Arizona Sample Letter for Refinancing of Loan

Description

How to fill out Sample Letter For Refinancing Of Loan?

Are you presently within a position in which you require papers for sometimes enterprise or person functions just about every working day? There are plenty of legitimate document themes available on the Internet, but getting kinds you can depend on is not effortless. US Legal Forms offers thousands of kind themes, just like the Arizona Sample Letter for Refinancing of Loan, that happen to be written to meet state and federal needs.

If you are already familiar with US Legal Forms internet site and also have an account, just log in. Next, you are able to acquire the Arizona Sample Letter for Refinancing of Loan web template.

Unless you come with an account and want to start using US Legal Forms, abide by these steps:

- Obtain the kind you want and make sure it is for the proper metropolis/state.

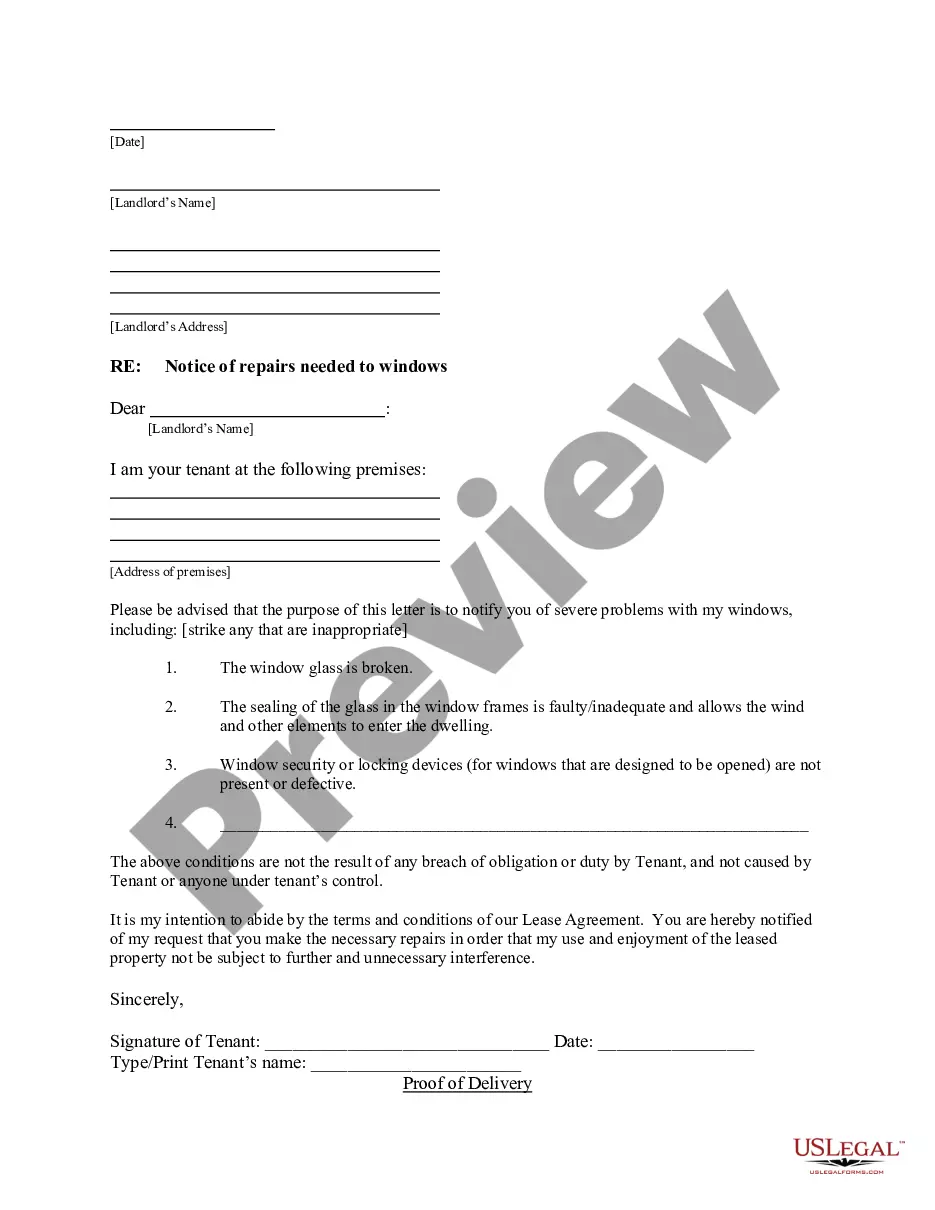

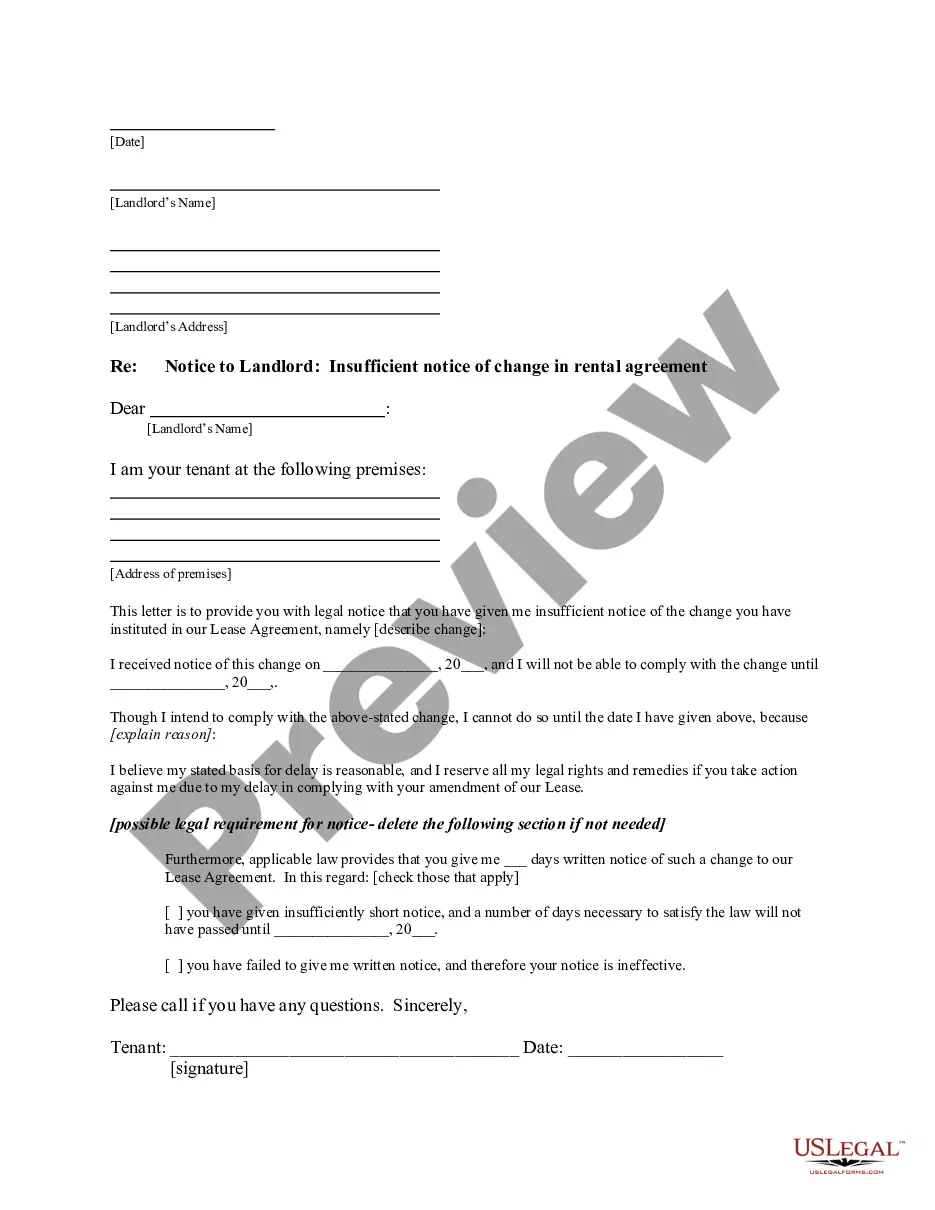

- Take advantage of the Preview key to check the form.

- See the explanation to ensure that you have selected the proper kind.

- When the kind is not what you are seeking, use the Lookup area to get the kind that meets your requirements and needs.

- If you discover the proper kind, click Acquire now.

- Pick the pricing plan you need, fill out the desired info to make your bank account, and pay for the transaction using your PayPal or Visa or Mastercard.

- Decide on a hassle-free file format and acquire your version.

Discover all the document themes you possess purchased in the My Forms menus. You can aquire a further version of Arizona Sample Letter for Refinancing of Loan whenever, if necessary. Just click the essential kind to acquire or produce the document web template.

Use US Legal Forms, one of the most comprehensive assortment of legitimate forms, to save lots of time as well as prevent errors. The support offers professionally made legitimate document themes that can be used for an array of functions. Generate an account on US Legal Forms and commence making your life a little easier.

Form popularity

FAQ

Make sure your letter of explanation includes:The current date (the day you write the letter)The name of your lender.Your lender's complete mailing address and phone number.A subject line that begins with RE: and includes your name, application number or other identifying information.More items...?

The most recent mortgage statement on the home you're refinancing and any other properties you own. The most recent billing statement for any outstanding home equity loans or lines of credit.

Commonly referred to as an 'LOE' or 'LOX,' letters of explanation are often requested by lenders to gain more specific information on a mortgage borrower and their situation. An LOX can necessary when there is inconsistent, incomplete, or unclear information on a loan application.

The HUD-1 Settlement Statement is a document that lists all charges and credits to the buyer and to the seller in a real estate settlement, or all the charges in a mortgage refinance.

How to write a letter of explanationThe lender's name and address.Your name and your application number.The date you're submitting the letter and expected closing date (if you know it)A short statement that helps an underwriter fully understand your situation in regards to the reason for concern.More items...?

How to write a letter of explanationFacts. Include all the details with correct dates and dollar amounts.Resolution. Explain how and when the situation was resolved.Acknowledgment. It's important that the letter outline why the problem won't arise again. Recognize if and how you could have avoided this mistake.20-Apr-2022

What to include in your letter of explanationLay out the letter as you would any other, with your full street address and phone number at the top.Date the letter with the date on which you're writing it.Put in the recipient (the lender's) name and full address.More items...?

Make sure your letter of explanation includes:The current date (the day you write the letter)The name of your lender.Your lender's complete mailing address and phone number.A subject line that begins with RE: and includes your name, application number or other identifying information.More items...

Out Refinance Letter is a formal request drafted by a mortgage borrower who is looking to use the equity they have built for their advantage and replace their old mortgage with a new one, receiving a sum of money to invest in remodeling, repay accumulated debts, or handle other financial issues.

Out Refinance Letter is a formal request drafted by a mortgage borrower who is looking to use the equity they have built for their advantage and replace their old mortgage with a new one, receiving a sum of money to invest in remodeling, repay accumulated debts, or handle other financial issues.