Arizona Sample Letter for Employee Automobile Expense Allowance

Description

How to fill out Sample Letter For Employee Automobile Expense Allowance?

US Legal Forms - among the premier collections of legal documents in the United States - offers a wide selection of legal form templates that you can download or print.

By utilizing the website, you can access thousands of forms for business and personal purposes, categorized by types, states, or keywords. You will find the latest versions of forms such as the Arizona Sample Letter for Employee Automobile Expense Allowance in just a few moments.

If you possess an account, Log In to download the Arizona Sample Letter for Employee Automobile Expense Allowance from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms in the My documents section of your account.

Process the order. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form to your device. Make modifications. Complete, edit, print, and sign the downloaded Arizona Sample Letter for Employee Automobile Expense Allowance. Every template you add to your account has no expiration date and is yours permanently. Therefore, if you wish to download or print another copy, simply visit the My documents section and click on the form you need. Access the Arizona Sample Letter for Employee Automobile Expense Allowance through US Legal Forms, one of the largest collections of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are simple steps to help get you started.

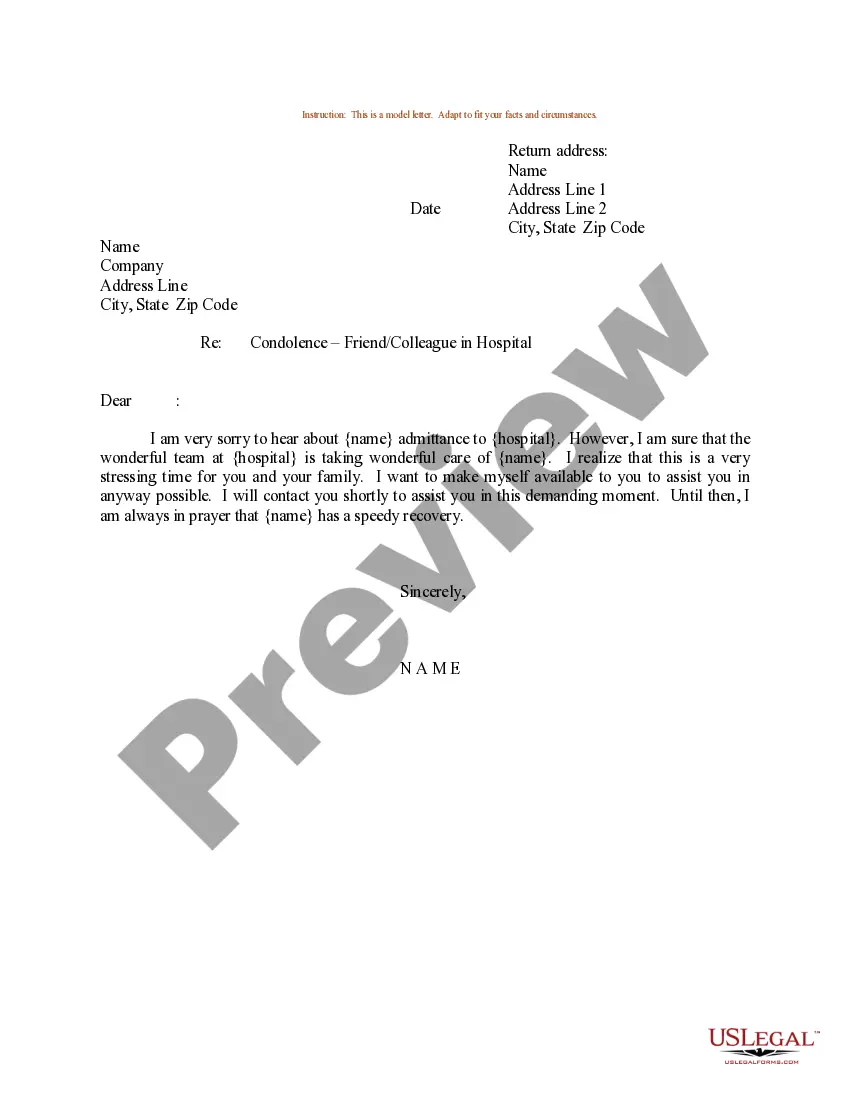

- Ensure you have selected the correct form for your city/area. Click the Preview button to review the form's content.

- Examine the form details to confirm you have chosen the right form.

- If the form does not suit your needs, utilize the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, validate your choice by clicking the Buy now button.

- Then, select the pricing plan you prefer and provide your credentials to register for an account.

Form popularity

FAQ

Is car allowance part of a salary? Car allowances are paid on top of your salary. It's a one-time cash sum that you have to use for getting a vehicle to commute to work with. Car allowance is taxed as income tax.

(Describe in your words). I hereby write this letter to request my (Allowance Type) allowance of () which is due for (Cause). I have brought this matter to the attention of (Authority name) but as of today (date), the payment has not been made to my bank account. (Describe the actual problem and situation).

A standard vehicle allowance is a monthly compensation for the costs of using a motor vehicle for work. This payment is typically part of a paycheck. It's up to the employee whether to put that money toward a car payment or to use it to defray gas expense, wear and tear, and other car costs.

Using a standard vehicle of a certain age, you can generally predict the yearly maintenance costs for each band of miles driven. Divide it by 12, and you've got the monthly amount.

Responsibility Allowances are a formal means of recognition and remuneration for temporary. changes in the level of duties and responsibilities that employees agree to undertake when business needs dictate.

A car allowance is a set amount that you give to your employees to cover a period of time. This car allowance is intended to cover typical costs of owning a vehicle, such as maintenance, wear-and-tear, insurance, fuel and depreciation.

My name is (name), an employee with your company (Name) in the department of (Name). I have worked with your company for () years and I take pride in being part of your team. (Describe in your words). I hereby write this letter to request my (Allowance Type) allowance of () which is due for (Cause).

I (name) working in (department) of your reputed company having employee ID (mention your employee ID number) and I am writing this letter in reference to the night shift allowance. I shall be highly obliged if you could kindly proceed with the night shift allowance in my name.

Because a standard car allowance is a non-accountable plan, it should be taxed fully as W-2 income. The employer should withhold federal income taxes, FICA/Medicare taxes, and (if applicable) state income taxes on the full allowance amount. The car allowance should be taxed at the employee's income bracket.

Here are few other great methods.Try asking for a percentage increase.Use a formula based on your age.If your allowance is based on chore completion, consider asking for a raise in the price of tasks that are more difficult or require more time.Your allowance should generally reflect your responsibilities.More items...