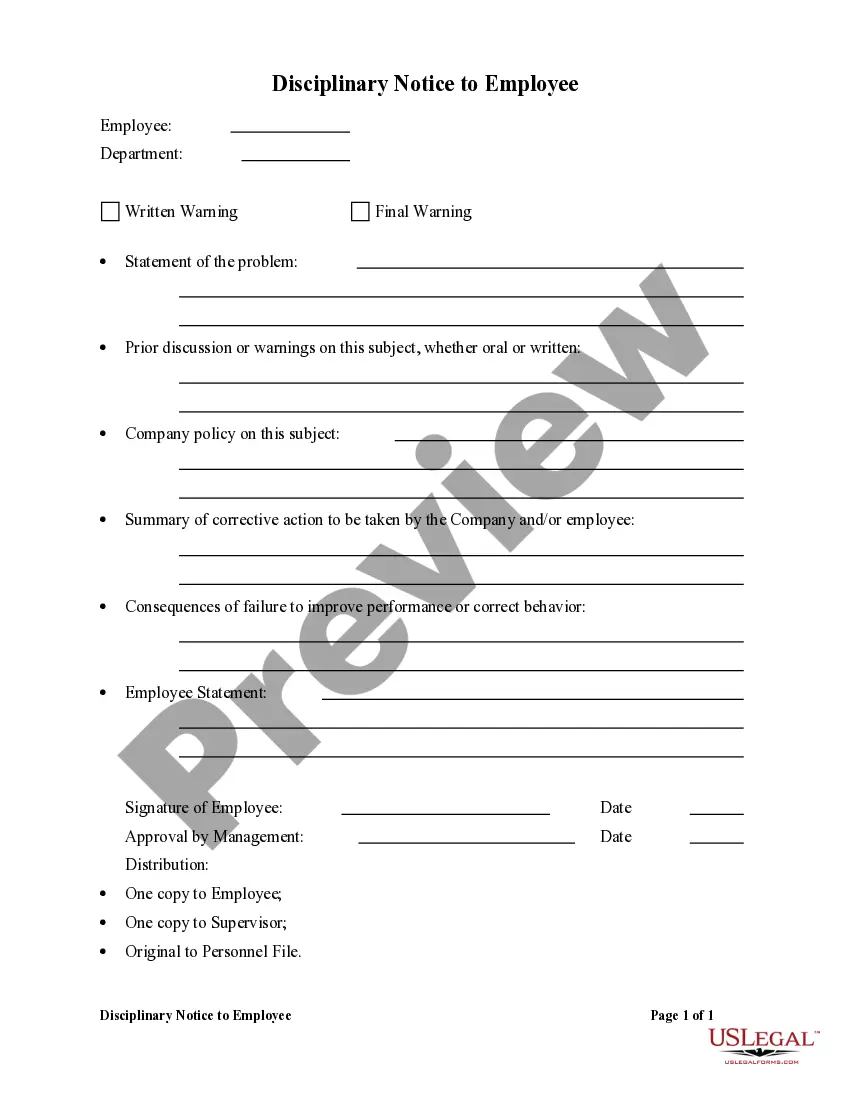

A gift agreement documents a gift has been made by the donor to a charitable organization and is legally enforceable. A pledge agreement records a commitment by a donor to make a gift at a future time.

Elements of Gift InstrumentsDate of the agreement.Legal name of the NFP recipient.Legal name(s) of the donor(s).If more than one donor, an indication of the donors' intent to be obligated jointly, severally, or both jointly and severally.More items...

One of the most important responsibilities of trustees is to oversee the management and allocation of the institution's assets. Trustees are legally obligated to be prudent in their investment management, but they also should make every effort to achieve as substantial a return as prudence will allow.

Can I use my donor-advised funds (DAFs) to pay personal pledges? Yes, with qualifications. Section 4 of IRS Notice 2017-73 addresses personal pledges, which effectively allows DAFs to make grants that satisfy pledges so long as the DAF sponsor does not reference the pledge in the grant letter or check.

The endowment value increased from $31.2 billion on June 30, 2020 to $42.3 billion on June 30, 2021. Endowment distributions to Yale's operating budget during the period amounted to $1.5 billion, covering 35% of the university's budget.

Endowment. $1.97 billion (2018)

For example, at the beginning of fiscal year 2020-21, Stanford's endowment was valued at $28.9 billion. The endowment payout of $1.33 billion 4.6% of the endowment's value covered about 21 percent of the university's operating costs of $6.2 billion.

Gift agreements are completed and signed to prevent misunderstandings, and show your donor that you care and that they are valued and important. As a nonprofit organization must keep accurate records on donations received, so must a donor keep records of donations they've made especially when it comes to tax time.

ASU's endowment tops $1.25 billion, improves ranking for fiscal year 2021. The Arizona State University endowment posted strong investment returns and giving levels during the COVID-19 pandemic, which means more scholarships, enrichment and research for the university.