Arizona Unrestricted Charitable Contribution of Cash

Description

How to fill out Unrestricted Charitable Contribution Of Cash?

Are you presently in a situation where you require documents for either business or personal reasons almost all the time.

There are numerous authentic document templates accessible online, but finding ones you can rely on is challenging.

US Legal Forms offers a vast array of form templates, such as the Arizona Unrestricted Charitable Contribution of Cash, that are designed to comply with federal and state regulations.

If you identify the correct form, simply click Purchase now.

Choose the pricing plan you wish, complete the necessary information to create your account, and pay for the order using your PayPal or Visa/Mastercard.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Arizona Unrestricted Charitable Contribution of Cash template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

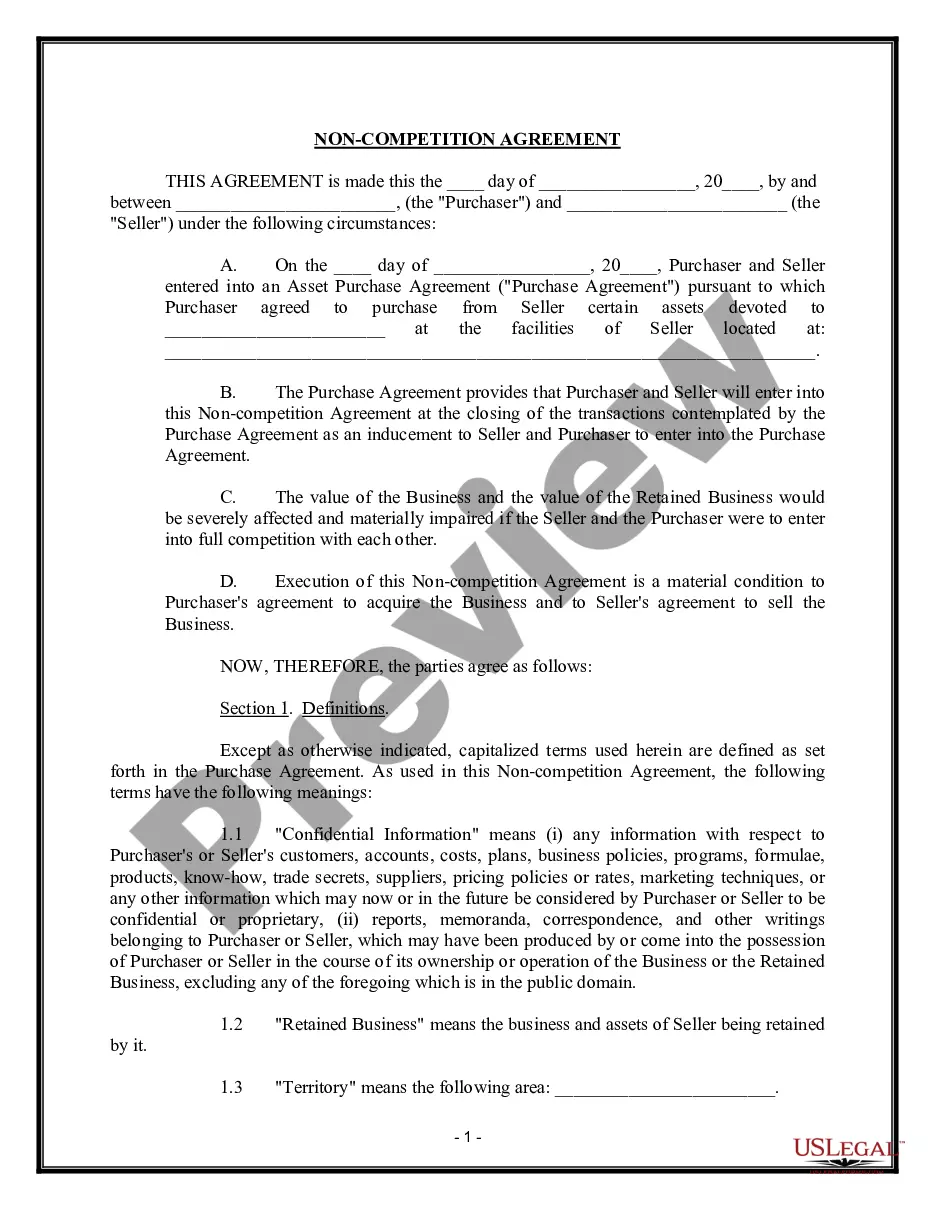

- Utilize the Review option to examine the form.

- Check the description to confirm that you have selected the correct form.

- If the form is not what you require, use the Search box to find the form that meets your needs and specifications.

Form popularity

FAQ

In certain circumstances, you can deduct charitable contributions without itemizing. For example, the IRS allows a standard deduction for cash contributions made to qualifying charities, including those recognized under the Arizona Unrestricted Charitable Contribution of Cash guidelines. This makes it simpler for many taxpayers to still benefit from their generosity. However, it’s essential to stay updated on tax laws to ensure compliance and maximize your deductions.

Yes, charitable contributions in Arizona are generally deductible if made to qualifying organizations. By making an Arizona Unrestricted Charitable Contribution of Cash, you not only support your community but also enhance your tax situation. Be sure to keep thorough records of your donations and verify that the organizations meet the state's criteria for deductions. This helps you take full advantage of the benefits associated with charitable giving.

AZ form 321 is the Arizona Tax Credit for Charitable Organizations form. It allows taxpayers to claim a credit for contributions made to qualifying charitable entities, specifically those addressing various community needs. By filing this form, you can take advantage of the Arizona Unrestricted Charitable Contribution of Cash and enhance your tax benefits. Completing form 321 ensures that you maximize your charitable contributions while supporting your favorite causes.

Yes, contributions to 529 plans in Arizona can receive a state tax deduction. This allows you to contribute to a child's education fund while benefiting from the Arizona Unrestricted Charitable Contribution of Cash tax deduction. Single filers can deduct up to $2,000 per beneficiary, while married couples can deduct up to $4,000. This makes investing in education both beneficial and affordable.

In Arizona, taxpayers can claim deductions on their tax returns for contributions made to qualifying charitable organizations. These Arizona Unrestricted Charitable Contributions of Cash can benefit both the donor and the community. Depending on your filing status and income level, the amount eligible for deduction may vary. It's essential to understand the rules to maximize your benefits while supporting worthy causes.

To claim an Arizona charitable tax credit, you will need to complete specific tax forms that verify your contributions. Ensure that your donations are made to charities that accept Arizona Unrestricted Charitable Contributions of Cash. This documentation will allow you to effectively claim your credits on your tax return, streamlining the process while supporting your favorite causes.

For the year 2025, individuals can typically donate up to $400 for single filers and $800 for married couples filing jointly to qualify for state tax credits. Consider making your contributions in the form of Arizona Unrestricted Charitable Contributions of Cash to make the most of your charitable giving. Staying informed about changes in tax credits can help you maximize your benefits.

Qualifying charities for Arizona tax credits include nonprofit organizations that provide assistance in education, health care, and community services. Be sure to choose those that accept Arizona Unrestricted Charitable Contributions of Cash for maximum benefit. This allows your contribution to enhance the community while granting you advantageous tax deductions.

Absolutely, charitable donations are tax deductible in Arizona, and this includes donations categorized as Arizona Unrestricted Charitable Contributions of Cash. When you donate to eligible charities, you can claim these amounts against your taxable income. This arrangement allows you to contribute to your community while also minimizing your tax obligations.

Yes, charitable donations are generally tax deductible in Arizona, including those recognized as Arizona Unrestricted Charitable Contributions of Cash. When you donate to qualifying charities, you can usually deduct the amount from your taxable income. This not only supports the cause but also provides financial relief on your taxes.