The Arizona Partnership Buy-Sell Agreement with Purchase on Death, Retirement, or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death is a legally binding contract that outlines the terms and conditions for the transfer of ownership interests in a partnership in the event of death, retirement, or voluntary withdrawal of a partner. This agreement is specifically designed to ensure a smooth transition and continuity of the partnership business. The primary objective of this agreement is to provide a mechanism for the remaining partners to purchase the share of the departing partner, funded by life insurance policies taken out on each partner. The proceeds from the life insurance policies are utilized to finance the purchase and value the departing partner's interest in the partnership. There are several types of Arizona Partnership Buy-Sell Agreements with Purchase on Death, Retirement, or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death, depending on the specific circumstances and preferences of the partners. These include: 1. Partnership Buy-Sell Agreement with Purchase on Death: This type of agreement is triggered by the death of a partner. In the event of a partner's untimely demise, the surviving partners will use the life insurance proceeds to buy out the deceased partner's interest. 2. Partnership Buy-Sell Agreement with Purchase on Retirement: This agreement is applicable when a partner reaches the retirement age or decides to retire voluntarily. The retiring partner's interest in the partnership is bought out using the funds from the life insurance policies. 3. Partnership Buy-Sell Agreement with Purchase on Withdrawal: This type of agreement comes into play when a partner chooses to voluntarily withdraw from the partnership for personal or professional reasons. The remaining partners will utilize the life insurance proceeds to facilitate the buyout of the departing partner's interest. The main advantage of implementing this type of agreement is that it ensures a smooth transition and minimizes disruptions within the partnership upon the occurrence of death, retirement, or withdrawal of a partner. Additionally, the use of life insurance policies guarantees the availability of funds to finance the purchase, eliminating the need for partners to rely on personal savings or external financing. It is vital for partners in an Arizona partnership to draft a comprehensive and legally binding Buy-Sell Agreement with clear provisions for purchase on death, retirement, or withdrawal of a partner. Seeking the advice of a qualified attorney specializing in partnership law is highly recommended tailoring the agreement to the specific needs and goals of the partners.

Arizona Partnership Buy-Sell Agreement with Purchase on Death, Retirement or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death

Description

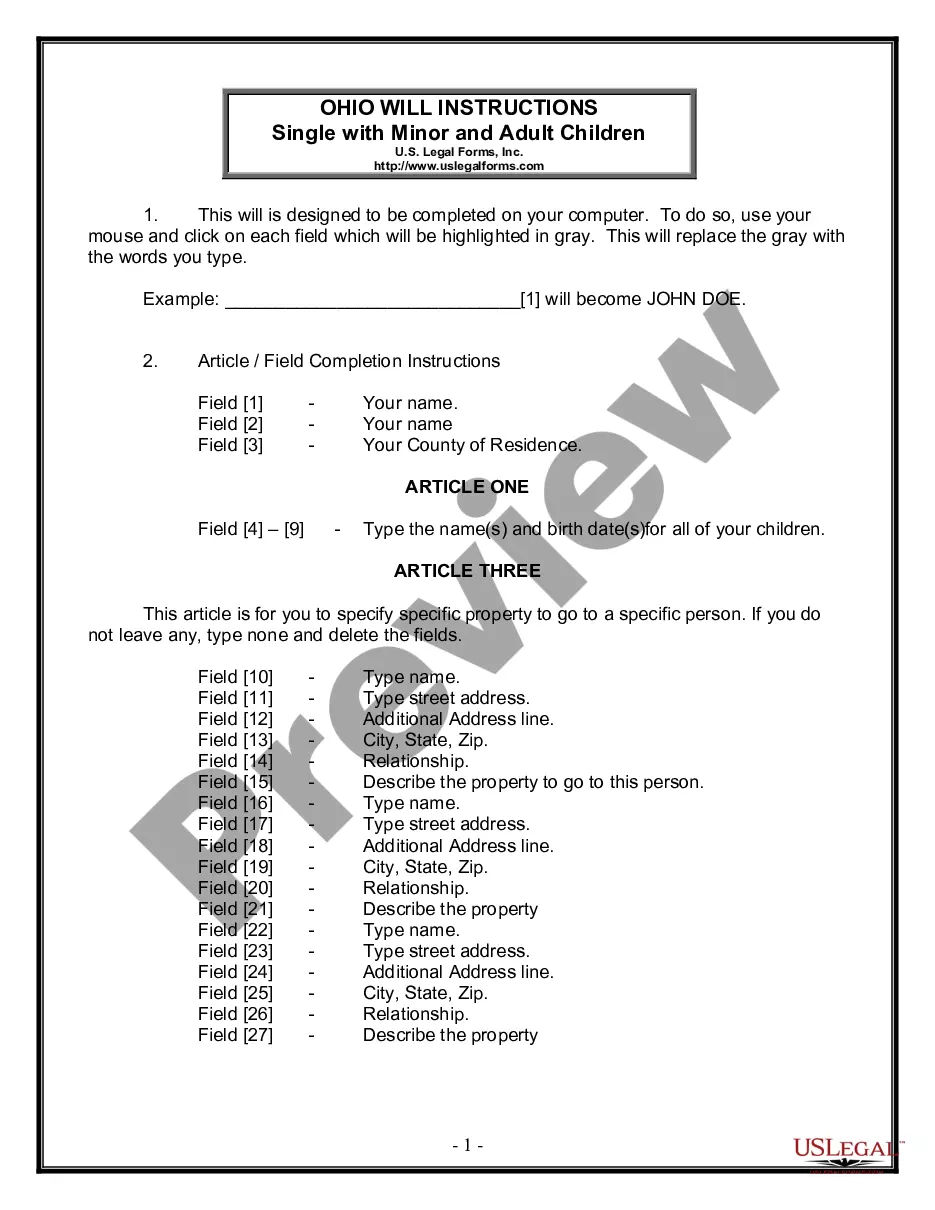

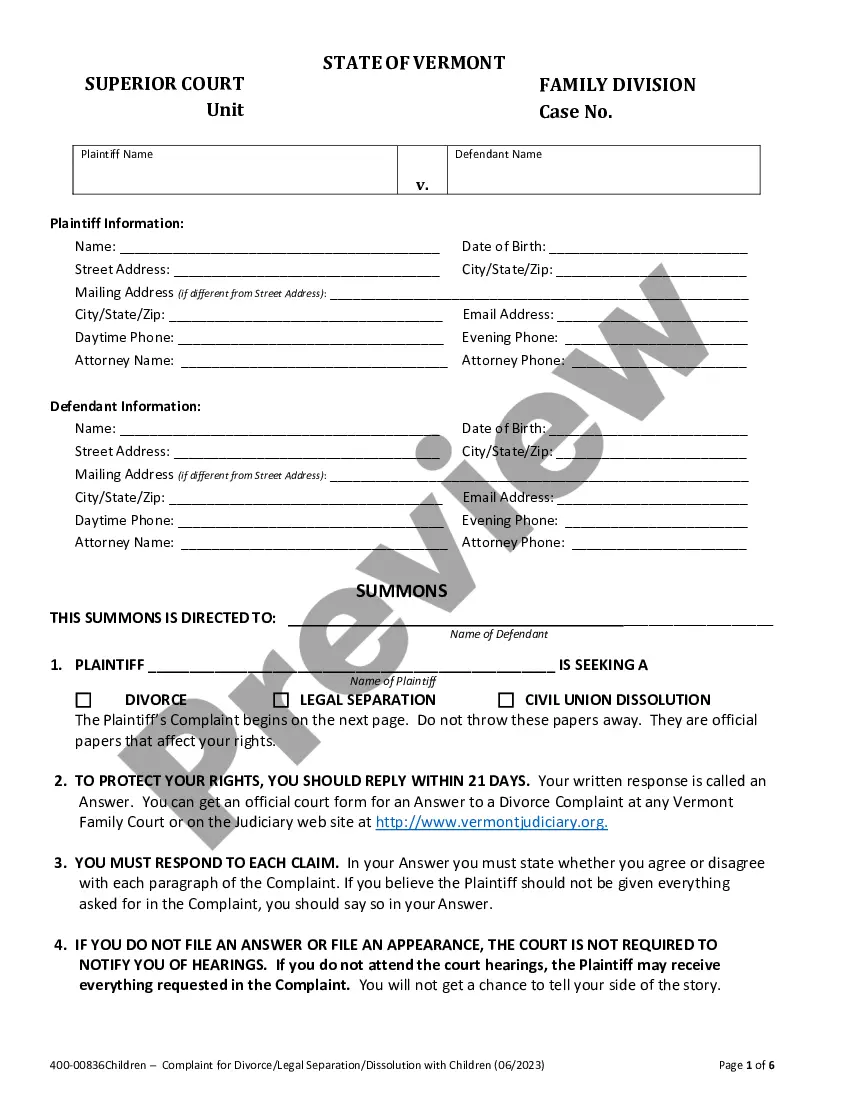

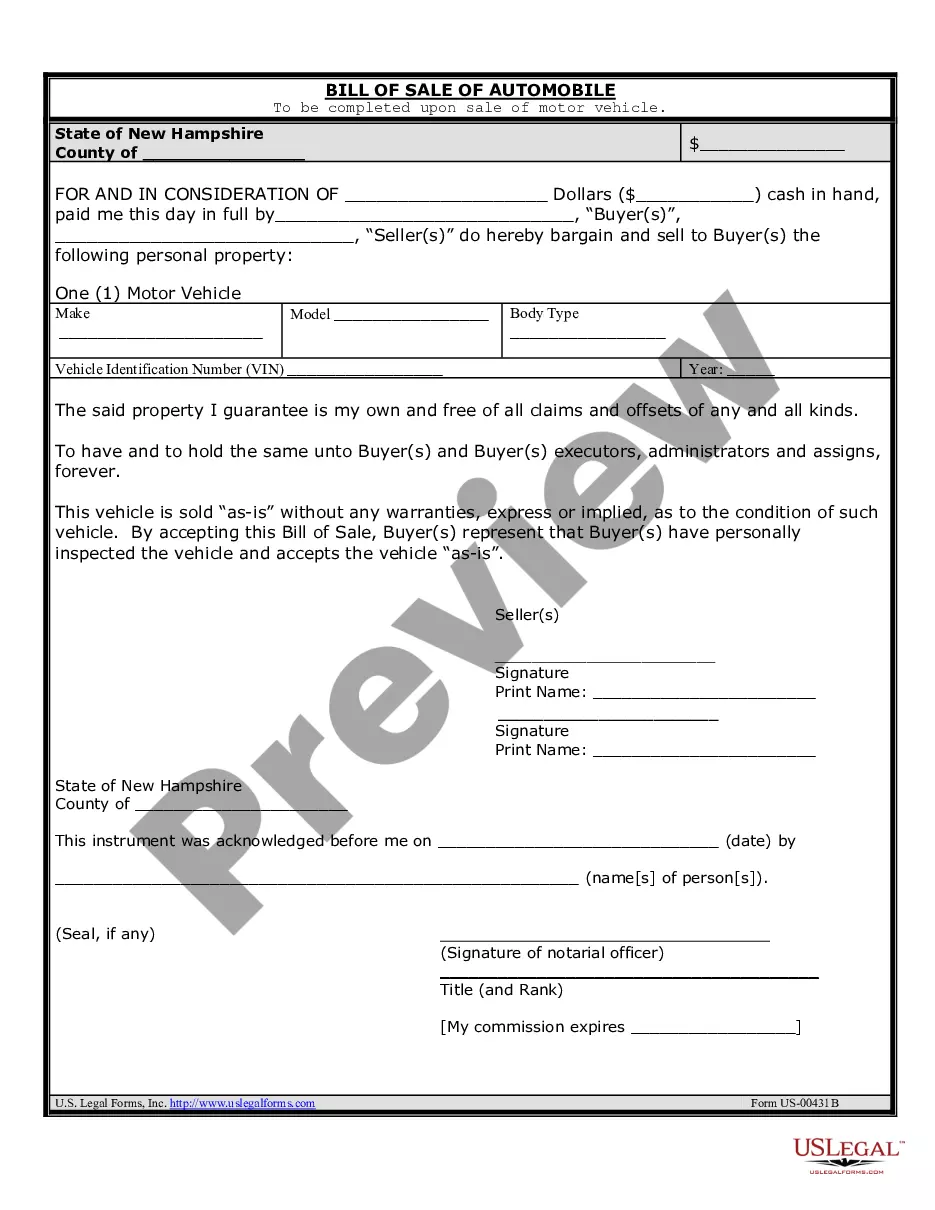

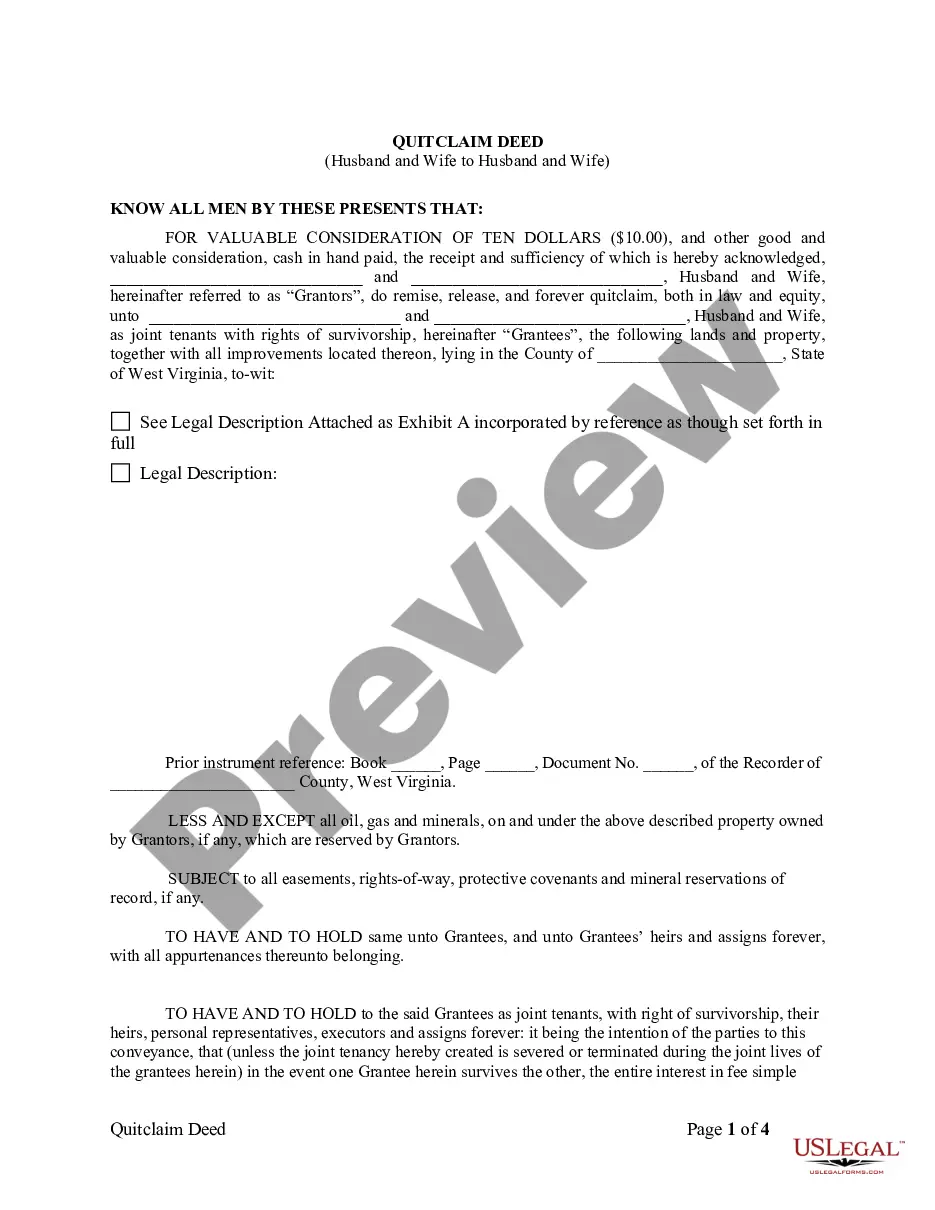

How to fill out Arizona Partnership Buy-Sell Agreement With Purchase On Death, Retirement Or Withdrawal Of Partner With Life Insurance On Each Partner To Fund Purchase In Case Of Death?

Are you inside a position that you require papers for both company or personal functions virtually every time? There are a lot of legitimate papers themes available online, but discovering kinds you can rely on isn`t effortless. US Legal Forms provides 1000s of kind themes, just like the Arizona Partnership Buy-Sell Agreement with Purchase on Death, Retirement or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death, which are created to fulfill state and federal requirements.

When you are previously knowledgeable about US Legal Forms site and get a free account, basically log in. Following that, you may acquire the Arizona Partnership Buy-Sell Agreement with Purchase on Death, Retirement or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death template.

Unless you have an accounts and would like to start using US Legal Forms, follow these steps:

- Discover the kind you require and make sure it is for the proper metropolis/region.

- Use the Preview option to examine the shape.

- See the explanation to ensure that you have selected the right kind.

- If the kind isn`t what you`re trying to find, use the Search industry to get the kind that suits you and requirements.

- Whenever you get the proper kind, just click Buy now.

- Choose the pricing prepare you need, fill in the necessary information to produce your money, and purchase the order using your PayPal or credit card.

- Decide on a hassle-free data file format and acquire your copy.

Find every one of the papers themes you might have bought in the My Forms menus. You can aquire a further copy of Arizona Partnership Buy-Sell Agreement with Purchase on Death, Retirement or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death at any time, if needed. Just click on the necessary kind to acquire or produce the papers template.

Use US Legal Forms, by far the most comprehensive selection of legitimate kinds, in order to save time as well as steer clear of errors. The assistance provides appropriately made legitimate papers themes which you can use for a selection of functions. Generate a free account on US Legal Forms and commence making your way of life easier.

Form popularity

FAQ

Why is life insurance important? Buying life insurance protects your spouse and children from the potentially devastating financial losses that could result if something happened to you. It provides financial security, helps to pay off debts, helps to pay living expenses, and helps to pay any medical or final expenses.

One common question we receive when discussing key person benefits is What is a buy/sell agreement? A buy/sell agreement, also known as a buyout agreement, is a contract funded by a life insurance policy that can help minimize the turmoil caused by the sudden departure, disability or death of a business owner or

Cross-purchase agreements allow remaining owners to buy the interests of a deceased or selling owner. Redemption agreements require the business entity to buy the interests of the selling owner.

The smartest method for funding a buy-sell agreement is through life insurance. This ensures that funds are immediately available when a death occurs; plus, death benefit proceeds are generally income-tax free.

The business owners individually own the policies insuring each other's lives. When a business owner dies, the proceeds are paid to those surviving owners who hold one or more policies on the deceased owner, and these surviving owners buy the shares from the deceased owner's personal representative.

Buyout agreement (also known as a buy-sell agreement) refers to a contract that gives rights to at least one party of the contract to buy the share, assets, or rights of another party given a specific event. These agreements can arise in a variety of contexts as stand-alone contracts or parts of larger agreements.

Each owner would pay the premiums and be the beneficiary of the policy. The face amount of the insurance would be calculated based on the other's ownership interest. Upon the death of one owner, the insurance proceeds would be used to purchase the ownership interests from the deceased owner's estate or family.

One common question we receive when discussing key person benefits is What is a buy/sell agreement? A buy/sell agreement, also known as a buyout agreement, is a contract funded by a life insurance policy that can help minimize the turmoil caused by the sudden departure, disability or death of a business owner or

Advantages of a Cross Purchase PlanWhen the owner(s) purchase the business interest of their departed or deceased owner, their basis increases by what they pay to the exiting owner or estate of the deceased owner. This then improves the tax consequences of their exit if it occurs during their lifetime.

Right to access books and accounts: Each partner can inspect and copy books of accounts of the business. This right is applicable equally to active and dormant partners. Right to share profits: Partners generally describe in their deed the proportion in which they will share profits of the firm.