Arizona Debt Settlement Offer in Response to Creditor's Proposal When faced with overwhelming debt, individuals in Arizona have the option to negotiate a debt settlement offer in response to a creditor's proposal. A debt settlement offer is a structured agreement that aims to settle a borrower's outstanding debts for less than the total amount owed. This strategy is often pursued as an alternative to bankruptcy, allowing the debtor to make affordable payments while avoiding the severe consequences of bankruptcy. In response to a creditor's proposal, Arizona residents have several types of debt settlement offers available to them. These options are designed to provide flexibility and cater to the specific needs of the debtor. Common types of Arizona debt settlement offers include: 1. Lump-Sum Settlement: In this arrangement, the debtor negotiates a reduced, one-time payment to the creditor in exchange for settling the entire debt. This type of settlement offer can be beneficial for individuals with access to a significant sum of money, such as a lump sum inheritance or savings. 2. Structured Repayment Plan: With a structured repayment plan, debtors agree to make regular monthly payments to the creditor over a specified period. The amount and duration of the repayment plan are negotiated between the parties to establish affordable payments based on the debtor's financial situation. 3. Partial Debt Forgiveness: In some cases, creditors may be willing to forgive a portion of the debt outright, allowing the debtor to settle the remaining balance. This form of settlement offer offers significant relief to individuals struggling with unmanageable debts. 4. Creditor-Based Settlement: In this scenario, the creditor proposes a specific settlement offer to the debtor, usually involving reduced interest rates, waived fees, or extended repayment terms. Debtors can analyze these proposals, negotiate terms, and ultimately accept an offer that aligns with their financial capabilities. When considering a debt settlement offer in response to a creditor's proposal, Arizona residents should be aware of the potential impacts on their credit score. While debt settlement enables borrowers to reduce their debts, it may have a temporary negative effect on credit rating. However, successfully settling debts and adhering to the negotiated terms can gradually improve one's creditworthiness over time. To initiate an Arizona debt settlement offer, it is advisable to seek assistance from a reputable debt settlement company or consult with a qualified attorney specializing in debt-related matters. These professionals possess the expertise to negotiate with creditors on your behalf, ensuring that the proposed settlement offer is fair and achievable based on your financial circumstances. In conclusion, when faced with the burden of debt in Arizona, a debt settlement offer in response to a creditor's proposal can provide a viable path towards financial recovery. By exploring the various types of settlement offers available and engaging the expertise of professionals, individuals can work towards resolving their debts and regaining control of their financial future.

Arizona Debt Settlement Offer in Response to Creditor's Proposal

Description

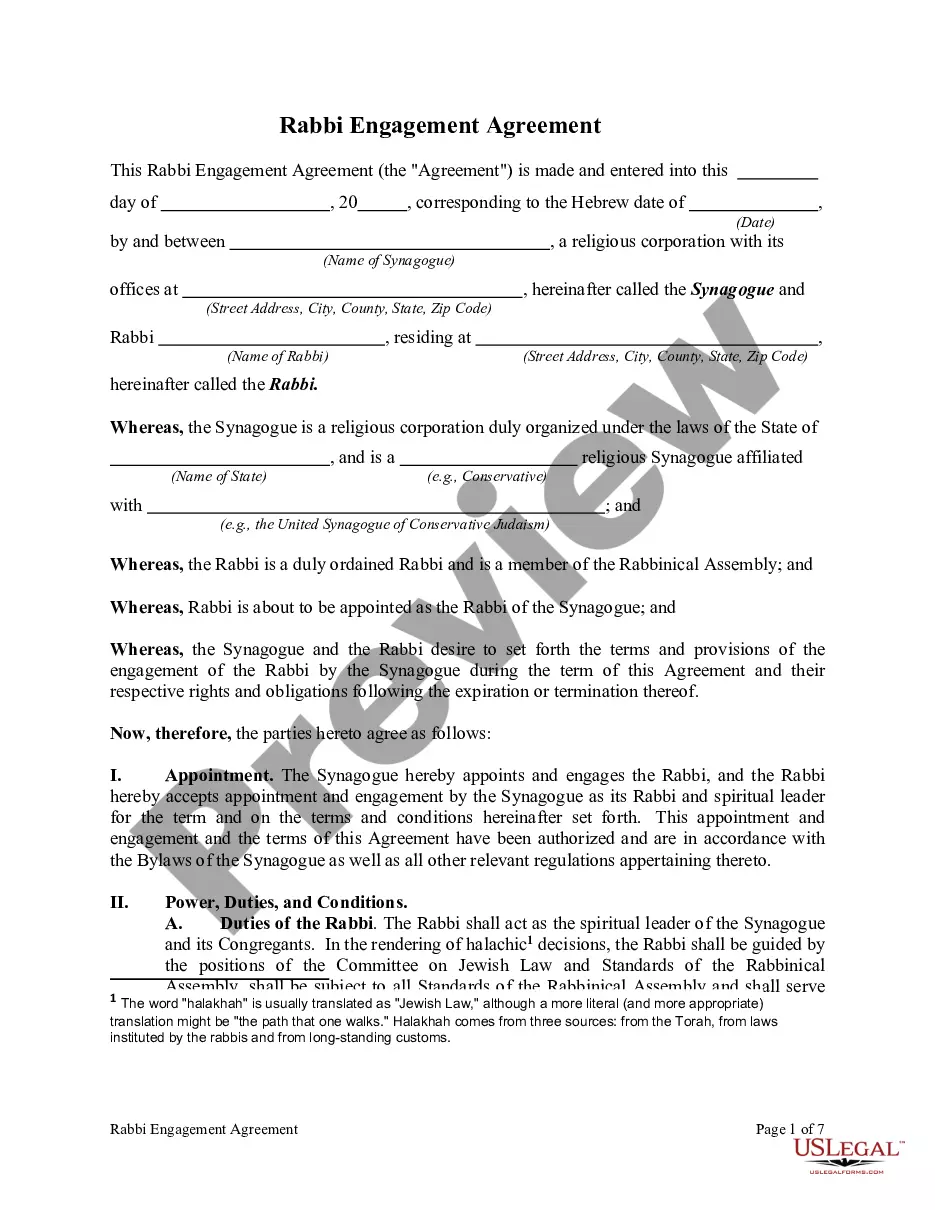

How to fill out Arizona Debt Settlement Offer In Response To Creditor's Proposal?

Are you presently in the place in which you need to have paperwork for both organization or person uses just about every working day? There are a variety of lawful document layouts available on the net, but getting versions you can depend on is not effortless. US Legal Forms delivers a large number of form layouts, much like the Arizona Debt Settlement Offer in Response to Creditor's Proposal, which are published to fulfill federal and state specifications.

When you are previously informed about US Legal Forms web site and possess a free account, just log in. Following that, you are able to obtain the Arizona Debt Settlement Offer in Response to Creditor's Proposal design.

Unless you offer an account and want to start using US Legal Forms, adopt these measures:

- Get the form you want and ensure it is to the right city/state.

- Utilize the Review switch to analyze the form.

- Look at the explanation to ensure that you have chosen the correct form.

- If the form is not what you are looking for, use the Look for field to get the form that fits your needs and specifications.

- If you find the right form, simply click Acquire now.

- Select the pricing program you want, fill out the desired information to produce your account, and pay for your order using your PayPal or bank card.

- Select a hassle-free file structure and obtain your duplicate.

Discover all the document layouts you possess bought in the My Forms menus. You can aquire a further duplicate of Arizona Debt Settlement Offer in Response to Creditor's Proposal whenever, if possible. Just click on the necessary form to obtain or print out the document design.

Use US Legal Forms, by far the most extensive variety of lawful kinds, to save lots of efforts and stay away from faults. The service delivers skillfully produced lawful document layouts that you can use for a variety of uses. Make a free account on US Legal Forms and begin producing your daily life easier.