A partnership buy-sell agreement is a legally binding contract that outlines the terms and conditions for the sale and purchase of a deceased partner's interest in a partnership. In Arizona, there is a specific type of agreement called the Arizona Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor. This agreement is designed to ensure a smooth transition of ownership and provide financial security for both the surviving partner(s) and the estate of the deceased partner. The Arizona Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor establishes a predetermined value for the deceased partner's interest in the partnership. This fixed value is determined based on various factors, including the partnership's financial statements, market conditions, and any independent appraisals. The agreement aims to eliminate uncertainties and potential conflicts by providing a clear valuation method. There are different variations of the Arizona Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor, including: 1. Traditional Fixed Value Agreement: This type of agreement sets a specific price for the buyout of the deceased partner's interest. The surviving partner(s) are obligated to purchase the interest from the estate at the fixed value. 2. Adjustable Value Agreement: In this version, the fixed value can be adjusted periodically, typically to reflect changes in the partnership's performance, market conditions, or other relevant factors. 3. Cross-Purchase Agreement: A Cross-Purchase Agreement allows the surviving partner(s) to purchase the deceased partner's interest in proportion to their ownership percentage in the partnership. This type of agreement helps maintain the balance of ownership within the partnership. 4. Entity Redemption Agreement: In an Entity Redemption Agreement, the partnership itself has the obligation to buy back the deceased partner's interest. The partnership uses its own funds or obtains financing to complete the buyback. The primary goal of the Arizona Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor is to ensure a smooth transfer of ownership and provide financial security for both the surviving partner(s) and the deceased partner's estate. This type of agreement protects the interests of all parties involved and minimizes the potential for disputes during a difficult time.

Arizona Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor

Description

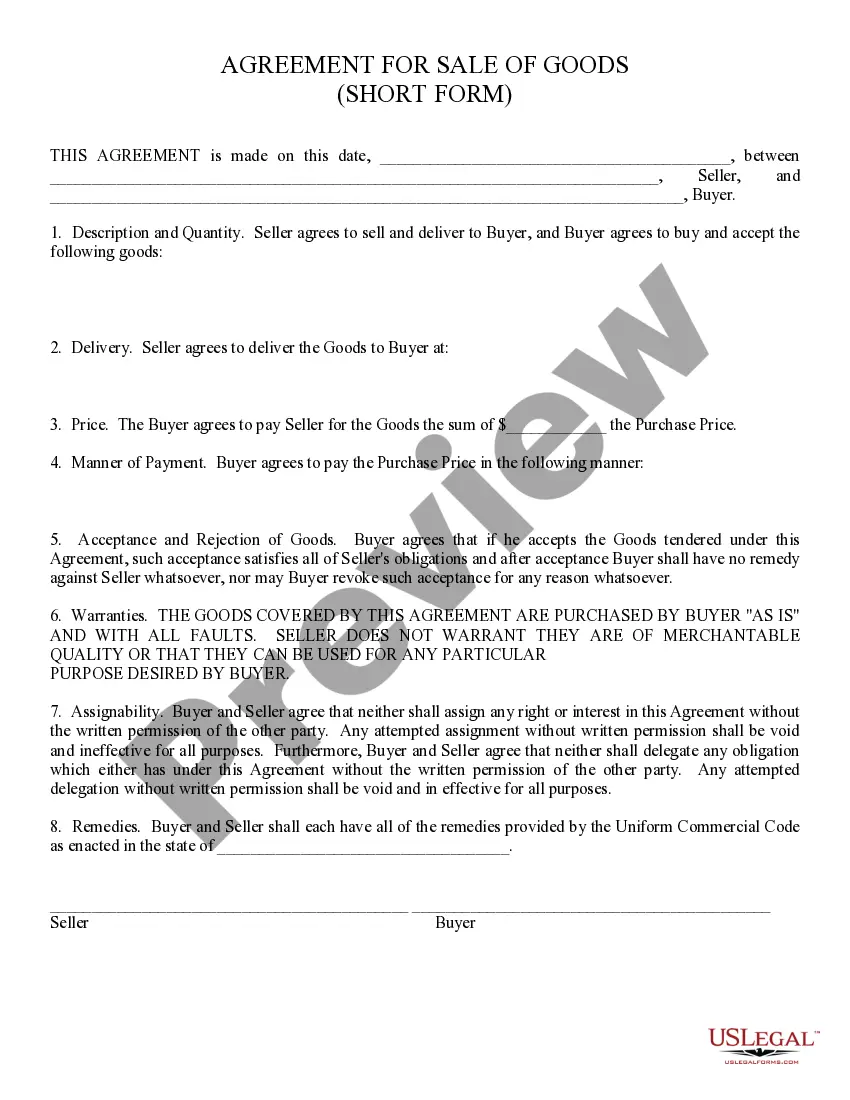

How to fill out Arizona Partnership Buy-Sell Agreement Fixing Value And Requiring Sale By Estate Of Deceased Partner To Survivor?

Choosing the right legal document template can be a have a problem. Naturally, there are tons of templates accessible on the Internet, but how can you discover the legal type you will need? Take advantage of the US Legal Forms web site. The services provides thousands of templates, like the Arizona Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor, which can be used for enterprise and personal requires. All the varieties are examined by experts and fulfill state and federal needs.

When you are presently authorized, log in to the account and then click the Acquire button to get the Arizona Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor. Utilize your account to check throughout the legal varieties you possess acquired in the past. Go to the My Forms tab of your respective account and acquire another copy of the document you will need.

When you are a brand new consumer of US Legal Forms, here are basic guidelines so that you can stick to:

- Very first, make sure you have selected the correct type for your personal town/region. You may examine the form utilizing the Review button and browse the form outline to make certain it is the best for you.

- In case the type does not fulfill your requirements, use the Seach field to obtain the proper type.

- Once you are certain that the form would work, select the Acquire now button to get the type.

- Pick the prices strategy you desire and enter in the needed information. Design your account and pay for your order using your PayPal account or charge card.

- Select the file file format and acquire the legal document template to the gadget.

- Comprehensive, revise and produce and signal the attained Arizona Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor.

US Legal Forms will be the biggest catalogue of legal varieties that you will find a variety of document templates. Take advantage of the company to acquire professionally-made files that stick to state needs.

Form popularity

FAQ

The buy and sell agreement requires that the business share be sold to the company or the remaining members of the business according to a predetermined formula. In the case of the death of a partner, the estate must agree to sell.

According to Section 37, of the Partnership Law, if a member of the firm dies or otherwise ceases to be a partner of the firm, and the remaining partners carry on the business without any final settlement of accounts between them and the outgoing partner, then the outgoing partner or his estate is entitled to share of

A retiring partner may be free from any liability to any third party for the acts of the firm by an agreement made by the outgoing partner with a third-party done before his retirement and such agreement being implied during the dealing.

This is one of the few ways that the parties can feel comfortable that the valuation will be unbiased and take into consideration the company's current condition. The valuation provision of a buy-sell agreement covers how a shareholder's interest will be priced.

The key elements of a buy-sell agreement include:Element 1. Identify the parties.Element 2. Triggered buyout event.Element 3. Buy-sell structure.Element 4. Company valuation.Element 5. Funding resources.Element 6. Taxation considerations.

The circumstances under which the business entity can be dissolved, the process of dissolution, and how distributions of the company's assets are to be made among the owners are critical terms to be reviewed in a Buy-Sell Agreement.

When does a business need a buy-sell agreement? Every co-owned business needs a buy-sell, or buyout agreement the moment the business is formed or as soon after that as possible. A buy-sell, or buyout agreement, protects business owners when a co-owner wants to leave the company (and protects the owner who's leaving).

Right to access books and accounts: Each partner can inspect and copy books of accounts of the business. This right is applicable equally to active and dormant partners. Right to share profits: Partners generally describe in their deed the proportion in which they will share profits of the firm.

Buyout agreement (also known as a buy-sell agreement) refers to a contract that gives rights to at least one party of the contract to buy the share, assets, or rights of another party given a specific event. These agreements can arise in a variety of contexts as stand-alone contracts or parts of larger agreements.

Cross-purchase agreements allow remaining owners to buy the interests of a deceased or selling owner. Redemption agreements require the business entity to buy the interests of the selling owner.