Arizona Seller's Affidavit of Nonforeign Status

Description

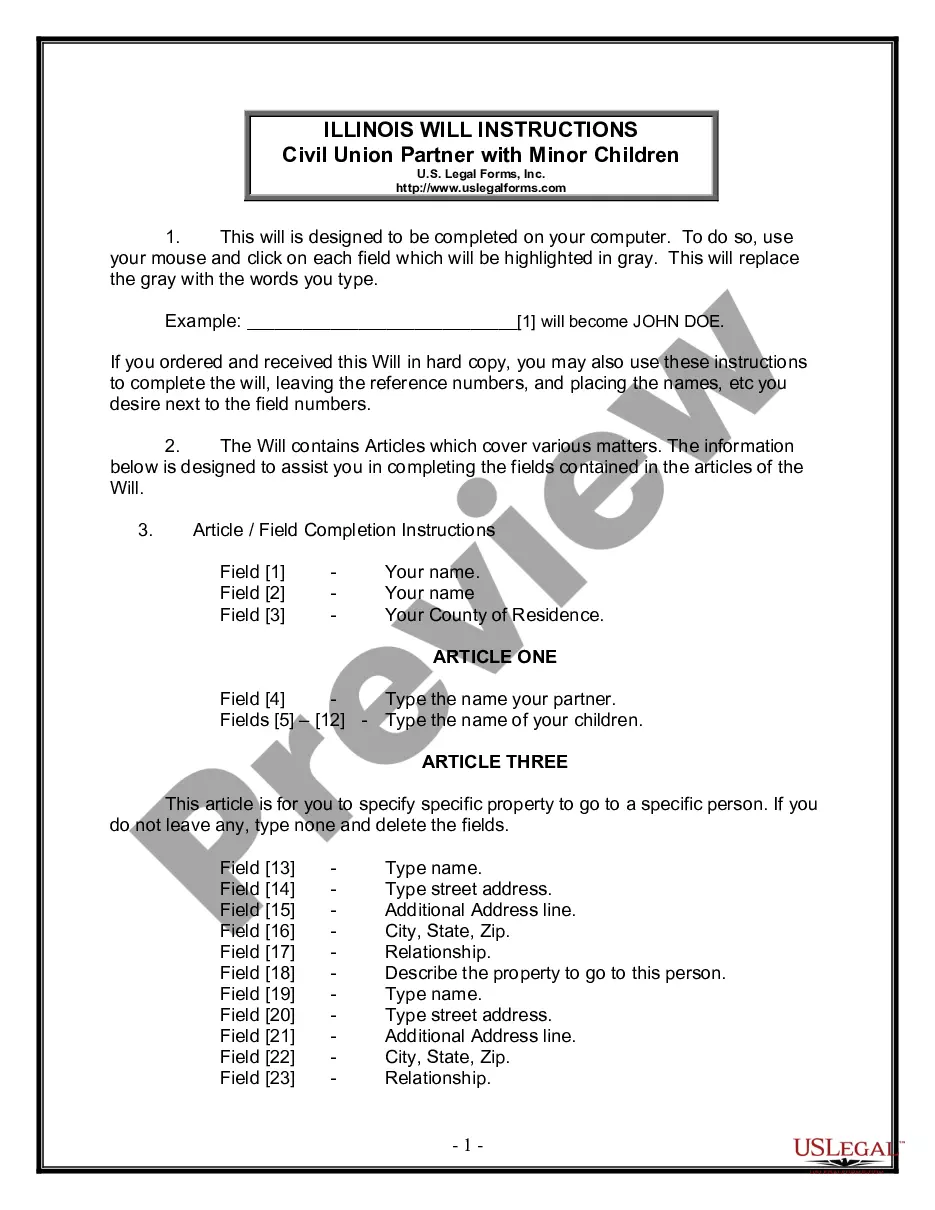

How to fill out Seller's Affidavit Of Nonforeign Status?

Are you presently within a position that you need documents for both enterprise or personal purposes just about every day time? There are a lot of legal document web templates available on the Internet, but locating versions you can depend on is not straightforward. US Legal Forms delivers thousands of form web templates, much like the Arizona Seller's Affidavit of Nonforeign Status, that happen to be published in order to meet state and federal specifications.

Should you be presently informed about US Legal Forms web site and have a merchant account, simply log in. After that, you can download the Arizona Seller's Affidavit of Nonforeign Status design.

Should you not come with an bank account and would like to begin using US Legal Forms, abide by these steps:

- Obtain the form you will need and make sure it is to the appropriate town/county.

- Make use of the Preview button to check the shape.

- See the explanation to ensure that you have selected the proper form.

- When the form is not what you are seeking, make use of the Look for discipline to discover the form that fits your needs and specifications.

- When you find the appropriate form, click Purchase now.

- Opt for the pricing plan you desire, complete the desired information and facts to create your bank account, and purchase your order with your PayPal or Visa or Mastercard.

- Choose a handy file file format and download your duplicate.

Locate all of the document web templates you may have purchased in the My Forms food list. You can obtain a additional duplicate of Arizona Seller's Affidavit of Nonforeign Status at any time, if required. Just go through the essential form to download or produce the document design.

Use US Legal Forms, the most comprehensive assortment of legal types, to save lots of efforts and prevent blunders. The service delivers appropriately created legal document web templates that you can use for a selection of purposes. Make a merchant account on US Legal Forms and initiate making your daily life a little easier.

Form popularity

FAQ

The Foreign Investment in Real Property Tax Act of 1980, also known as FIRPTA, may apply to your purchase. FIRPTA is a tax law that imposes U.S. income tax on foreign persons selling U.S. real estate.

FIRPTA Certificate: A FIRPTA certificate is used to to notify the IRS that the seller of real estate is not a foreign-person. When a foreign person sells real estate, the IRS wants to know about it. Even though some capital gains income tax is exempt to foreign persons, real estate is not exempt.

What Is a FIRPTA Affidavit? The Affidavit is the form that is used by the seller to certify under Penalty of Perjury that the seller is not a foreign seller. Generally, the escrow company or agents involved in the underlying sale will be responsible for facilitating the signatures.

A FIRPTA affidavit, also known as Affidavit of Non-Foreign Status, is a form a seller purchasing a U.S. property uses to certify under oath that they aren't a foreign citizen. The form includes the seller's name, U.S. taxpayer identification number and home address.

A FIRPTA affidavit, also known as Affidavit of Non-Foreign Status, is a form a seller purchasing a U.S. property uses to certify under oath that they aren't a foreign citizen. The form includes the seller's name, U.S. taxpayer identification number and home address.