Title: Arizona Sample Letter for Reinstatement of Loan — Compromise of Matter Keywords: Arizona, loan reinstatement, compromise of matter, sample letter Introduction: When facing financial difficulties, individuals in Arizona may find themselves in a position where their loan is at risk of being compromised. At such times, it becomes crucial to take necessary steps to reinstate the loan agreement. A well-drafted sample letter can be invaluable in explaining the situation, negotiating terms, and securing a compromise with the lender to reinstate the loan. In this article, we will provide a detailed description of what Arizona Sample Letter for Reinstatement of Loan — Compromise of Matter entails, highlighting its importance and various types. Types of Arizona Sample Letter for Reinstatement of Loan — Compromise of Matter: 1. Personal Loan Reinstatement Letter for Compromise of Matter: This type of letter is suitable for individuals seeking to reinstate a personal loan that has faced a compromise of matter due to unforeseen circumstances. The letter must explain the reasons for the compromise and present a reasonable proposal to repay the loan. 2. Mortgage Loan Reinstatement Letter for Compromise of Matter: For homeowners who are struggling to maintain their mortgage payments and are at risk of default, this type of letter helps negotiate a compromise that allows them to reinstate the loan. It should highlight the reasons for the compromise and propose a solution, such as modified payment terms or interest rates. 3. Business Loan Reinstatement Letter for Compromise of Matter: When a business faces financial troubles jeopardizing its ability to repay the loan, this letter serves as a formal request to reinstate the loan through a compromise. It should outline the challenges the business is experiencing, propose a realistic plan to rectify the situation, and suggest repayment terms that accommodate both the business and the lender. Content of the Sample Letter: 1. Salutation: Begin the letter by addressing the lender appropriately, using their name and title if known. 2. Introduction: Clearly state your purpose for writing the letter, emphasizing the compromise of matter that has led to the need for loan reinstatement. 3. Explanation: Provide a detailed explanation of the circumstances that have caused the compromise, such as unexpected financial setbacks, medical emergencies, or any significant change in circumstances. 4. Acknowledgment of Responsibility: Take responsibility for the past and express the desire to resolve the situation by highlighting your commitment to meeting the loan obligations. 5. Proposal for Compromise: Propose a reasonable compromise that presents viable options for loan reinstatement. This could include modified repayment terms, lower interest rates, extended loan duration, or a combination of these. 6. Assurance of Future Compliance: Reiterate your dedication to maintaining the loan agreement moving forward, ensuring that the lender can trust in your commitment. 7. Closing: Offer appreciation for the lender's consideration and provide contact details for further discussions or necessary documentation. Conclusion: When seeking a compromise to reinstate a loan in Arizona, using a well-crafted sample letter can significantly improve your chances of success. By tailoring the letter to your specific situation and adhering to legal guidelines, you can present a compelling case to the lender, leading to a mutually beneficial agreement.

Arizona Sample Letter for Reinstatement of Loan - Compromise of Matter

Description

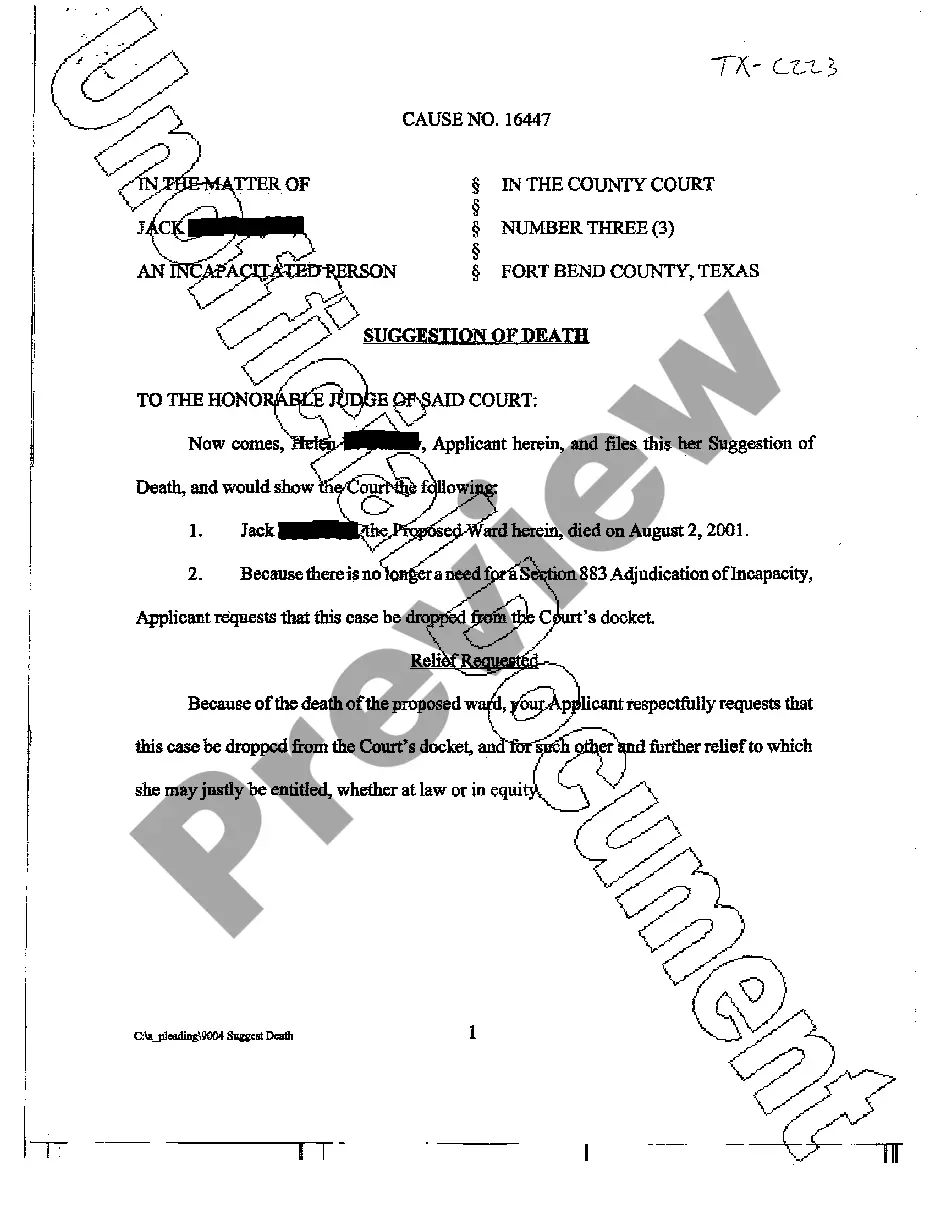

How to fill out Arizona Sample Letter For Reinstatement Of Loan - Compromise Of Matter?

If you want to total, down load, or print legitimate file layouts, use US Legal Forms, the biggest assortment of legitimate varieties, that can be found online. Make use of the site`s easy and hassle-free research to get the paperwork you need. Different layouts for enterprise and individual uses are categorized by categories and suggests, or keywords. Use US Legal Forms to get the Arizona Sample Letter for Reinstatement of Loan - Compromise of Matter within a handful of clicks.

If you are previously a US Legal Forms buyer, log in to the bank account and click the Down load option to get the Arizona Sample Letter for Reinstatement of Loan - Compromise of Matter. Also you can gain access to varieties you formerly acquired inside the My Forms tab of your bank account.

If you use US Legal Forms the very first time, follow the instructions listed below:

- Step 1. Ensure you have chosen the form to the right city/region.

- Step 2. Use the Review method to look through the form`s content material. Don`t forget about to read through the outline.

- Step 3. If you are not satisfied using the develop, utilize the Search discipline near the top of the display to get other variations in the legitimate develop template.

- Step 4. Once you have identified the form you need, click on the Buy now option. Opt for the pricing strategy you prefer and put your accreditations to register for the bank account.

- Step 5. Procedure the transaction. You should use your Мisa or Ьastercard or PayPal bank account to finish the transaction.

- Step 6. Choose the structure in the legitimate develop and down load it in your device.

- Step 7. Complete, change and print or signal the Arizona Sample Letter for Reinstatement of Loan - Compromise of Matter.

Every legitimate file template you buy is your own permanently. You may have acces to each and every develop you acquired inside your acccount. Go through the My Forms area and decide on a develop to print or down load once more.

Compete and down load, and print the Arizona Sample Letter for Reinstatement of Loan - Compromise of Matter with US Legal Forms. There are many skilled and express-certain varieties you may use for your enterprise or individual demands.

Form popularity

FAQ

But once the foreclosure sale is finalized, you may no longer be eligible to reinstate your mortgage. If your home is in foreclosure, reach out to your lender. They will be able to provide details on the mortgage reinstatement options that are still available to you.

A reinstatement clause is an insurance policy clause that states when coverage terms are reset after the insured individual or business files a claim due to previous loss or damage. Reinstatement clauses don't usually reset a policy's terms, but they do allow the policy to restart coverage for future claims.

Reinstatement involves making a single payment to catch up with everything due on a loan. By contrast, payoff involves paying the lender the total remaining balance of the loan. (Payoff before a foreclosure sale is commonly known as redemption, which is an equitable right available in every state.)

You may be able to get it back by reinstating your loan. Typically, you do this by bringing your loan up-to-date with a lump-sum payment that covers all past due payments, fees, and late charges. Your right to reinstatement might be built into your loan contract, or state law may require your lender to allow it.

The deadline for reinstating your loan is 90 days after you were served with a foreclosure notice. By this deadline, you will be required to make up the missed payments and pay other fees and expenses.

Verify Previous Employment. Call the human resources department for the name of the senior recruiter, HR manager or the hiring manager for the job for which you're applying.Contact Former Supervisor.Write Introduction.Describe Skills and Company Knowledge.Ask for an Interview.

How to write a reinstatement letterKnow who you're writing to.Look at the current job openings.Start with a friendly introduction.State the reason for writing.Explain why they should hire you.Conclude with a call to action.Include your contact information.

Negotiating a ReinstatementDefaulting property owners can also negotiate reinstatement of their mortgage loans with their lenders. Negotiating a reinstatement of a defaulted mortgage with that loan's lender is a bit more involved than simply paying all missed payments and late fees though.

Reinstating a loan. A "reinstatement" occurs when the borrower brings the delinquent loan current in one lump sum. Reinstating a loan stops a foreclosure because the borrower catches up on the defaulted payments. The borrower also has to pay any overdue fees and expenses incurred because of the default.