Title: Arizona Notice of Special Stockholders' Meeting to Consider Recapitalization: A Comprehensive Overview Keywords: Arizona, Notice, Special Stockholders' Meeting, Recapitalization, Types Introduction: An Arizona Notice of Special Stockholders' Meeting to Consider Recapitalization is a legal document that notifies shareholders about a meeting convened to discuss and vote on potential recapitalization initiatives carried out by a company. This description aims to provide a detailed overview of this document, its purpose, and potential types of special stockholders' meetings related to recapitalization. 1. Purpose of the Arizona Notice of Special Stockholders' Meeting: The primary purpose of an Arizona Notice of Special Stockholders' Meeting to Consider Recapitalization is to inform shareholders about a crucial meeting where they will have the opportunity to voice their opinions and vote on potential recapitalization plans. Recapitalization involves restructuring a company's financial structure, typically through changes in equity or debt arrangements, and the meeting serves as a platform to discuss such decisions collectively. 2. Content of the Notice: The Arizona Notice of Special Stockholders' Meeting includes essential information that shareholders need to know before attending the meeting. This includes the meeting date, time, and location, as well as details regarding the specific recapitalization proposals to be considered. It may also inform shareholders of any requirements for attendance, such as registration or proxy voting. 3. Types of Arizona Notice of Special Stockholders' Meeting for Recapitalization: While there may not be distinct "types" of special stockholders' meetings for recapitalization, the document can be used to address various recapitalization strategies or scenarios. Some potential types of recapitalization meetings that could require an Arizona Notice of Special Stockholders' Meeting may include: a) Equity Recapitalization: This refers to a restructuring of a company's equity structure, involving changes in the number and types of shares issued. It may involve actions like stock splits, reverse stock splits, dilution, or conversion of shares. b) Debt Restructuring: In cases where a company is burdened by excessive debt, a special stockholders' meeting may be called to consider debt restructuring plans. This can involve modifications to interest rates, payment schedules, conversion of debt into equity, or refinancing strategies. c) Merger or Acquisition Recapitalization: If a company is considering a merger or acquisition, a special stockholders' meeting is essential to obtain shareholder approval. Recapitalization plans may involve a vote on issuance of new shares, share swaps, or changes in ownership structures. d) Financial Distress Recapitalization: When a company is in financial distress, it may need an Arizona Notice of Special Stockholders' Meeting to discuss recapitalization plans, such as debt-for-equity swaps, rights offerings, stock redemptions, or capital injections from new investors. Conclusion: The Arizona Notice of Special Stockholders' Meeting to Consider Recapitalization is a vital communication tool for shareholders, providing them with information about an upcoming meeting where recapitalization proposals will be discussed and voted upon. The document caters to various types of recapitalization strategies that may necessitate such meetings, ensuring shareholders' involvement in shaping the company's financial structure.

Arizona Notice of Special Stockholders' Meeting to Consider Recapitalization

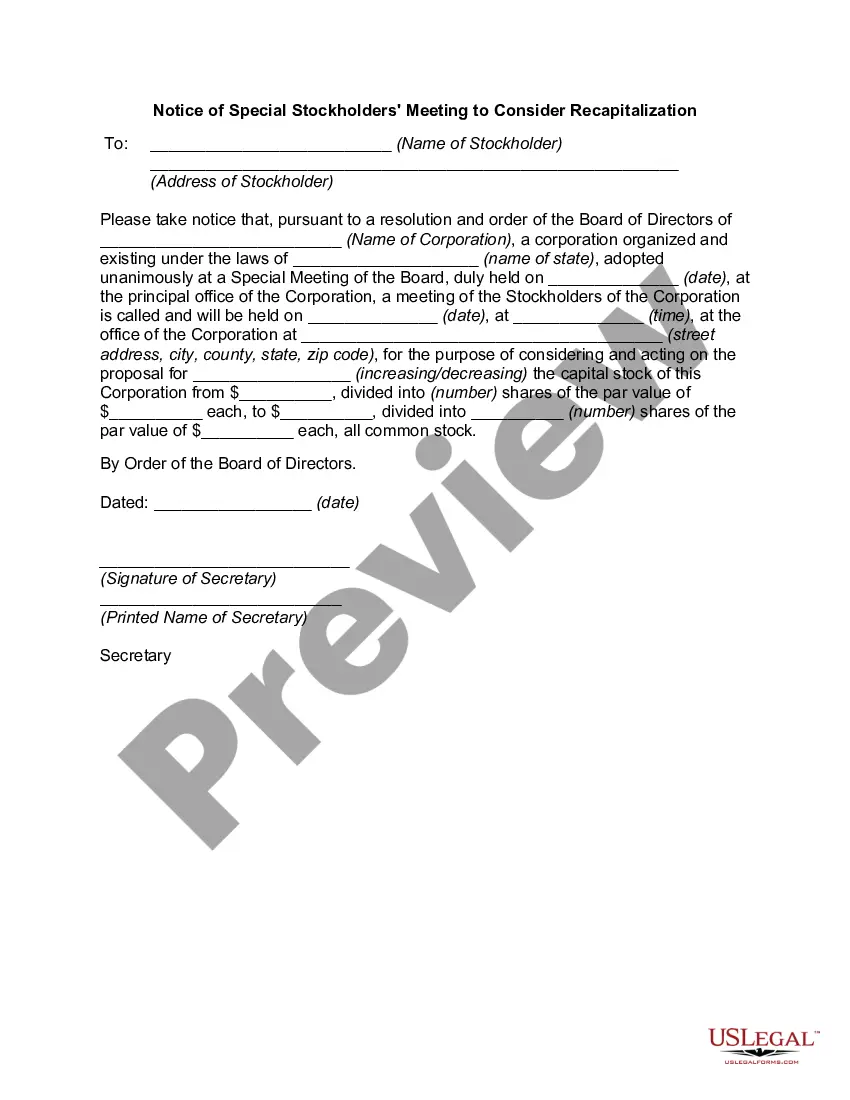

Description

How to fill out Arizona Notice Of Special Stockholders' Meeting To Consider Recapitalization?

If you need to complete, download, or printing legitimate file themes, use US Legal Forms, the most important selection of legitimate forms, which can be found on the web. Take advantage of the site`s simple and convenient search to find the files you will need. Various themes for organization and personal uses are sorted by groups and suggests, or keywords and phrases. Use US Legal Forms to find the Arizona Notice of Special Stockholders' Meeting to Consider Recapitalization in a number of click throughs.

In case you are previously a US Legal Forms client, log in in your profile and click the Obtain key to obtain the Arizona Notice of Special Stockholders' Meeting to Consider Recapitalization. You can even gain access to forms you formerly downloaded inside the My Forms tab of your profile.

If you are using US Legal Forms the very first time, refer to the instructions under:

- Step 1. Ensure you have selected the shape for that proper metropolis/nation.

- Step 2. Use the Preview choice to look over the form`s content. Do not neglect to learn the outline.

- Step 3. In case you are unhappy with the form, utilize the Look for industry at the top of the display screen to get other types of the legitimate form design.

- Step 4. When you have identified the shape you will need, select the Get now key. Pick the rates strategy you like and put your credentials to register for an profile.

- Step 5. Approach the deal. You may use your Мisa or Ьastercard or PayPal profile to perform the deal.

- Step 6. Find the format of the legitimate form and download it on the product.

- Step 7. Complete, change and printing or sign the Arizona Notice of Special Stockholders' Meeting to Consider Recapitalization.

Every single legitimate file design you acquire is your own property permanently. You might have acces to each form you downloaded with your acccount. Go through the My Forms section and choose a form to printing or download once again.

Compete and download, and printing the Arizona Notice of Special Stockholders' Meeting to Consider Recapitalization with US Legal Forms. There are many skilled and state-distinct forms you may use to your organization or personal needs.