The Arizona Post Bankruptcy Petition Discharge Letter is a crucial document provided to individuals who have successfully completed their bankruptcy proceedings in the state of Arizona. This letter signifies the formal discharge of their debts, giving them a fresh financial start. The main purpose of the Arizona Post Bankruptcy Petition Discharge Letter is to inform the debtor that their bankruptcy case has been successfully closed and their debts have been legally eliminated or discharged. It provides a summary of the bankruptcy process and serves as proof to creditors that they are no longer legally obligated to repay the discharged debts. Keywords: Arizona, post-bankruptcy, petition discharge letter, bankruptcy proceedings, formal discharge, debts, fresh financial start, completed, closed, legally eliminated, discharged, summary, proof, creditors, obligations. There are three distinct types of Arizona Post Bankruptcy Petition Discharge Letters: 1. Chapter 7 Discharge Letter: This type of discharge letter is issued to individuals or businesses who qualify for Chapter 7 bankruptcy. Chapter 7 bankruptcy typically involves the liquidation of assets to repay creditors, followed by the discharge of any remaining eligible debts. The Chapter 7 discharge letter is a strong indication that the debtor's debts have been fully discharged, and they are no longer liable for them. 2. Chapter 13 Discharge Letter: Chapter 13 bankruptcy involves the creation of a repayment plan where debtors make regular payments to their creditors over a specific period, usually three to five years. Once the repayment plan is successfully completed, the debtor qualifies for a Chapter 13 discharge letter. This letter signifies that the debtor has fulfilled their obligations under the repayment plan and any remaining eligible debts have been discharged. 3. Chapter 11 Discharge Letter: Chapter 11 bankruptcy is primarily designed for businesses or individuals with substantial debts who seek to restructure their financial affairs. Upon successful completion of the Chapter 11 bankruptcy plan, a discharge letter is issued. This letter confirms that the debtor has effectively reorganized their debts and obligations, allowing them to continue operating their business or personal finance activities. Keywords: Chapter 7, Chapter 13, Chapter 11, discharge letter, bankruptcy, liquidation, assets, creditors, repayment plan, obligations, restructure, financial affairs, eligibility. In conclusion, the Arizona Post Bankruptcy Petition Discharge Letter is a crucial document that formally declares the completion of the bankruptcy process and the discharge of eligible debts. Whether it is a Chapter 7, Chapter 13, or Chapter 11 discharge letter, it provides debtors with the legal validation they need to move on from their financial difficulties and rebuild their financial future.

Arizona Post Bankruptcy Petition Discharge Letter

Description

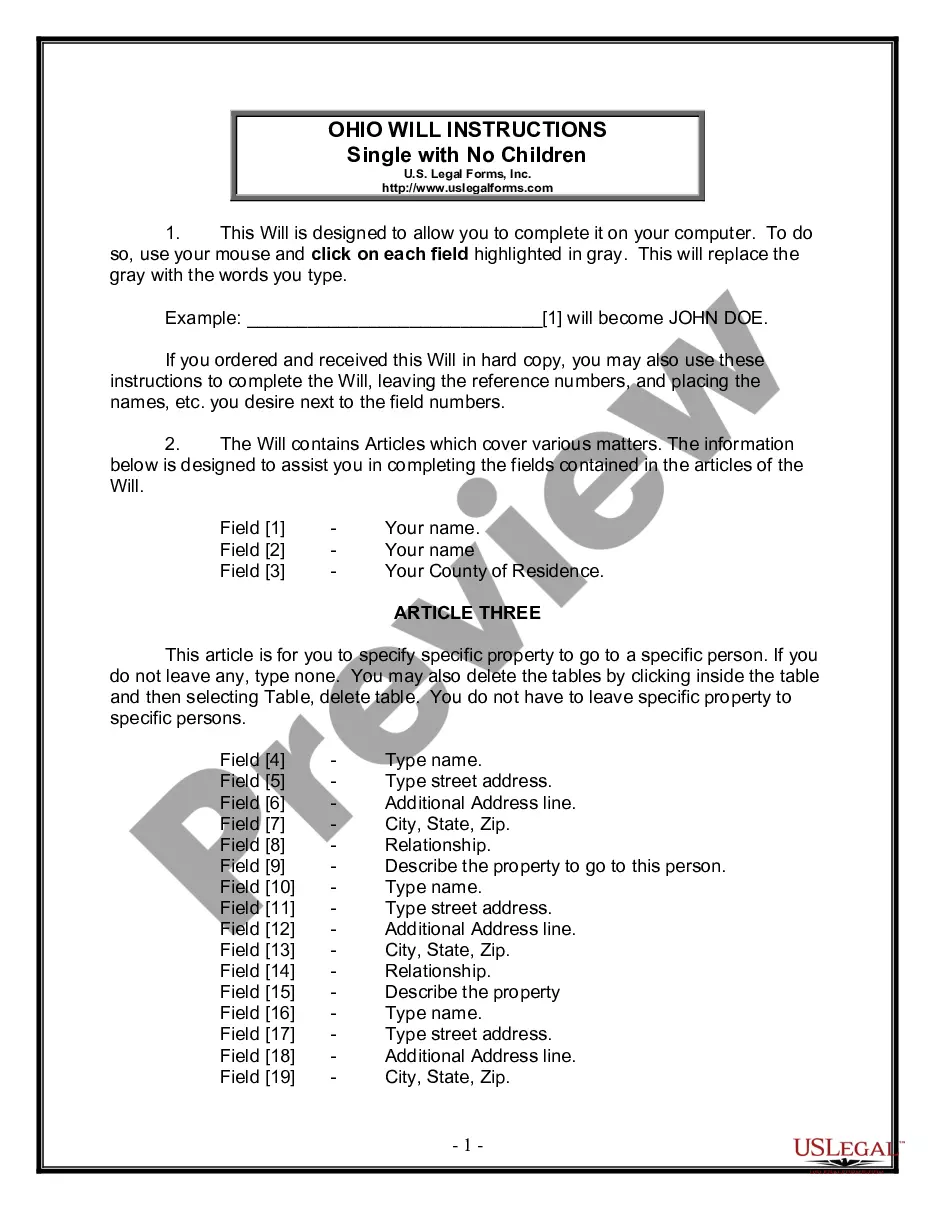

How to fill out Arizona Post Bankruptcy Petition Discharge Letter?

Are you currently inside a position the place you will need documents for possibly company or personal uses virtually every time? There are tons of authorized papers layouts available on the Internet, but finding ones you can rely isn`t easy. US Legal Forms offers 1000s of type layouts, like the Arizona Post Bankruptcy Petition Discharge Letter, that happen to be created in order to meet state and federal demands.

If you are presently knowledgeable about US Legal Forms web site and have an account, just log in. Next, you may acquire the Arizona Post Bankruptcy Petition Discharge Letter format.

Unless you provide an accounts and would like to begin to use US Legal Forms, follow these steps:

- Discover the type you want and make sure it is for that right metropolis/state.

- Utilize the Review key to check the form.

- See the outline to ensure that you have chosen the right type.

- In case the type isn`t what you`re looking for, use the Research area to find the type that meets your needs and demands.

- If you get the right type, simply click Acquire now.

- Choose the prices plan you would like, fill in the desired details to generate your bank account, and buy your order making use of your PayPal or bank card.

- Choose a hassle-free document file format and acquire your backup.

Find all of the papers layouts you have purchased in the My Forms food selection. You may get a additional backup of Arizona Post Bankruptcy Petition Discharge Letter any time, if necessary. Just select the essential type to acquire or print the papers format.

Use US Legal Forms, probably the most extensive variety of authorized kinds, to save time and prevent faults. The service offers appropriately created authorized papers layouts which can be used for a variety of uses. Generate an account on US Legal Forms and commence making your way of life easier.

Form popularity

FAQ

If the trustee finds hidden assets, the trustee can ask the court to revoke or take back your discharge. The trustee can do this at any time before the case closes or, even after, up to one year after the discharge date.

After a Chapter 11 plan is confirmed by the court, the plan must be implemented and carried out, either by the debtor or by the successor to the debtor under the plan. If the plan calls for the debtor to be reorganized or for a new corporation to be formed, this function must be carried out first.

A bankruptcy discharge, also known as a discharge in bankruptcy, refers to a permanent court order that releases a debtor from personal liability for certain types of debts. It is sometimes referred to simply as a discharge and comes at the end of a bankruptcy.

The bankruptcy is reported in the public records section of your credit report. Both the bankruptcy and the accounts included in the bankruptcy should indicate they are discharged once the bankruptcy has been completed. To verify this, the first step is to get a copy of your personal credit report.

A "discharge letter" is a term used to describe the order that the bankruptcy court mails out toward the end of the case. The order officially discharges (wipes out) qualifying debt, such as credit card and utility bill balances, medical debt, and personal loans.

Closing a Chapter 7 Bankruptcy After DischargeA Chapter 7 case will remain open after the discharge if the Chapter 7 trustee appointed to the matter needs additional time to sell assets or if the case involves litigation.

Assuming that everything goes according to schedule, you can expect to receive your bankruptcy discharge (the court order that wipes out your debts) about 60 days after your 341 meeting of creditors hearing, plus a few days for mailing.

The bankruptcy is reported in the public records section of your credit report. Both the bankruptcy and the accounts included in the bankruptcy should indicate they are discharged once the bankruptcy has been completed. To verify this, the first step is to get a copy of your personal credit report.

Since a chapter 12 or chapter 13 plan may provide for payments to be made over three to five years, the discharge typically occurs about four years after the date of filing.