An Arizona Agreement to Sell Partnership Interest to a Third Party refers to a legally binding document that outlines the terms and conditions under which a partner transfers their ownership stake in a partnership to an external party. This agreement serves as a legal protection for both the selling partner and the buyer, ensuring a smooth transition of ownership and protecting the rights of all involved parties. There are various types of Arizona Agreement to Sell Partnership Interest to Third Party, which may vary according to specific circumstances and the nature of the partnership. Some common types include: 1. General Partnership Agreement: This agreement is used when partners in a general partnership decide to sell their interest to a third party. It specifies the percentage of partnership interest being sold, the sale price, payment terms, and any conditions attached to the sale. 2. Limited Partnership Agreement: In a limited partnership, where there are general partners and limited partners, the sale of partnership interest must adhere to the terms outlined in the limited partnership agreement. This document ensures that the transfer of interest does not violate any provisions specified for limited partners. 3. Limited Liability Partnership Agreement: If partners in a limited liability partnership wish to sell their interest to an external party, an agreement is required to establish the terms of sale while ensuring the continuity of the partnership. It addresses the rights and obligations of the selling partner, the buyer, and the remaining partners. Key elements typically included in an Arizona Agreement to Sell Partnership Interest to Third Party may include: 1. Parties involved: Identify the selling partner, the buyer, and the partnership itself. Provide their full legal names, addresses, and contact details. 2. Sale terms: Specify the percentage or number of partnership interests being sold, the sale price, the payment terms (e.g., lump sum or installment payments), and any conditions or contingencies attached to the sale. 3. Closing process: Outline the steps required to complete the sale, including the transfer of legal ownership, notification to the partnership, and any necessary government registrations. 4. Representations and warranties: State that the selling partner has the legal right to sell their interest, and that there are no undisclosed liabilities or claims against the partnership. 5. Existing partnership agreements: Clearly state that the buyer acknowledges and accepts all obligations and benefits outlined in the existing partnership agreement. 6. Confidentiality clause: Protect the sensitive information of the partnership by including a clause that restricts the buyer from disclosing any confidential or proprietary information learned during the sale process. 7. Governing law and jurisdiction: Specify that the agreement will be governed by Arizona state laws and outline the jurisdiction in which disputes will be resolved. It is crucial to consult with a legal professional experienced in business and partnership matters to ensure that an Arizona Agreement to Sell Partnership Interest to a Third Party complies with all applicable laws and accurately reflects the intentions of all parties involved.

Arizona Agreement to Sell Partnership Interest to Third Party

Description

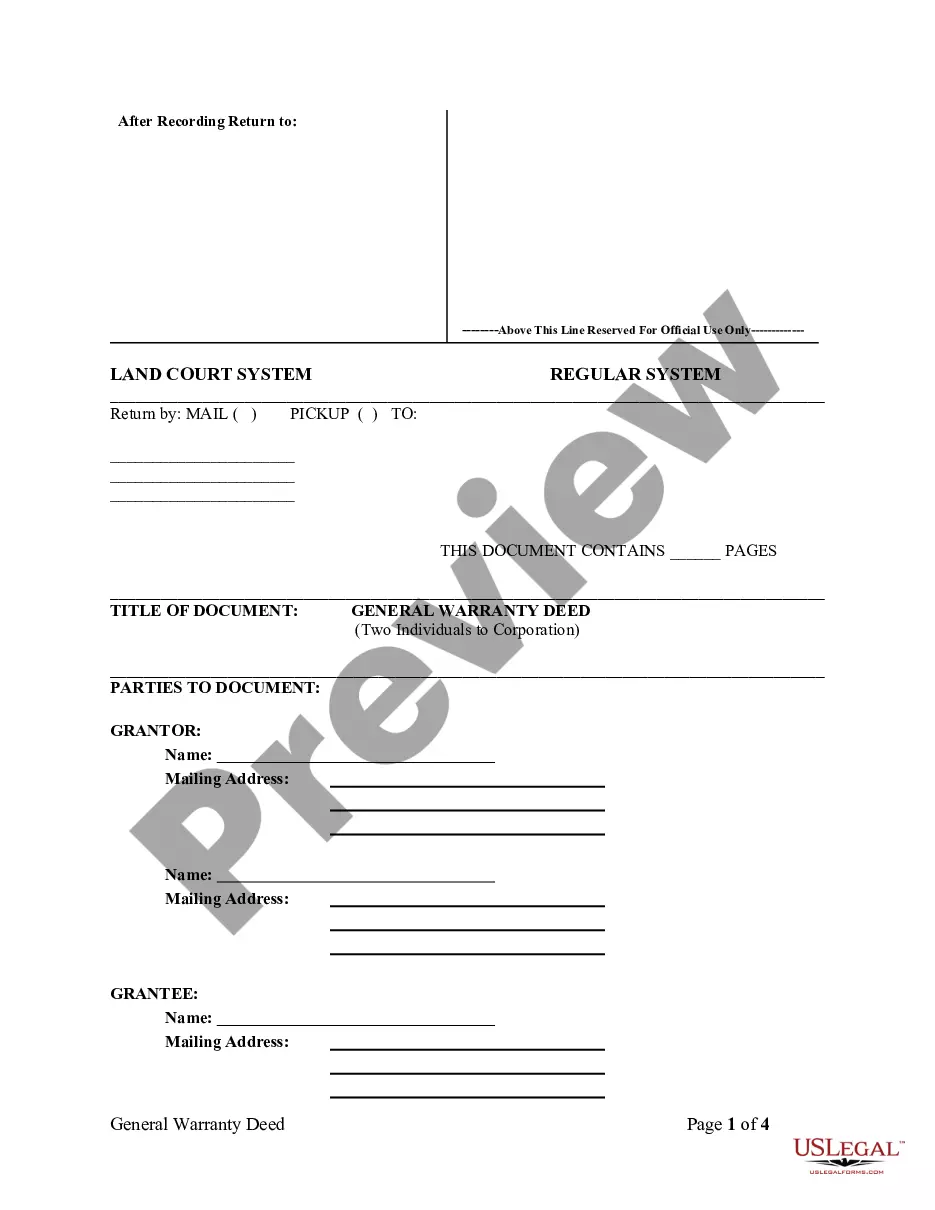

How to fill out Arizona Agreement To Sell Partnership Interest To Third Party?

Are you currently within a place in which you will need papers for possibly business or specific functions almost every day time? There are a lot of legal file web templates accessible on the Internet, but finding versions you can depend on isn`t simple. US Legal Forms provides a large number of kind web templates, like the Arizona Agreement to Sell Partnership Interest to Third Party, that happen to be created in order to meet federal and state specifications.

When you are currently acquainted with US Legal Forms web site and also have your account, merely log in. Next, it is possible to obtain the Arizona Agreement to Sell Partnership Interest to Third Party format.

Unless you offer an account and wish to begin using US Legal Forms, follow these steps:

- Discover the kind you want and make sure it is for that right town/region.

- Use the Preview button to analyze the form.

- See the explanation to ensure that you have selected the proper kind.

- When the kind isn`t what you`re searching for, make use of the Lookup discipline to get the kind that meets your requirements and specifications.

- Once you obtain the right kind, just click Buy now.

- Choose the rates plan you desire, fill out the necessary information to generate your bank account, and pay money for your order making use of your PayPal or credit card.

- Choose a hassle-free file structure and obtain your backup.

Find all of the file web templates you might have purchased in the My Forms menus. You can get a extra backup of Arizona Agreement to Sell Partnership Interest to Third Party any time, if necessary. Just click the essential kind to obtain or produce the file format.

Use US Legal Forms, one of the most considerable variety of legal kinds, in order to save time as well as avoid errors. The service provides appropriately manufactured legal file web templates which can be used for a range of functions. Create your account on US Legal Forms and begin generating your lifestyle easier.

Form popularity

FAQ

The sale of a partnership interest is generally treated as a sale of a capital asset, resulting in capital gain or loss for the selling partner.

Because tax law views a partnership both as an entity and as an aggregate of partners, the sale of a partnership interest may result either in a capital gain or loss or all or a portion of the gain may be taxed as ordinary income.

A partnership agreement must contain the name and address of each partner and his contribution to the business. Contributions may consist of cash, property and services. The agreement must detail how the partners intend to allocate the company's profits and losses.

written partnership agreement will reduce the risk of misunderstandings and disputes between the owners. Without a written agreement, owners in a company will be stuck with the state's default rules.

As long as an agreement satisfies all of the aforesaid three elements, then there exists a valid contract regardless of whether or not it is in writing. For this reason, a contract is a contract in whatever form it may be, unless the law requires that it be in writing for it to be valid or enforceable.

A sale of a partnership interest occurs when one partner sells their ownership interest to another person or entity. The partnership is generally not involved in the transaction. However, the buyer and seller will notify the partnership of the transaction.

The transfer of a partner's economic interest in a partnership is determined by the partnership agreement, or by statute if there is no partnership agreement. Unless permitted by the partnership agreement, no person may become a partner without the consent of all the other partners.

Under the purchase scenario, one or more remaining partners may buy out the terminating partner's interest for fair market value (FMV) plus any relief of debt realized by the partner.

Written Contracts Provide Proof of Details It provides the ultimate understanding of the agreement between the owners of a company or its investors, about the services rendered by a third party, or payment obligations to your hired workers. All these things should be stated within the written contract as legal proof.

Because tax law views a partnership both as an entity and as an aggregate of partners, the sale of a partnership interest may result either in a capital gain or loss or all or a portion of the gain may be taxed as ordinary income.

More info

Law Firm ContractsPatent Lawyers Corporations Copyright Lawyers Immigration Lawyers Intellectual Property Lawyers Internet Lawyers Formation Lawyers Trademark Lawyers Patents Lawyers Corporation Formation Lawyers Startups Trademark Resources Patent Resource Startup ResourcesFree Legal Documents Third party contract attorney that involves person party contract involved with transaction lawyer read Third party contract attorney that involves person party What Third Party Contracts to Consider Toggle navigation Works Lawyers know need spend hours finding lawyer post custom quotes from experienced lawyers instantly Post Business Lawyers Corporation Form Law Firm ContractsPatent Lawyers Corporations Copyright Lawyers Immigration Lawyers Int intellectual Property Lawyers Internet Lawyers Formation Lawyers Trademark Lawyers Patents Lawyers Corporation Formation Lawyers Startup Lawyers Trademark Resources Patent Resources Startup ResourcesFree Legal Documents Third party contracts agreements