Arizona Joint Trust with Income Payable to Trustees During Joint Lives is a type of trust arrangement commonly used by married couples or partners to ensure financial stability and flexibility during their lifetimes. This trust provides the beneficiaries (trustees) with a regular income stream while protecting their assets and allowing for effective estate planning. Key features of this trust include: 1. Joint Lives: The trust is established jointly by both spouses or partners and remains in effect throughout their lifetimes. It is designed to provide financial support to both individuals during their joint lives. 2. Income Payable to Trustees: One of the primary purposes of this trust is to generate income for the trustees. The trust assets are invested, and the generated income is distributed to the trustees regularly, according to a predetermined schedule. 3. Asset Protection: By placing assets into the trust, the trustees can protect them from potential creditors, lawsuits, or claims. The assets held within the trust are shielded, assuring financial security and stability for the trustees. 4. Flexibility: This type of trust provides flexibility in terms of managing and distributing assets. The trustees can maintain control and have the ability to modify the trust terms while both are alive and in agreement. They can make changes to beneficiary designations, alter the distribution of assets, or add or remove assets as needed. 5. Estate Planning Benefits: The Arizona Joint Trust with Income Payable to Trustees During Joint Lives also serves as a valuable tool for estate planning purposes. Upon the death of one of the trustees, the trust assets pass to the surviving trust or, typically without going through probate. It allows for easy transfer of assets, reduced administrative costs, and provides an efficient way to plan for the eventual transfer of wealth to heirs or other designated beneficiaries. Different types or variations of Arizona Joint Trust with Income Payable to Trustees During Joint Lives may include: 1. Revocable Joint Trust: This type of trust allows the trustees to retain the ability to make changes, modify, or revoke the trust at any time during their joint lives. It provides maximum flexibility for the trustees. 2. Irrevocable Joint Trust: In contrast to the revocable joint trust, this type of trust cannot be altered or revoked once it is established. It offers additional asset protection benefits and may have potential tax advantages. 3. Survivor's Trust: Sometimes referred to as a Bypass Trust or a Credit Shelter Trust, this type of joint trust is structured to maximize estate tax planning benefits upon the death of the first trust or. It aims to minimize estate taxes by utilizing the unified estate tax credit. 4. Marital Trust: Also known as an A Trust or TIP (Qualified Terminable Interest Property) trust. It is designed to provide income for the surviving spouse after the death of the first trust or while ensuring the preservation of assets and the efficient transfer of wealth to the ultimate beneficiaries. Overall, an Arizona Joint Trust with Income Payable to Trustees During Joint Lives is a flexible estate planning tool that allows married couples or partners to manage their assets, generate income, and protect their wealth throughout their lifetimes. It provides financial security, maximizes tax benefits, and facilitates the smooth transfer of assets upon the death of one trust or.

Arizona Joint Trust with Income Payable to Trustors During Joint Lives

Description

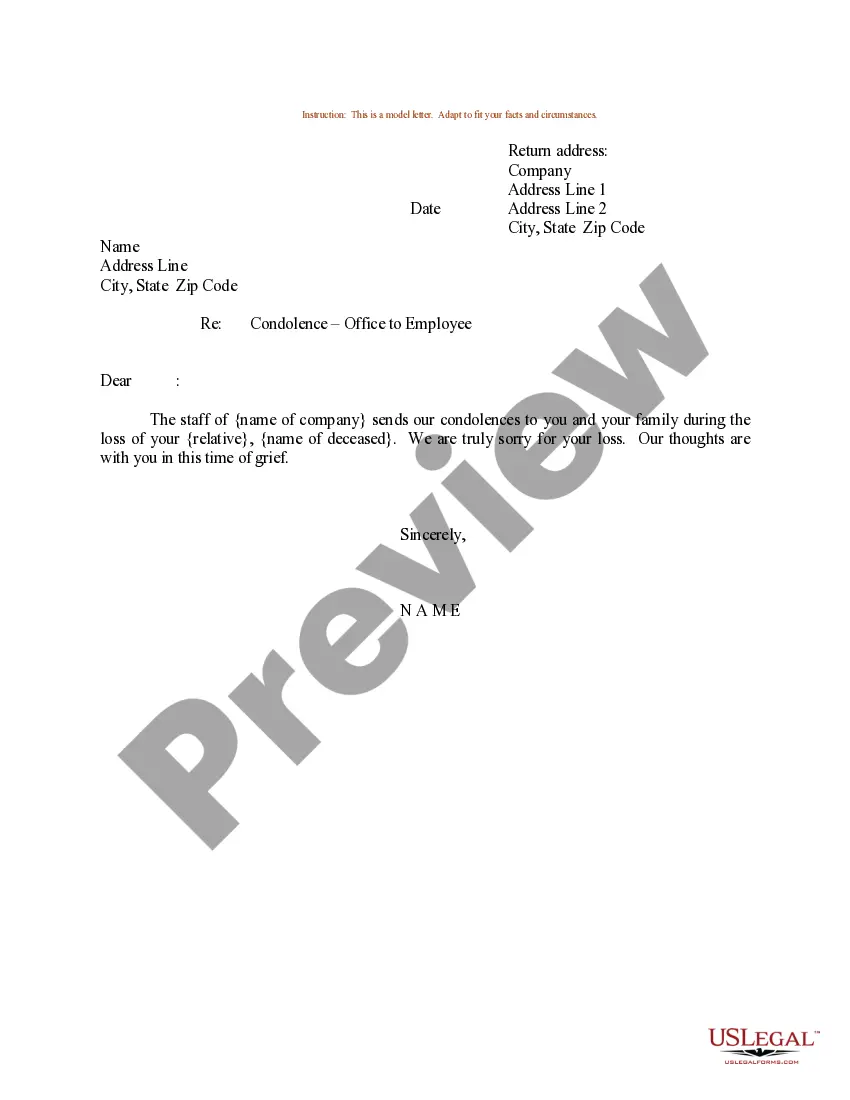

How to fill out Arizona Joint Trust With Income Payable To Trustors During Joint Lives?

Have you been inside a situation in which you need paperwork for sometimes organization or specific uses just about every day? There are a variety of authorized record layouts available online, but finding types you can trust is not straightforward. US Legal Forms delivers a large number of form layouts, such as the Arizona Joint Trust with Income Payable to Trustors During Joint Lives, that are written to meet federal and state requirements.

If you are previously knowledgeable about US Legal Forms site and have your account, basically log in. Afterward, you are able to obtain the Arizona Joint Trust with Income Payable to Trustors During Joint Lives template.

Should you not have an accounts and need to begin to use US Legal Forms, follow these steps:

- Get the form you will need and make sure it is for your appropriate area/area.

- Use the Review switch to review the shape.

- Read the explanation to ensure that you have selected the appropriate form.

- In case the form is not what you are seeking, use the Research field to discover the form that fits your needs and requirements.

- Whenever you get the appropriate form, click on Buy now.

- Pick the costs program you would like, complete the required information to generate your money, and buy the order making use of your PayPal or credit card.

- Decide on a handy data file formatting and obtain your copy.

Find all of the record layouts you may have bought in the My Forms food list. You may get a extra copy of Arizona Joint Trust with Income Payable to Trustors During Joint Lives any time, if necessary. Just click on the necessary form to obtain or printing the record template.

Use US Legal Forms, one of the most substantial selection of authorized forms, to conserve some time and stay away from mistakes. The support delivers expertly produced authorized record layouts that you can use for a range of uses. Generate your account on US Legal Forms and commence producing your life a little easier.

Form popularity

FAQ

Under typical circumstances, the surviving spouse would become the sole trustee after the death of one spouse. The surviving spouse would control the shared property, and the personal property of the deceased spouse would be distributed to the beneficiaries.

After one spouse dies, the surviving spouse is free to amend the terms of the trust document that deal with his or her property, but can't change the parts that determine what happens to the deceased spouse's trust property.

A revocable living trust becomes irrevocable once the sole grantor or dies or becomes mentally incapacitated. If you have a joint trust for you and your spouse, then a portion of the joint trust can become irrevocable when the first spouse dies and will become irrevocable when the last spouse dies.

Money in joint accounts Normally this means that the surviving joint owner automatically owns the money. The money does not form part of the deceased person's estate for administration and therefore does not need to be dealt with by the executor or administrator.

The general principle. The general starting point in cases of jointly held bank accounts is that on the death of one of the account holders, the account balance passes in its entirety, by the 'principle of survivorship', to the surviving account holder.

What happens in this type of trust is that the trust is a joint revocable trust when both spouses are alive. When one of the spouses dies, the trust will then split into two trusts automatically. Each trust will have half the assets of the trust along with the separate property of the spouse.

Trusts can be both single and joint. A single living trust involves just one individual, while a joint living trust usually involves a married couple. Joint living trusts are commonly used to transfer assets between spouses upon one spouse's death.

While there's no limit to how many trustees one trust can have, it might be beneficial to keep the number low. Here are a few reasons why: Potential disagreements among trustees. The more trustees you name, the greater the chance they'll have different ideas about how your trust should be managed.

Joint trusts are also revocable living trusts, set up to hold all of the assets of a married couple and to provide access to the trust assets for both. Typically, at the first death, half of the assets receive a step-up in basis, but all of the assets stay in the trust.

Or she may have named someone else to act as co-trustee with you. The living trust document should say whether you and any co-trustees can make decisions alone or must agree on decisions, either unanimously or by majority rule. If no instruction is given, Arizona law allows decisions by majority rule.