Title: Arizona Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time Introduction: In the state of Arizona, debtors have the right to request a lower interest rate on their credit card accounts for a specific period. This letter serves as a formal request from a debtor to their credit card company, seeking a reduction in the interest rate. Below you will find a template for an Arizona Letter from a debtor to a credit card company, requesting a lower interest rate for a certain period of time. Template for Arizona Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time: [Your Name] [Your Address] [City, State, ZIP] [Email Address] [Phone Number] [Date] [Credit Card Company Name] [Credit Card Company Address] [City, State, ZIP] Subject: Request for Lower Interest Rate for [Specify Time Period] Dear [Credit Card Company Name], I hope this letter finds you well. I am writing to request a lower interest rate on my credit card account with your company for a specific period of time, as allowed by the laws in Arizona. I believe that a reduced interest rate during this period would provide me with some financial relief and help me manage my outstanding balance more effectively. As a responsible cardholder, I have been making timely payments on my credit card account and have maintained a good credit history with your company. I have demonstrated my commitment to meeting my financial obligations, and I believe this makes me eligible for a lower interest rate. I understand that the company has promotional offers or options available for customers in similar situations, and I would appreciate it if you would consider extending such an offer to me. By reducing the interest rate on my account for the specified time period, I can focus my efforts on paying down the outstanding balance more efficiently. I kindly request your prompt attention to this matter and would be grateful if you could respond to my request within [Specify Timeframe, e.g., 30 days] in order to effectively plan my finances. If you require any additional documentation or information to process my request, please let me know, and I will provide it promptly. I am hopeful that we can come to a mutually beneficial agreement, allowing me to continue being a valuable customer of your credit card services. Thank you for your attention and understanding. Your favorable consideration is highly appreciated. Yours sincerely, [Your Name] Types of Arizona Letters from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time: 1. Standard Arizona Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time 2. Arizona Letter from Debtor to Credit Card Company Seeking Financial Hardship Lower Interest Rate 3. Arizona Letter from Debtor to Credit Card Company Requesting Temporary Interest Rate Reduction for Debt Consolidation Please note that these are just sample variations, and debtors can modify the content as per their specific circumstances while adhering to the relevant laws in Arizona.

Arizona Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time

Description

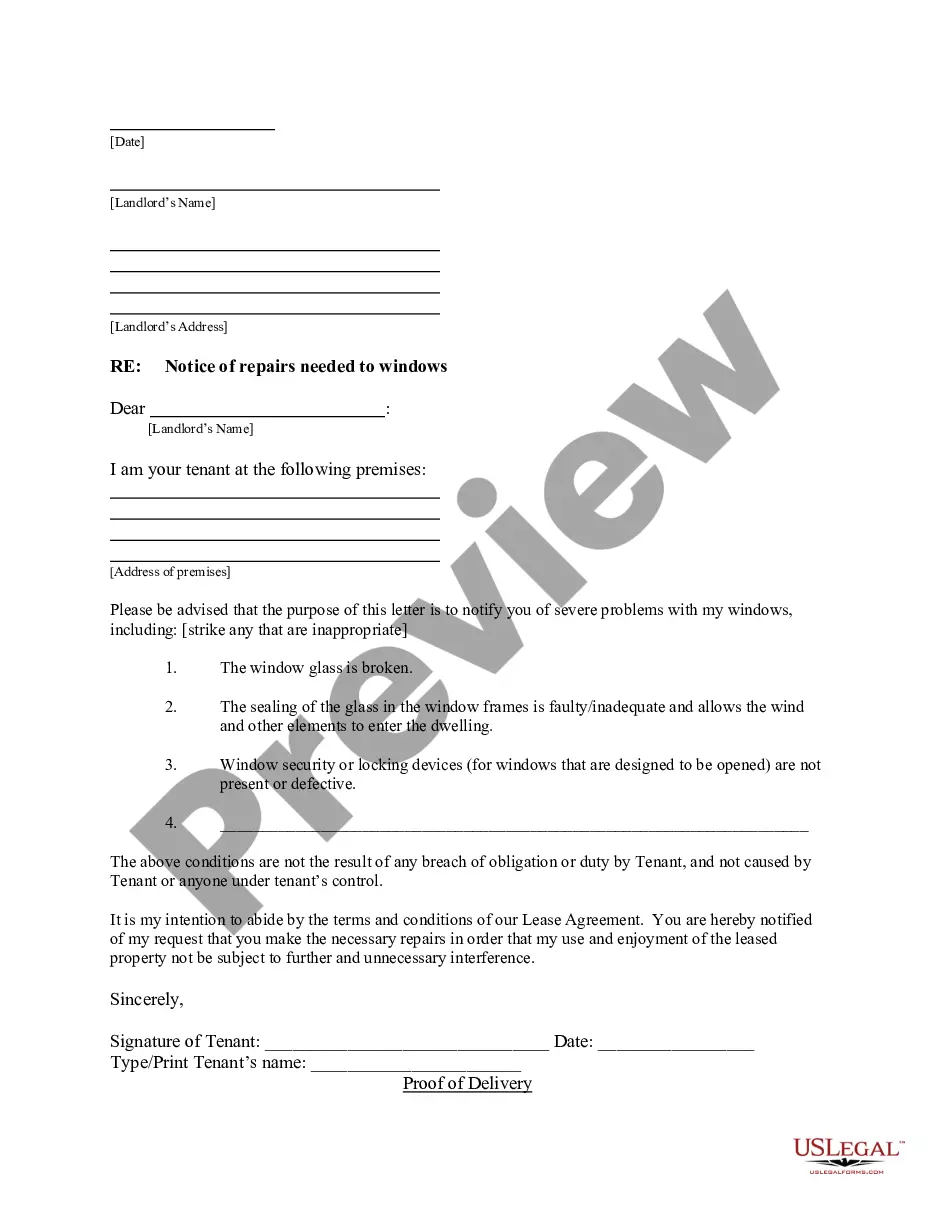

How to fill out Letter From Debtor To Credit Card Company Requesting A Lower Interest Rate For A Certain Period Of Time?

Finding the right legitimate record template could be a have a problem. Naturally, there are a lot of web templates accessible on the Internet, but how can you get the legitimate type you need? Make use of the US Legal Forms website. The assistance offers a large number of web templates, like the Arizona Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time, which you can use for business and personal needs. All of the types are checked by specialists and meet up with federal and state demands.

Should you be presently authorized, log in for your account and click on the Acquire key to get the Arizona Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time. Make use of your account to search through the legitimate types you possess purchased previously. Proceed to the My Forms tab of your respective account and acquire another copy of the record you need.

Should you be a fresh consumer of US Legal Forms, allow me to share simple guidelines that you can follow:

- Initially, make sure you have chosen the right type for your personal town/area. You may examine the shape while using Review key and look at the shape information to guarantee it is the right one for you.

- If the type is not going to meet up with your requirements, utilize the Seach industry to find the proper type.

- When you are certain the shape is acceptable, select the Buy now key to get the type.

- Choose the prices plan you desire and enter in the needed info. Create your account and pay money for your order using your PayPal account or Visa or Mastercard.

- Select the file structure and down load the legitimate record template for your gadget.

- Complete, edit and printing and signal the attained Arizona Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time.

US Legal Forms is definitely the biggest library of legitimate types that you can find numerous record web templates. Make use of the service to down load appropriately-created paperwork that follow state demands.

Form popularity

FAQ

Your credit card company can generally increase your interest rate for new transactions, as long it gives you notice 45-days in advance. New transactions are ones that occur more than 14 days after provision of the notice.

Write a debt settlement letter to your creditor. Explain your current situation and how much you can pay. Also, provide them with a clear description of what you expect in return, such as removal of missed payments or the account shown as paid in full on your report.

It's worth noting that interest rates aren't reported to credit bureaus and have no direct impact on your credit score. A hard inquiry is the only reason your credit score would drop after requesting a lower rate, and asking your card issuer for a lower rate won't always trigger a hard inquiry.

How Long Can a Debt Collector Pursue an Old Debt? Each state has a law referred to as a statute of limitations that spells out the time period during which a creditor or collector may sue borrowers to collect debts. In most states, they run between four and six years after the last payment was made on the debt.

State in the letter you are requesting an interest rate reduction for the following reasons and be specific. Include competitor offers with lower rates, your creditor's own new introductory rates, and state your timely payment history and length of time you've had the account.

Yes. You can and should negotiate mortgage rates when you're getting a home loan. Research confirms that those who get multiple quotes get lower rates.

In Arizona, the statute of limitations for credit card debt is three years. The statute for mortgages and medical debts is six years. The statute for car loans is four years. Unpaid state taxes have a statute of 10 years.

There is no clear statute regarding limitations for a lawsuit to collect a credit card debt in Arizona. At least two relevant statutes may be applicable in this state: One for open accounts (three years from default) and one for written contracts (six years from default).

How to Lower Your Credit Card Interest RateStart With the Card You've Had the Longest. It's a good idea to ask for lower rates on all your credit cards if you have more than one.Ask for a Temporary Break if Necessary.Try Again.Call the Rest of Your Issuersand Put Your Savings to Use.

If you're unhappy with your credit card's interest rate, securing a lower one may be as simple as asking your credit card issuer. They may decline your request, but it doesn't hurt to ask. If you've established a history of on-time payments and other responsible behavior with the issuer, your odds may be good.