Arizona Sample Letter for Judicial Foreclosure

Description

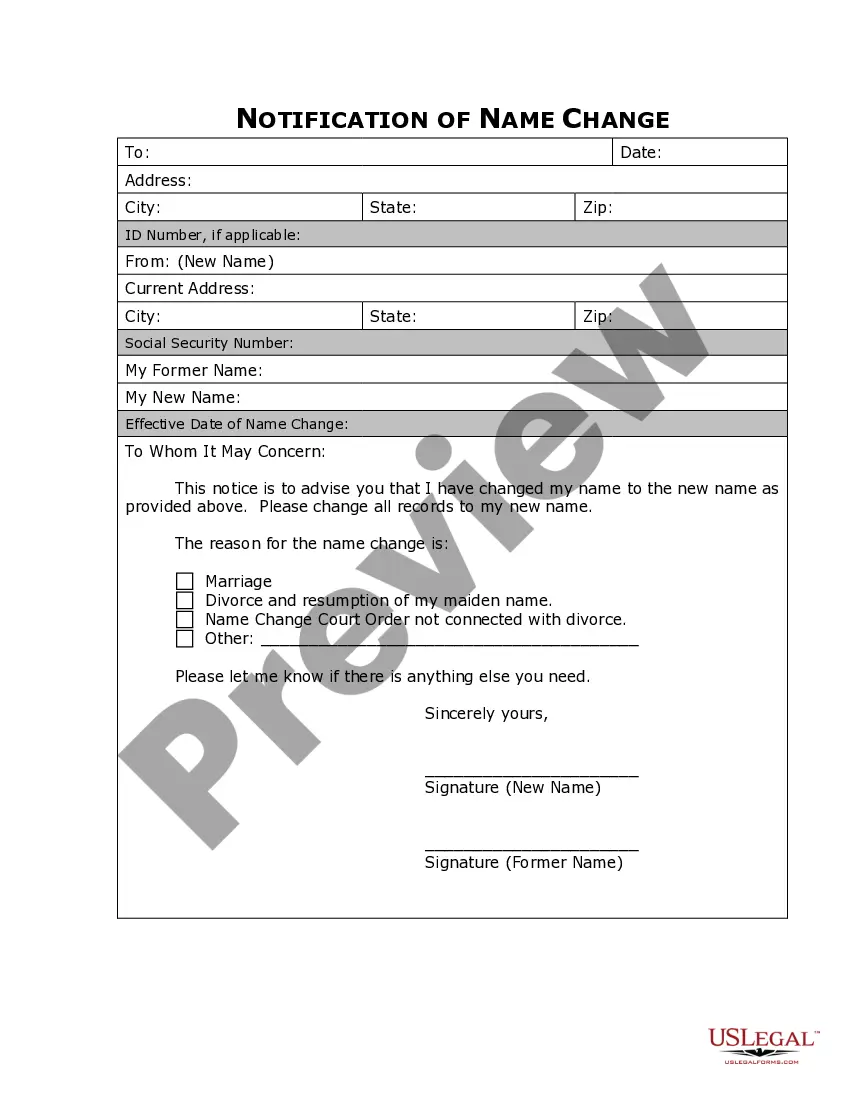

How to fill out Sample Letter For Judicial Foreclosure?

US Legal Forms - one of many largest libraries of lawful forms in the USA - delivers a variety of lawful papers web templates it is possible to download or print. Making use of the web site, you will get thousands of forms for company and person functions, categorized by categories, claims, or key phrases.You will discover the most recent versions of forms just like the Arizona Sample Letter for Judicial Foreclosure in seconds.

If you already have a subscription, log in and download Arizona Sample Letter for Judicial Foreclosure from your US Legal Forms catalogue. The Down load key can look on each form you perspective. You get access to all formerly downloaded forms in the My Forms tab of your bank account.

If you would like use US Legal Forms for the first time, listed here are easy recommendations to obtain started:

- Make sure you have selected the right form for your town/county. Click the Preview key to review the form`s content material. Look at the form description to actually have selected the right form.

- In case the form doesn`t suit your demands, use the Lookup field towards the top of the display screen to get the one that does.

- Should you be pleased with the shape, confirm your selection by visiting the Get now key. Then, pick the pricing plan you favor and give your references to sign up for the bank account.

- Process the deal. Use your charge card or PayPal bank account to finish the deal.

- Select the file format and download the shape on the device.

- Make changes. Complete, revise and print and sign the downloaded Arizona Sample Letter for Judicial Foreclosure.

Every web template you included in your bank account does not have an expiry date and is yours permanently. So, in order to download or print one more duplicate, just go to the My Forms section and then click in the form you will need.

Gain access to the Arizona Sample Letter for Judicial Foreclosure with US Legal Forms, by far the most substantial catalogue of lawful papers web templates. Use thousands of skilled and status-certain web templates that meet your small business or person requirements and demands.

Form popularity

FAQ

Judicial foreclosure refers to foreclosure proceedings that take place through the court system. This type of foreclosure process often occurs when a mortgage note lacks a power of sale clause, which would legally authorize the mortgage lender to sell the property if a default occurred.

Step 2: Notice of Sale or Order of Sale In a judicial foreclosure, once the court has issued their judgment granting the foreclosure, the clerk of the court will prepare an Order of Sale directing the sheriff or constable to sell the property at auction.

Judicial foreclosure - involves sale of the mortgaged property under the supervision of a court; initiated by a lawsuit; available in every state. non-judicial foreclosure - involves sale of the mortgage property without court supervision; available in many, but not all, states.

Foreclosure Laws in Arizona A notice of sale must be published in a newspaper located in the county where the property is located. The notice must be placed on the property 20 days before the sale date and it must be recorded in the recorder's office in the county where the property is located.

How Long Does the Typical Foreclosure Process Take in Arizona? Arizona lenders typically need between 90 and 120 days to foreclose on a property in a non judicial foreclosure process that is uncontested by the borrower.

While the process varies by state, in general lenders pursue the following course of action to initiate a judicial foreclosure: Notice of intent: Once a mortgage is unpaid for 120 days, the lender informs the borrower by mail that foreclosure proceedings will begin.

In Arizona, a judicial foreclosure is a court procedure. The plaintiff must file and serve a complaint, among other things. There is a deadline for the borrower and others to submit an answer.

The order of payment in a foreclosure is; the cost of the sale (advertising, attorney fees, trustee fees, etc.), any special assessment taxes and general taxes, the first mortgage, whatever is recorded next.