Description: Arizona Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status is a specific type of trust established in the state of Arizona that is designed to fulfill charitable purposes while also seeking tax-exempt status. This trust is created with the condition that it will only come into existence once it has obtained the necessary qualifications for tax-exempt status from the Internal Revenue Service (IRS). By setting up an Arizona Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status, individuals or organizations can ensure that their charitable intentions are met while also maximizing the potential tax benefits. This type of trust demonstrates a commitment to philanthropy and responsible financial planning. The creation of this trust is contingent upon achieving tax-exempt status, which means that all necessary steps must be taken to meet the IRS requirements for charitable organizations. These requirements typically involve demonstrating the charitable nature of the trust's activities, filing the appropriate paperwork, and adhering to the IRS guidelines for tax-exempt organizations. There are various types of Arizona Charitable Trusts with Creation Contingent upon Qualification for Tax Exempt Status, including: 1. Charitable Remainder Trust: This type of trust allows individuals to transfer assets into the trust and continue receiving income from those assets during their lifetime. After their passing, the remaining assets are distributed to the designated charitable organizations. 2. Charitable Lead Trust: In this type of trust, the income generated by the trust is directed towards charitable causes during a specified period. After the predetermined period ends, the remaining assets are passed on to non-charitable beneficiaries, such as family members or loved ones. 3. Pooled Income Fund: A pooled income fund allows multiple individuals to contribute assets into a collective trust. The income generated by the trust is then distributed among the donors, with the remaining assets eventually benefiting charitable organizations. 4. Charitable Annuity Trust: With a charitable annuity trust, individuals can transfer assets to the trust and receive a fixed annuity payment over a specified period. After the annuity period ends, the remaining assets are given to the designated charitable organizations. Creating an Arizona Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status requires careful planning, legal expertise, and adherence to applicable state and federal regulations. It is important to consult with an experienced attorney or financial advisor to ensure compliance with all legal and tax requirements. Overall, an Arizona Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status offers individuals and organizations an effective means to support charitable causes while potentially enjoying tax advantages.

Arizona Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status

Description

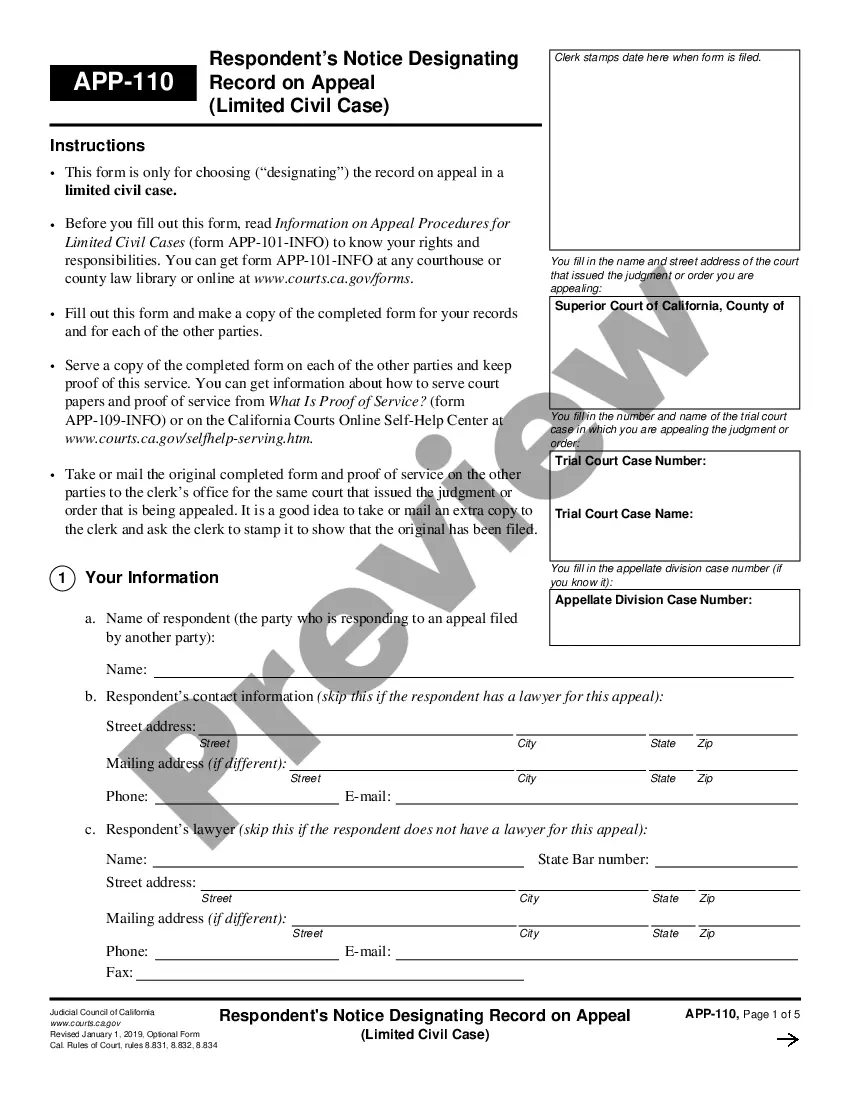

How to fill out Arizona Charitable Trust With Creation Contingent Upon Qualification For Tax Exempt Status?

You may invest hours on the Internet looking for the legal file web template that fits the federal and state demands you will need. US Legal Forms supplies thousands of legal kinds which are examined by pros. You can actually acquire or printing the Arizona Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status from our services.

If you currently have a US Legal Forms bank account, you are able to log in and then click the Acquire button. Next, you are able to complete, edit, printing, or signal the Arizona Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status. Every single legal file web template you buy is yours permanently. To acquire yet another backup for any bought develop, proceed to the My Forms tab and then click the corresponding button.

If you use the US Legal Forms web site initially, stick to the simple directions beneath:

- Initially, make sure that you have chosen the correct file web template for that state/area of your choosing. See the develop explanation to ensure you have picked the appropriate develop. If available, utilize the Review button to check through the file web template as well.

- If you would like discover yet another model from the develop, utilize the Research industry to obtain the web template that suits you and demands.

- Upon having located the web template you would like, simply click Buy now to continue.

- Find the costs program you would like, type your credentials, and sign up for your account on US Legal Forms.

- Complete the deal. You should use your credit card or PayPal bank account to pay for the legal develop.

- Find the file format from the file and acquire it for your device.

- Make adjustments for your file if possible. You may complete, edit and signal and printing Arizona Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status.

Acquire and printing thousands of file layouts making use of the US Legal Forms Internet site, which provides the largest assortment of legal kinds. Use specialist and state-certain layouts to take on your business or person requirements.

Form popularity

FAQ

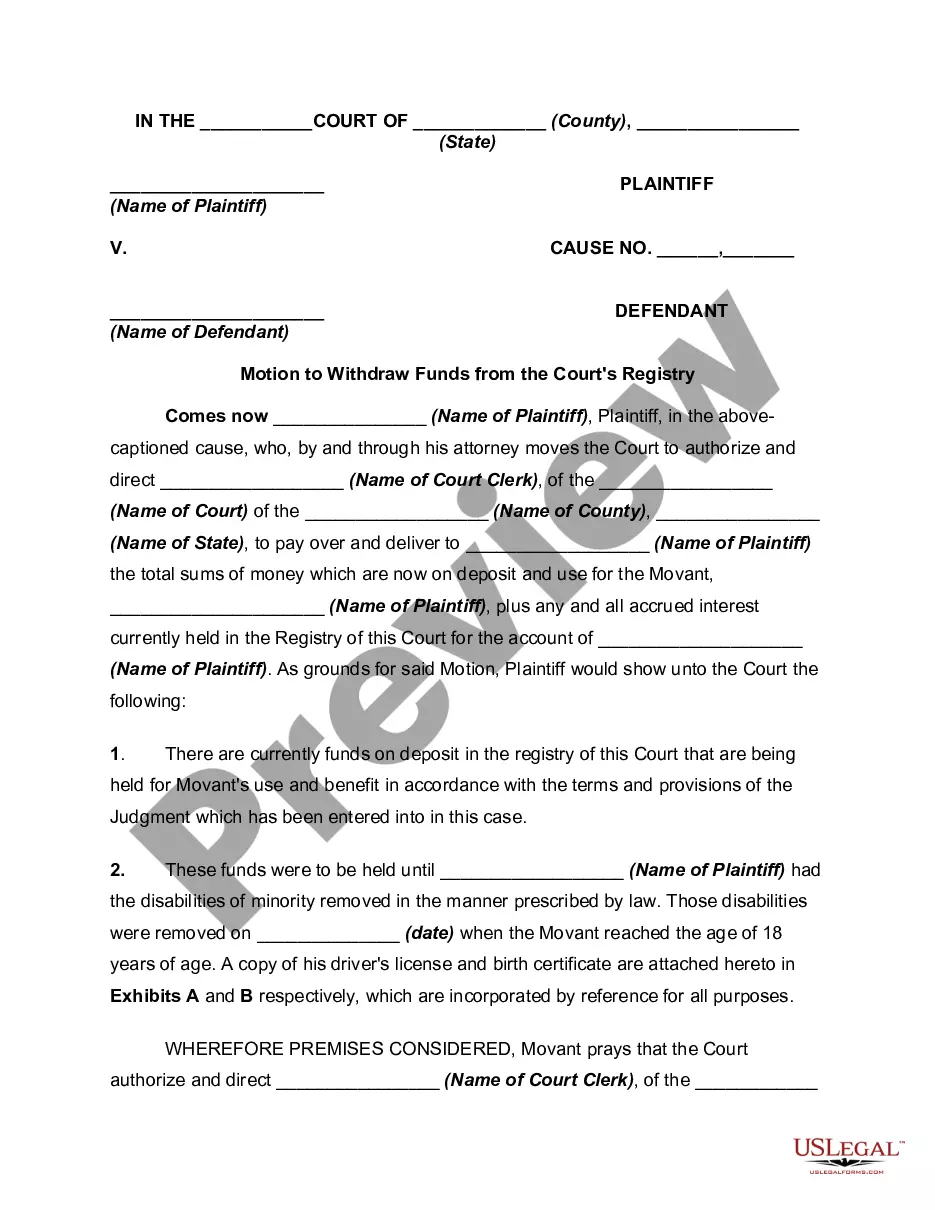

Qualifying health care and other nonprofit organizations must annually apply for an exemption letter with the Arizona Department of Revenue. For more information on this process, visit: .

To become a QCO or QFCO, a charitable organization must complete the application form and submit it along with required documentation to ADOR.

In Arizona, certain items may be exempt from the sales tax to all consumers, not just tax-exempt purchasers. Some examples of exceptions to the sales tax are certain types of groceries, some medical devices, certain prescription medications, and any machinery and chemicals which are used in research and development.

The IRS groups the 501(c)(9), 501(c)(4), and 501(c)(17) together when the latter two are employees' associations.

To be tax-exempt under section 501(c)(3) of the Internal Revenue Code, an organization must be organized and operated exclusively for exempt purposes set forth in section 501(c)(3), and none of its earnings may inure to any private shareholder or individual.

The Arizona Charitable Tax Credit permits any credits for contributions to Qualified Charitable Organizations (QCOs) and Qualifying Foster Care Charitable Organizations (QFCOs) that are not applied against tax obligations for the most recent taxable year to be carried forward for a period of five consecutive years (

Qualified organizations include nonprofit groups that are religious, charitable, educational, scientific, or literary in purpose, or that work to prevent cruelty to children or animals. You will find descriptions of these organizations under Organizations That Qualify To Receive Deductible Contributions.

To qualify, a QCO must meet ALL of the following provisions: Is exempt from federal income taxes under Section 501(c)(3), or is a designated community action agency that receives community services block grant program monies pursuant to 42 United States Code Section 9901.

To be exempt from withholding, both of the following must be true: You owed no federal income tax in the prior tax year, and. You expect to owe no federal income tax in the current tax year.

Arizona provides two separate tax credits for individuals who make contributions to charitable organizations: one for donations to Qualifying Charitable Organizations (QCO) and the second for donations to Qualifying Foster Care Charitable Organizations (QFCO).