Arizona Agreement Between Board Member and Close Corporation

Description

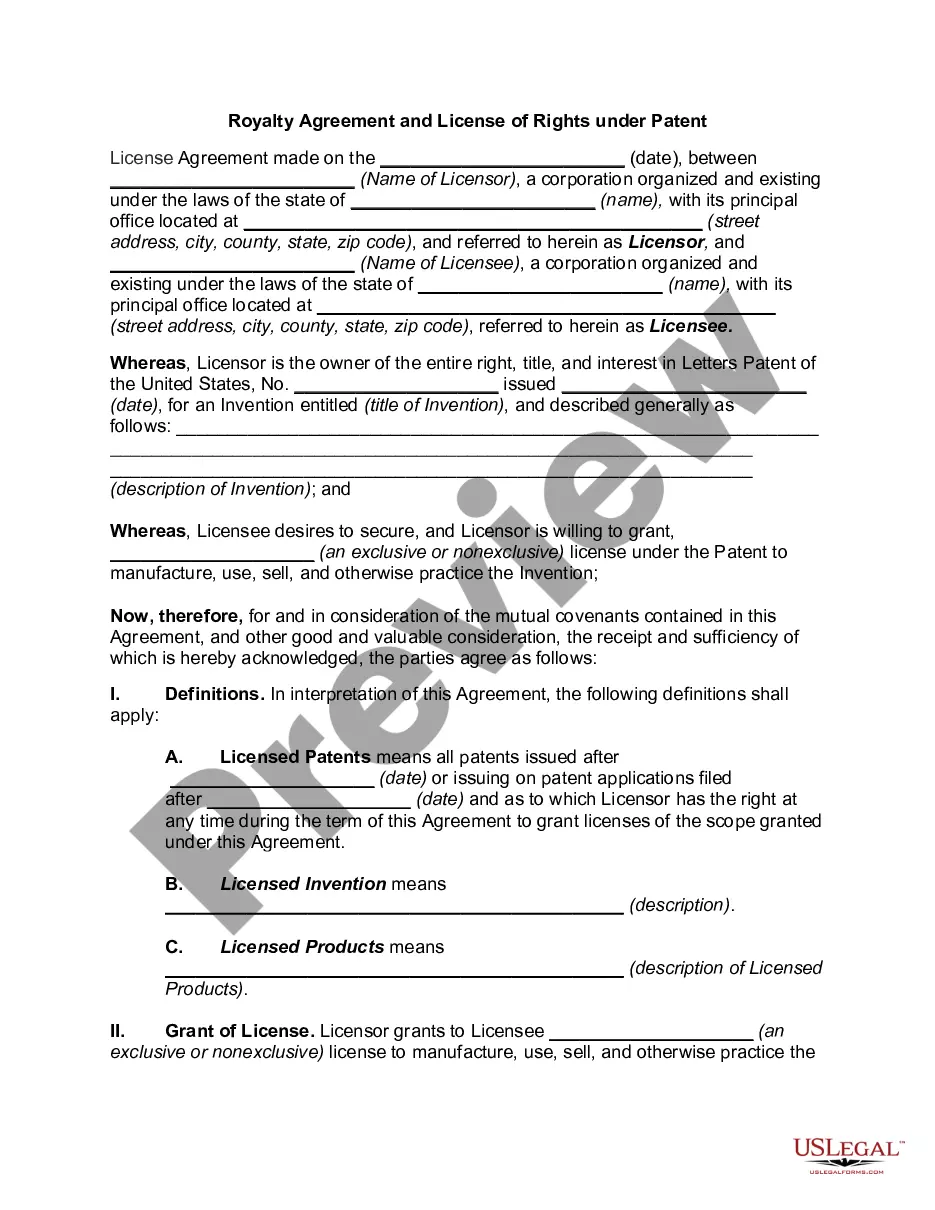

How to fill out Agreement Between Board Member And Close Corporation?

Are you in a situation where you frequently need documents for either business or personal reasons? There are numerous legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers thousands of form templates, such as the Arizona Agreement Between Board Member and Close Corporation, designed to meet federal and state requirements.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. After that, you can download the Arizona Agreement Between Board Member and Close Corporation template.

Select a convenient file format and download your copy.

Access all the file templates you have purchased in the My documents menu. You can obtain another copy of the Arizona Agreement Between Board Member and Close Corporation anytime, if needed. Just click on the desired form to download or print the document template.

Utilize US Legal Forms, the largest collection of legal forms, to save time and reduce errors. The service provides well-designed legal document templates that can be used for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your specific city/state.

- Use the Preview button to review the form.

- Check the information to confirm that you have selected the correct form.

- If the form is not what you need, use the Search field to locate the form that suits your requirements.

- Once you find the correct form, click Purchase now.

- Choose the pricing plan you prefer, complete the necessary information to create your account, and pay for the order using your PayPal or credit card.

Form popularity

FAQ

Section 10-3821 of the Arizona Revised Statutes outlines the rights and responsibilities of board members within a corporation. This section emphasizes the importance of fiduciary duties, which include acting in the best interest of the corporation and its shareholders. Understanding this section is essential for anyone involved in an Arizona Agreement Between Board Member and Close Corporation, as it helps define governance practices and accountability standards.

Officially dissolving a corporation in AlbertaFile the Articles of Dissolution with Alberta registries and pay the fee (Owner) Close your GST account and payroll account (Owner or accountant) File final corporate tax return and GST return (Accountant) Pay any final balances owing (if any) (Owner)

The shareholders must sign a document, known simply as a "consent," that states the corporation is dissolved. The consent then must be properly entered in the corporation's records. You must give nonvoting shareholders at least ten days advance notice of the impending dissolution.

Before you file your articles of incorporation, you'll need to have bylaws that comply with Arizona law. Your bylaws contain the rules and procedures your corporation will follow for holding meetings, electing officers and directors, and taking care of other corporate formalities required in Arizona.

Does Arizona law require that Arizona limited liability companies have an Operating Agreement? No. Arizona's LLC law does not require any Arizona LLC or PLLC to have an Operating Agreement.

Any corporation may be incorporated as a close corporation, except mining or oil companies, stock exchanges, banks, insurance companies, public utilities, educational institutions, and corporations declared to be vested with public interest.

Close Corporations Key Featuresa Close Corporation (cc) is a legal entity.Audited financial statements are not required for Close Corporations.Meetings are not compulsory and can be held on an ad hoc basis.Close Corporations (CCs) may become shareholders in other companies.More items...

In Arizona, if you and the members of the LLC want to discontinue business, then it is necessary to dissolve their business legally to avoid any administrative and legal consequences. To dissolve an LLC in Arizona, you are required to submit a complete Article of Dissolution to the Secretary of State.

- A close corporation, within the meaning of this Code, is one whose articles of incorporation provide that: (1) All the corporation's issued stock of all classes, exclusive of treasury shares, shall be held of record by not more than a specified number of persons, not exceeding twenty (20); (2) all the issued stock of

Corporations DivisionCustomer Service: (602) 542-3026.Toll Free In-State Only: 1-(800) 345-5819.Email: answers@azcc.gov.