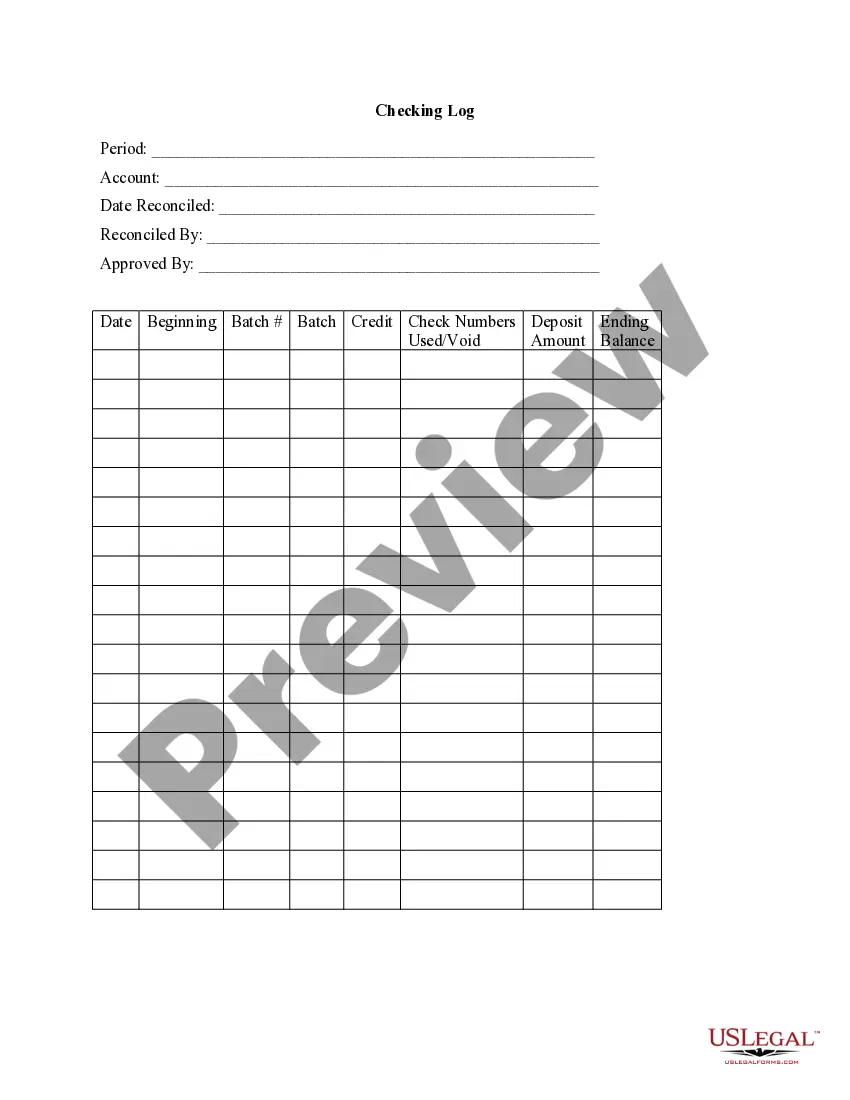

Arizona Checking Log

Description

How to fill out Checking Log?

You might spend hours online attempting to locate the legal document template that meets the federal and state requirements you desire.

US Legal Forms offers a vast selection of legal forms that have been assessed by experts.

You can obtain or create the Arizona Checking Log through my service.

- If you have a US Legal Forms account, you can Log In and hit the Acquire button.

- Then, you can complete, modify, create, or sign the Arizona Checking Log.

- Every legal document template you purchase is yours permanently.

- To obtain another copy of any purchased form, go to the My documents tab and press the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the straightforward instructions below.

- First, ensure you have selected the appropriate document template for the county/city you prefer.

Form popularity

FAQ

The grace period for e-file rejection generally allows for a 5-day window for individuals to correct issues. This applies not only in Arizona but in other states as well. It is critical to maintain an organized Arizona checking log to track these submissions.

Arizona offers a grace period of 5 days for e-file rejections. This means you can correct and resubmit your tax returns within this timeframe without facing immediate penalties. Keeping your Arizona checking log updated can help you monitor these deadlines closely.

Retroactive payments will be made for weeks claimed going back to March 29 for individuals receiving UI as well as individuals receiving PUA. You are eligible for FPUC if you receive any of the following benefits: Unemployment Insurance (UI) Unemployment Compensation for Federal Employees (UCFE)

It takes about four weeks from the date you apply for benefits to know if you are eligible for benefits. We use this time to gather information on your past wages, job separation, and general eligibility. You can check your claim status online at Unemployment Benefits Services or call Tele-Serv at 800-558-8321.

Although payroll records should be retained for the current tax year plus the previous three years, many employers keep these records for six years. A major reason for this is that some payroll records, such as business expenses claims, are also 'accounting' records.

Keep all records of employment taxes for at least four years after filing the 4th quarter for the year. These should be available for IRS review. Records should include: Your employer identification number.

Instructions for checking your claim status online: Access the Weekly Claims system and after choosing "English" or "Spanish", enter your Social Security Number and click the "View Payment Info" tab.

You can call our Automated Telephone System to listen to recorded information about your claim.Toll Free: 1 (877) 766-8477.Phoenix: (602) 417-3800.Tucson: (520) 884-8477.Telecommunications Relay Service for the Deaf/Hard of Hearing: 711 Toll-Free.

2 as the state and nation see an unprecedented number of people applying for jobless benefits because of COVID-19. DES spokesman Brett Bezio told Arizona Mirror those denied claims were deemed monetarily ineligible, meaning the people applying didn't meet the earnings eligibility requirement.

Retroactive claims can be filed by calling 877-600-2722 or by completing a Weekly Claim form for each week.