The Arizona Liquidation of Partnership with Sale and Proportional Distribution of Assets is a legal process that occurs when a partnership is dissolved and its assets are sold off to settle its debts and obligations. This process ensures that each partner receives their fair share of the remaining assets based on their ownership percentage in the partnership. In Arizona, there are different types of liquidation of partnership, including voluntary liquidation and involuntary liquidation. Voluntary liquidation occurs when the partners collectively decide to dissolve the partnership, while involuntary liquidation happens when a court order forces the dissolution of the partnership due to various reasons such as partnership misconduct or inability to carry out its business. During the liquidation process, the partnership's assets, including cash, property, and investments, are sold off to generate funds for settling outstanding debts, paying off creditors, and distributing the remaining proceeds proportionally among the partners. The partners' ownership percentage determines their entitlement to the liquidation proceeds. For example, if a partner owns a 40% stake in the partnership, they will be entitled to 40% of the liquidation proceeds. To begin the liquidation process, the partnership must first notify its creditors and publish a notice of dissolution in a local newspaper. This allows any interested parties, such as creditors or potential claimants, to come forward and submit their claims against the partnership before the assets are distributed. Once all valid claims have been addressed and debts paid off, the remaining assets are sold. The partnership may appoint a liquidator or use a third-party liquidation agent to handle the sale of assets. The liquidator’s role is to ensure a fair and transparent sale process, maximize the value of assets, and distribute the proceeds accordingly. After the assets are sold, the liquidation proceeds are used to settle any remaining debts and liabilities. The funds are then distributed among the partners based on their ownership percentages. Each partner will receive their proportionate share of the remaining proceeds, which serves as compensation for their investment and involvement in the partnership. It is important to note that the liquidation of partnership with a sale and proportional distribution of assets in Arizona is subject to state laws and regulations. The process can be complex, requiring legal expertise and careful consideration of various factors. Therefore, it is advisable for partners seeking to liquidate their partnership to consult with an experienced attorney who specializes in business dissolution and liquidation matters in Arizona.

Under What Conditions Will A Partner Recognize A Gain In A Liquidating Distribution

Description

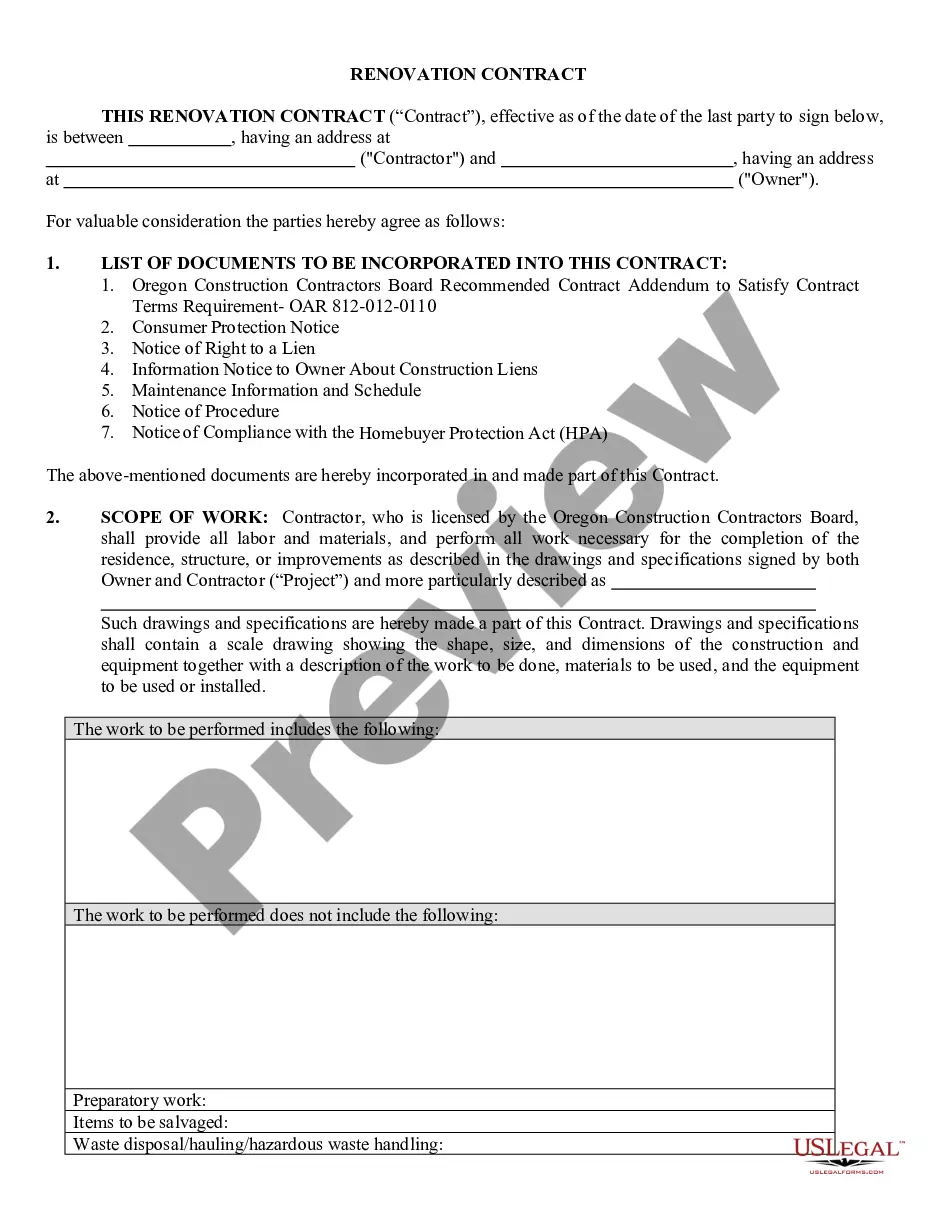

How to fill out Arizona Liquidation Of Partnership With Sale And Proportional Distribution Of Assets?

US Legal Forms - one of many largest libraries of lawful varieties in the States - provides a wide array of lawful papers templates you may download or print out. Making use of the web site, you can find a large number of varieties for enterprise and individual purposes, categorized by categories, says, or keywords and phrases.You can find the most up-to-date variations of varieties much like the Arizona Liquidation of Partnership with Sale and Proportional Distribution of Assets within minutes.

If you already have a monthly subscription, log in and download Arizona Liquidation of Partnership with Sale and Proportional Distribution of Assets from the US Legal Forms local library. The Download option will show up on every single form you look at. You gain access to all earlier saved varieties from the My Forms tab of your respective account.

If you wish to use US Legal Forms for the first time, listed here are simple instructions to get you started:

- Be sure you have picked the right form to your area/state. Go through the Preview option to check the form`s information. Read the form outline to actually have selected the right form.

- When the form doesn`t match your requirements, utilize the Search discipline near the top of the monitor to find the one that does.

- Should you be pleased with the shape, verify your choice by clicking on the Buy now option. Then, pick the rates prepare you like and provide your accreditations to register on an account.

- Process the transaction. Use your Visa or Mastercard or PayPal account to accomplish the transaction.

- Select the format and download the shape in your device.

- Make modifications. Complete, edit and print out and indicator the saved Arizona Liquidation of Partnership with Sale and Proportional Distribution of Assets.

Each and every template you included with your money lacks an expiry date and is also your own forever. So, if you would like download or print out one more copy, just go to the My Forms area and click on about the form you want.

Get access to the Arizona Liquidation of Partnership with Sale and Proportional Distribution of Assets with US Legal Forms, by far the most comprehensive local library of lawful papers templates. Use a large number of expert and condition-certain templates that meet up with your business or individual needs and requirements.

Form popularity

FAQ

Upon the winding up of a limited partnership, the assets shall be distributed as follows: (1) To creditors, including partners who are creditors, to the extent permitted by law, in satisfaction of liabilities of the limited partnership other than liabilities for distributions to partners under section 34-20d or 34-27d;

What is the partner's basis in property received in liquidation of his interest? When a partnership distributes property in a liquidating distribution, the recipient partner's outside basis reduced by any amount of cash included in the distribution is allocated to the distributed property.

Once the debts owed to all creditors are satisfied, the partnership property will be distributed to each partner according to their ownership interest in the partnership. If there was a partnership agreement, then that document controls the distribution.

When a partnership dissolves, the individuals involved are no longer partners in a legal sense, but the partnership continues until the business's debts are settled, the legal existence of the business is terminated and the remaining assets of the company have been distributed.

If a company goes into liquidation, all of its assets are distributed to its creditors. Secured creditors are first in line. Next are unsecured creditors, including employees who are owed money. Stockholders are paid last.

Cases. A dividend may be referred to as liquidating dividend when a company: Goes out of business and the net assets of the company (after all liabilities have been paid) are distributed to shareholders, or. Sells a portion of its business for cash and the proceeds are distributed to shareholders.

Only partners who receive a liquidating distribution of cash may have an immediate taxable gain or loss to report. The value of marketable securities, such as stock investments that are traded on a public stock exchange, and decreases to your share of the partnership's debt are both treated as cash distributions.

The basis of property (other than money) distributed by a partnership to a partner in liquidation of the partner's interest shall be an amount equal to the adjusted basis of such partner's interest in the partnership reduced by any money distributed in the same transaction.

The Voluntary Strike off and Dissolution of an LLP If the LLP is struck off with outstanding debts then creditors and other parties can apply for the business to be restored to the register so they can take action to recover the money they are owed.

Property Distributions. When property is distributed to a partner, then the partnership must treat it as a sale at fair market value ( FMV ). The partner's capital account is decreased by the FMV of the property distributed. The book gain or loss on the constructive sale is apportioned to each of the partners' accounts