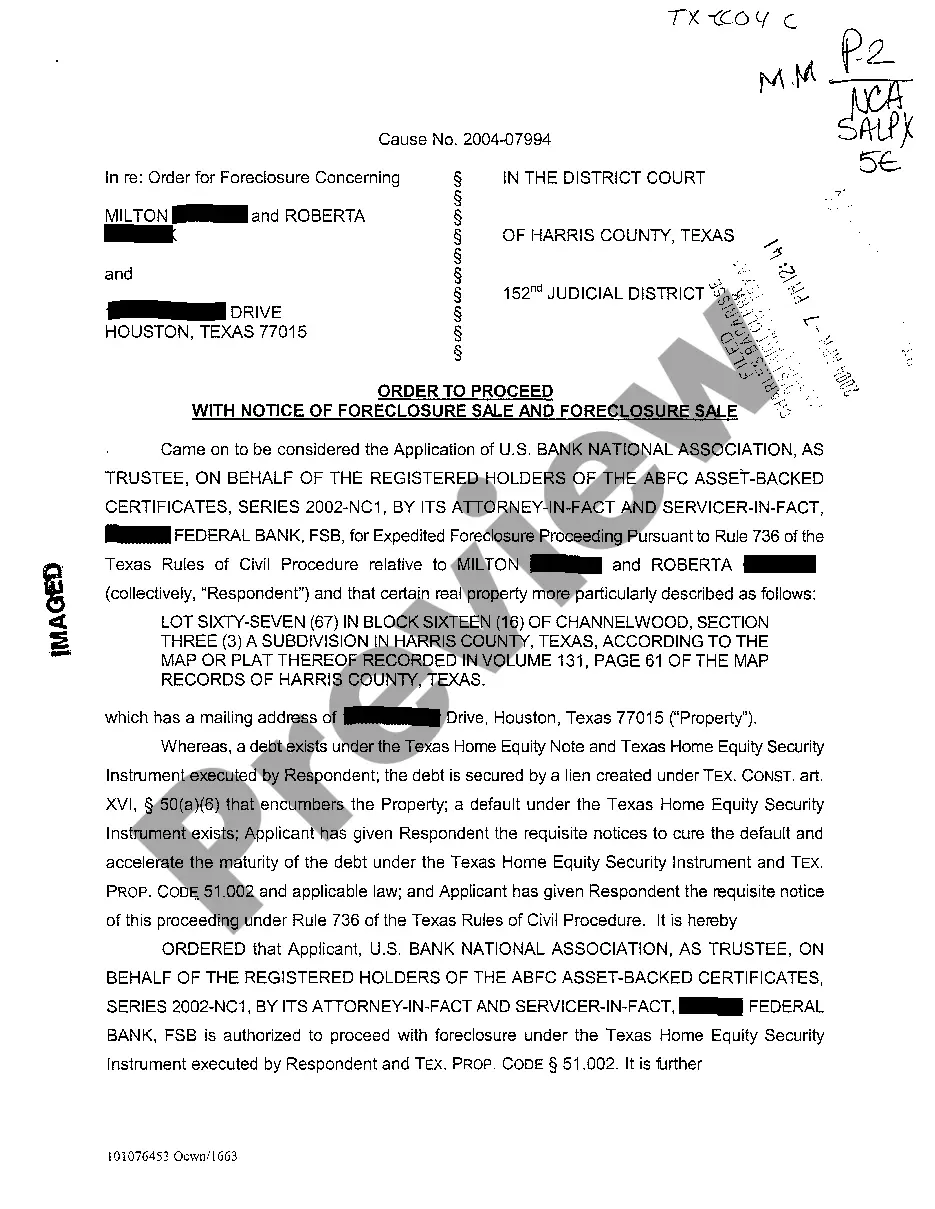

The Arizona Asset Information Sheet is a comprehensive document that provides detailed information about the assets owned by individuals, businesses, or organizations in the state of Arizona. This sheet serves as a crucial resource for asset management, financial planning, tax purposes, or legal matters related to assets. The Arizona Asset Information Sheet contains various sections that cover different types of assets. Some of the key information that might be included in this sheet are: 1. Real Estate Assets: This section provides details about properties owned in Arizona, such as residential homes, commercial buildings, vacant land, or rental properties. It includes property addresses, legal descriptions, purchase prices, current values, mortgage details, and any associated liabilities or encumbrances. 2. Financial Assets: This includes information regarding bank accounts, stocks, bonds, mutual funds, retirement accounts, or any other investment instruments held in financial institutions within Arizona. It may include the institution's name, account numbers, balances, interest rates, and other related details. 3. Personal Property Assets: This covers assets like vehicles, boats, artwork, jewelry, collectibles, or any other valuable personal possessions. This section typically includes detailed descriptions, purchase dates, current appraisals, and any relevant insurance information associated with these assets. 4. Business Assets: For individuals or organizations with businesses in Arizona, this section includes details about assets related to the business, such as equipment, machinery, inventory, intellectual property, patents, trademarks, or any other business-related assets. 5. Debts and Liabilities: In order to provide a complete financial picture, the Arizona Asset Information Sheet may also include a section dedicated to debts and liabilities. This section outlines any outstanding loans, mortgages, credit card debts, or other financial obligations associated with the aforementioned assets. It is important to note that the specific contents and format of the Arizona Asset Information Sheet may vary depending on the purpose and preferences of the individual or organization using it. Some variations or customized versions of this sheet may be available, such as the Arizona Asset Information Sheet for Estate Planning, Arizona Asset Information Sheet for Divorce Proceedings, or Arizona Asset Information Sheet for Loan Applications. In conclusion, the Arizona Asset Information Sheet is a comprehensive document that provides a detailed and organized overview of various assets owned within the state. It serves as a valuable tool for effective asset management, financial planning, legal matters, or tax compliance purposes.

The Arizona Asset Information Sheet is a comprehensive document that provides detailed information about the assets owned by individuals, businesses, or organizations in the state of Arizona. This sheet serves as a crucial resource for asset management, financial planning, tax purposes, or legal matters related to assets. The Arizona Asset Information Sheet contains various sections that cover different types of assets. Some of the key information that might be included in this sheet are: 1. Real Estate Assets: This section provides details about properties owned in Arizona, such as residential homes, commercial buildings, vacant land, or rental properties. It includes property addresses, legal descriptions, purchase prices, current values, mortgage details, and any associated liabilities or encumbrances. 2. Financial Assets: This includes information regarding bank accounts, stocks, bonds, mutual funds, retirement accounts, or any other investment instruments held in financial institutions within Arizona. It may include the institution's name, account numbers, balances, interest rates, and other related details. 3. Personal Property Assets: This covers assets like vehicles, boats, artwork, jewelry, collectibles, or any other valuable personal possessions. This section typically includes detailed descriptions, purchase dates, current appraisals, and any relevant insurance information associated with these assets. 4. Business Assets: For individuals or organizations with businesses in Arizona, this section includes details about assets related to the business, such as equipment, machinery, inventory, intellectual property, patents, trademarks, or any other business-related assets. 5. Debts and Liabilities: In order to provide a complete financial picture, the Arizona Asset Information Sheet may also include a section dedicated to debts and liabilities. This section outlines any outstanding loans, mortgages, credit card debts, or other financial obligations associated with the aforementioned assets. It is important to note that the specific contents and format of the Arizona Asset Information Sheet may vary depending on the purpose and preferences of the individual or organization using it. Some variations or customized versions of this sheet may be available, such as the Arizona Asset Information Sheet for Estate Planning, Arizona Asset Information Sheet for Divorce Proceedings, or Arizona Asset Information Sheet for Loan Applications. In conclusion, the Arizona Asset Information Sheet is a comprehensive document that provides a detailed and organized overview of various assets owned within the state. It serves as a valuable tool for effective asset management, financial planning, legal matters, or tax compliance purposes.