Arizona Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets

Description

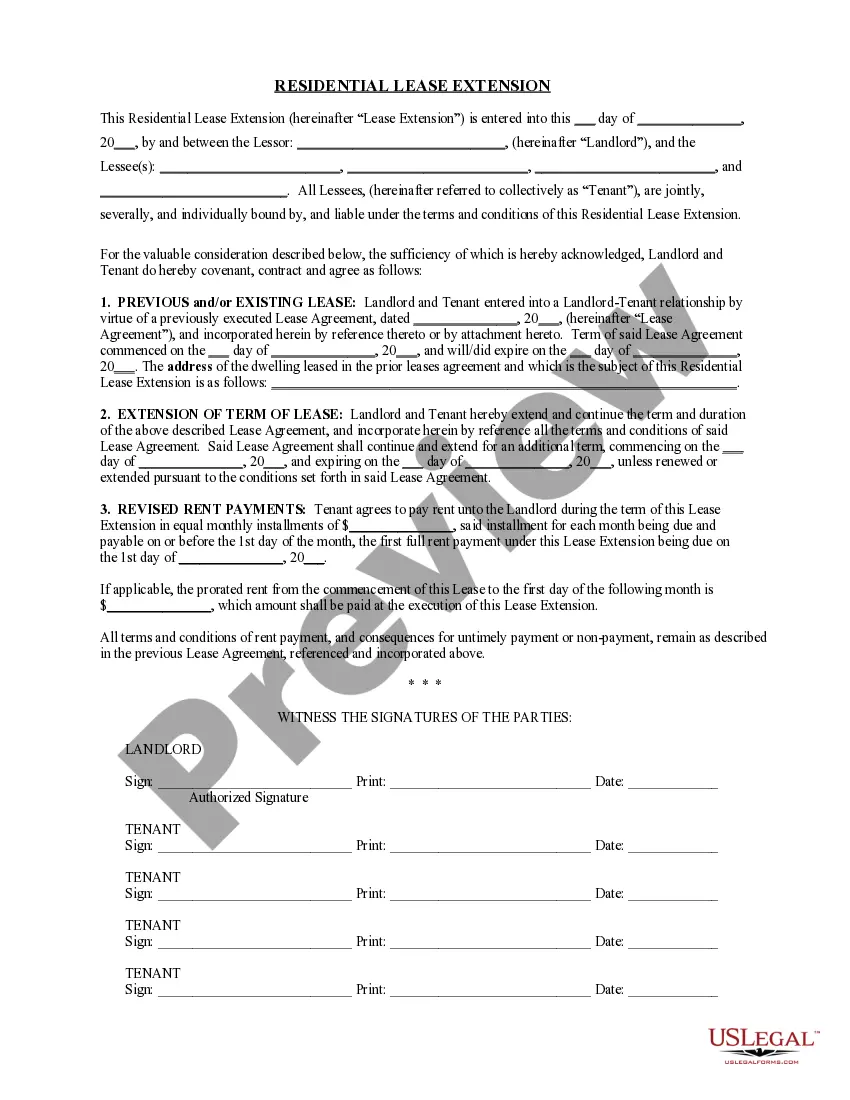

How to fill out Agreement To Dissolve And Wind Up Partnership With Sale To Partner And Disproportionate Distribution Of Assets?

US Legal Forms - one of the largest libraries of lawful forms in the USA - offers an array of lawful file web templates you can acquire or printing. While using web site, you can get a huge number of forms for organization and person purposes, categorized by types, states, or keywords and phrases.You can find the most up-to-date versions of forms much like the Arizona Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets in seconds.

If you currently have a subscription, log in and acquire Arizona Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets from the US Legal Forms library. The Acquire button will show up on every kind you perspective. You gain access to all previously saved forms in the My Forms tab of your own bank account.

If you wish to use US Legal Forms initially, allow me to share straightforward instructions to help you get started off:

- Ensure you have selected the correct kind for the city/area. Select the Review button to analyze the form`s content material. Browse the kind explanation to ensure that you have chosen the proper kind.

- In case the kind does not suit your needs, utilize the Look for industry at the top of the display screen to get the one that does.

- In case you are happy with the form, validate your option by clicking the Purchase now button. Then, pick the costs strategy you prefer and provide your accreditations to register to have an bank account.

- Procedure the purchase. Make use of credit card or PayPal bank account to finish the purchase.

- Select the file format and acquire the form on your own device.

- Make changes. Load, modify and printing and signal the saved Arizona Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets.

Every single web template you put into your account lacks an expiration particular date which is yours forever. So, if you would like acquire or printing one more copy, just go to the My Forms portion and click on in the kind you require.

Gain access to the Arizona Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets with US Legal Forms, by far the most considerable library of lawful file web templates. Use a huge number of professional and condition-distinct web templates that fulfill your organization or person requirements and needs.

Form popularity

FAQ

How to Properly Dissolve a Business Partnership in ArizonaReview Partnership Agreement. The first step to dissolving a partnership is to complete a thorough review of the partnership agreement.Withdrawal of Partners.File Dissolution with Arizona Secretary of State.

A distribution is disproportionate if a partner receives more or less than his pro rata share of IRC 751(b) hot assets. Partnership distributes money and/or property to a partner.

How to Dissolve a PartnershipReview and Follow Your Partnership Agreement.Vote on Dissolution and Document Your Decision.Send Notifications and Cancel Business Registrations.Pay Outstanding Debts, Liquidate, and Distribute Assets.File Final Tax Return and Cancel Tax Accounts.Limiting Your Future Liability.

File a Dissolution Form. You'll need to file a dissolution of partnership form with the state your business is based in to formally announce the end of the partnership. Doing so makes it clear that you are no longer in a partnership or liable for its debts; it's a good protective measure to take.

Can Partners Take Unequal Distributions? You may be entitled to unequal distribution of partnership profits regardless of the partners' share of capital under a partnership agreement. An S Corporation cannot take advantage of this tax break because it cannot adjust its tax bill in this way.

LLCs are not required to periodically distribute profits to members. If profits are distributed, a member still has an equal claim for future distributions.

Typically, state law provides that the partnership must first pay partners according to their share of capital contributions (the investments in the partnership), and then distribute any remaining assets equally.

A disproportionate distribution is a payout of corporate profits whereby some shareholders receive cash or other assets and others receive an increased interest in the company.

Do partnership distributions have to be equal? Partner equity does not typically equate to equivalent investment contributions from all business partners. Instead, partners can make equal contributions to the company and possess equal ownership rights, but make contributions in a variety of different forms.

Separation Agreement to Prevent Partnership DissolutionWhen one partner wants to leave the partnership, the partnership generally dissolves. Dissolution means the partners must fulfill any remaining business obligations, pay off all debts, and divide any assets and profits among themselves.