Arizona Qualifying Subchapter-S Revocable Trust Agreement is a legal document designed for individuals seeking to establish a trust structure that complies with both Arizona state laws and the requirements set forth by the Internal Revenue Service (IRS) for Subchapter-S corporations. This type of trust agreement allows individuals to enjoy the benefits of a revocable trust while also obtaining the tax advantages associated with S-Corporations. The Arizona Qualifying Subchapter-S Revocable Trust Agreement is specifically tailored to meet the legal and financial needs of Arizona residents, providing a comprehensive framework for managing assets, distributing wealth, and minimizing tax liabilities. This agreement enables the granter (the individual creating the trust) to maintain control over their assets during their lifetime while ensuring a smooth transfer of wealth and assets to beneficiaries upon their passing. Key features of the Arizona Qualifying Subchapter-S Revocable Trust Agreement include the option for the granter to revise or revoke the trust at any time, the ability to appoint a successor trustee to manage the trust assets in case of incapacity or death, and the flexibility to allocate income and expenses within the trust structure. With this trust agreement, the granter can also take advantage of the favorable tax treatment provided to S-Corporations, such as pass-through taxation, avoiding double taxation, and potential deductions. In Arizona, there are no specifically different types of Arizona Qualifying Subchapter-S Revocable Trust Agreements, as the agreement itself is designed to meet the requirements of Arizona state laws and the IRS regulations. However, individuals may customize certain provisions within the trust agreement to suit their specific circumstances and objectives. This flexibility allows for tailoring the agreement to address unique family dynamics, asset types, and estate planning goals. Overall, the Arizona Qualifying Subchapter-S Revocable Trust Agreement serves as a powerful tool for Arizona residents seeking to protect and manage their wealth, while also optimizing tax advantages associated with Subchapter-S corporations. It provides a reliable legal framework to ensure the smooth transition of assets and maximum benefits for both the granter and beneficiaries.

Arizona Qualifying Subchapter-S Revocable Trust Agreement

Description

How to fill out Arizona Qualifying Subchapter-S Revocable Trust Agreement?

Discovering the right authorized record template can be quite a struggle. Obviously, there are a variety of layouts available on the net, but how can you discover the authorized type you need? Take advantage of the US Legal Forms internet site. The assistance offers a huge number of layouts, for example the Arizona Qualifying Subchapter-S Revocable Trust Agreement, that you can use for enterprise and personal requires. All of the types are checked out by specialists and meet up with federal and state needs.

Should you be previously signed up, log in for your account and then click the Obtain switch to have the Arizona Qualifying Subchapter-S Revocable Trust Agreement. Utilize your account to check throughout the authorized types you have bought in the past. Proceed to the My Forms tab of your own account and get an additional duplicate of your record you need.

Should you be a fresh end user of US Legal Forms, listed below are simple instructions that you can adhere to:

- Initially, make certain you have chosen the right type to your city/county. It is possible to look over the form while using Review switch and browse the form description to guarantee this is basically the right one for you.

- If the type is not going to meet up with your preferences, utilize the Seach discipline to find the appropriate type.

- Once you are positive that the form is proper, click the Acquire now switch to have the type.

- Opt for the costs strategy you would like and enter the necessary information. Build your account and purchase the order with your PayPal account or bank card.

- Choose the submit file format and acquire the authorized record template for your system.

- Complete, change and produce and indication the received Arizona Qualifying Subchapter-S Revocable Trust Agreement.

US Legal Forms is definitely the most significant catalogue of authorized types where you will find numerous record layouts. Take advantage of the service to acquire skillfully-produced papers that adhere to express needs.

Form popularity

FAQ

Testamentary trusts.These trusts, which are established by your will, are eligible S corporation shareholders for up to two years after the transfer and then must either distribute the stock to an eligible shareholder or qualify as a QSST or ESBT.

You can put your S-Corp into your living trust by simply transferring your shares ownership to yourself as trustee of your living trust, but again, there are certain procedures that must be strictly followed....These trusts include:Electing small business trusts (ESBT)Grantor trusts.Qualified subchapter S trusts (QSST)

Specifically, S corporation shareholders must be individuals, specific trusts and estates, or certain tax-exempt organizations (501(c)(3)). Partnerships, corporations, and nonresident aliens cannot qualify as eligible shareholders.

Three commonly used types of ongoing trusts qualify as S corporation shareholders: grantor trusts, qualified subchapter S trusts (QSSTs) and electing small business trusts (ESBTs).

For example, if a trust is a grantor trust to one individual, it is eligible as an S corporation shareholder, even though it is irrevocable (rather than revocable).

As an initial matter, as long as the business owner is living, his or her revocable trust is treated as a grantor trust for income tax purposes, and as such, is an eligible S corporation shareholder.

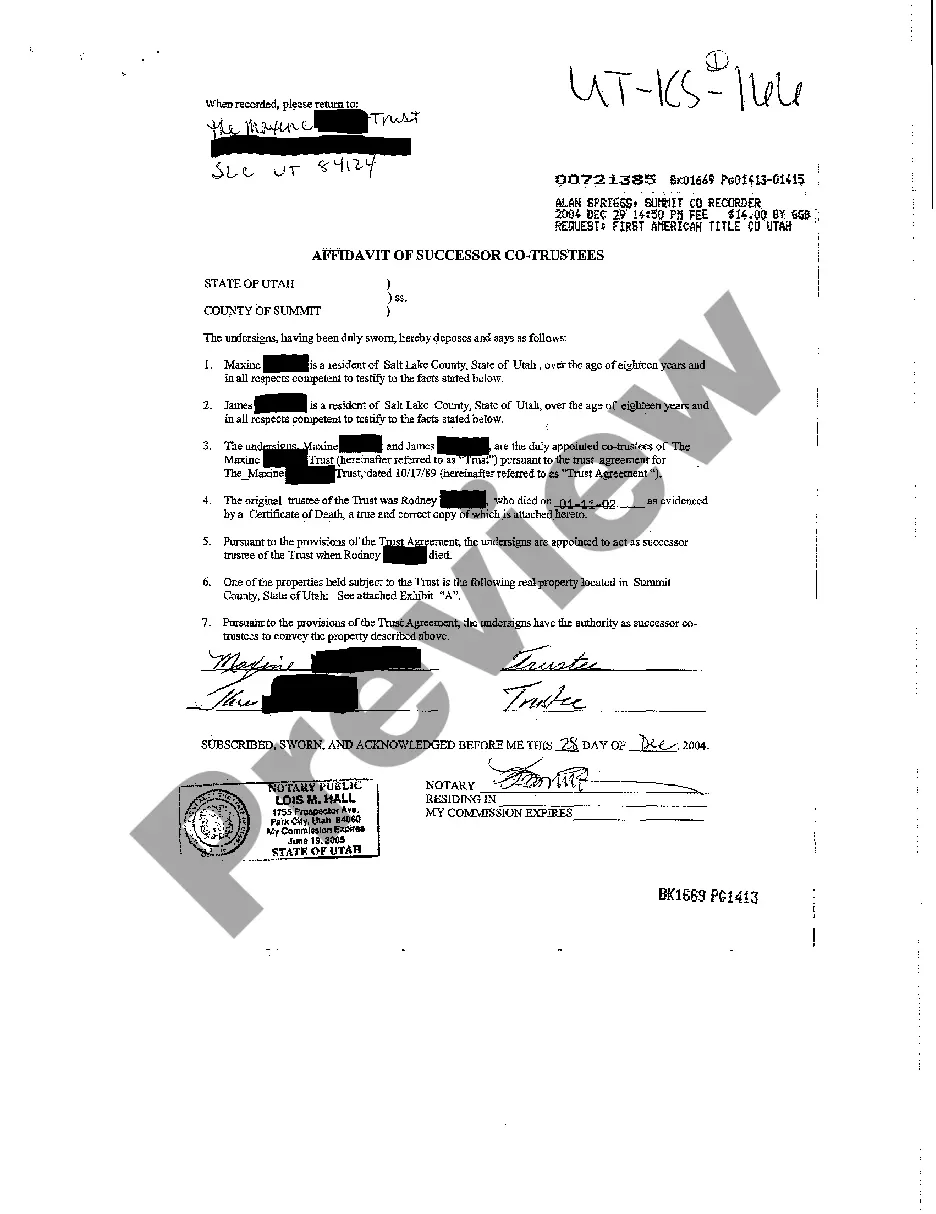

A qualified revocable trust (QRT) is any trust (or part of a trust) that was treated as owned by a decedent (on that decedent's date of death) by reason of a power to revoke that was exercisable by the decedent (without regard to whether the power was held by the decedent's spouse).

Since a revocable trust is not treated as separate from the grantor, it is an eligible S corporation shareholder while the grantor is alive.

A Qualified Subchapter S Trust, commonly referred to as a QSST Election, or a Q-Sub election, is a Qualified Subchapter S Subsidiary Election made on behalf of a trust that retains ownership as the shareholder of an S corporation, a corporation in the United States which votes to be taxed.

A trust can hold stock in an S corp only if it (1) is treated as owned by its grantor for income tax purposes under us grantor trust rules, (2) was a grantor trust immediately before its grantor's death (the trust can be a shareholder only for two years from that date), (3) received stock from the will of a decedent (