Arizona Jury Instruction - 10.10.4 Business Loss vs. Hobby Loss

Description

How to fill out Jury Instruction - 10.10.4 Business Loss Vs. Hobby Loss?

Have you been inside a situation in which you need to have paperwork for both organization or person uses nearly every working day? There are plenty of lawful papers templates available online, but finding types you can rely isn`t easy. US Legal Forms delivers thousands of form templates, much like the Arizona Jury Instruction - 10.10.4 Business Loss vs. Hobby Loss, which are created to fulfill state and federal specifications.

In case you are currently acquainted with US Legal Forms internet site and get a merchant account, merely log in. Afterward, you may down load the Arizona Jury Instruction - 10.10.4 Business Loss vs. Hobby Loss format.

Unless you offer an account and want to begin using US Legal Forms, abide by these steps:

- Discover the form you will need and ensure it is for your correct city/region.

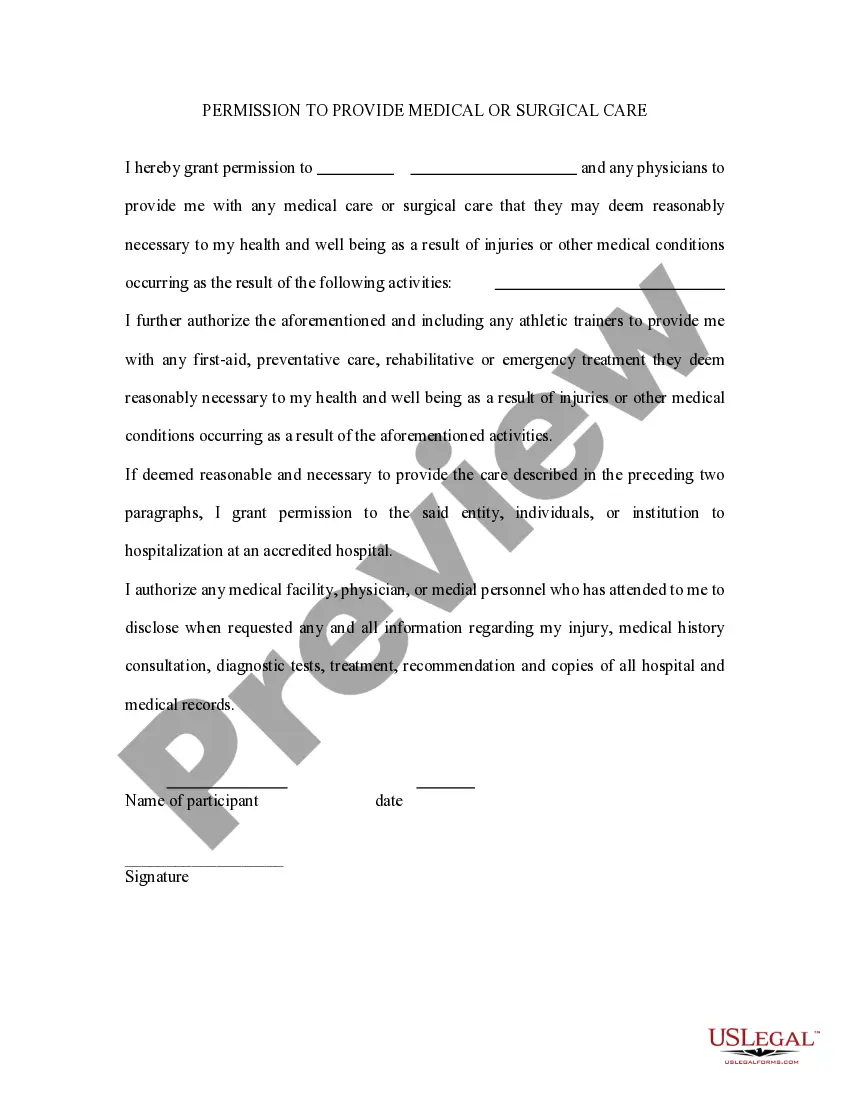

- Use the Preview switch to review the form.

- Look at the outline to actually have chosen the proper form.

- If the form isn`t what you`re trying to find, use the Research field to get the form that meets your requirements and specifications.

- Whenever you discover the correct form, click on Acquire now.

- Opt for the rates program you want, complete the required information to produce your money, and pay for the transaction utilizing your PayPal or Visa or Mastercard.

- Decide on a convenient paper format and down load your backup.

Find all the papers templates you have bought in the My Forms food selection. You may get a further backup of Arizona Jury Instruction - 10.10.4 Business Loss vs. Hobby Loss at any time, if possible. Just select the necessary form to down load or printing the papers format.

Use US Legal Forms, probably the most considerable selection of lawful types, to conserve time and steer clear of faults. The service delivers professionally created lawful papers templates that you can use for a variety of uses. Make a merchant account on US Legal Forms and begin creating your daily life easier.