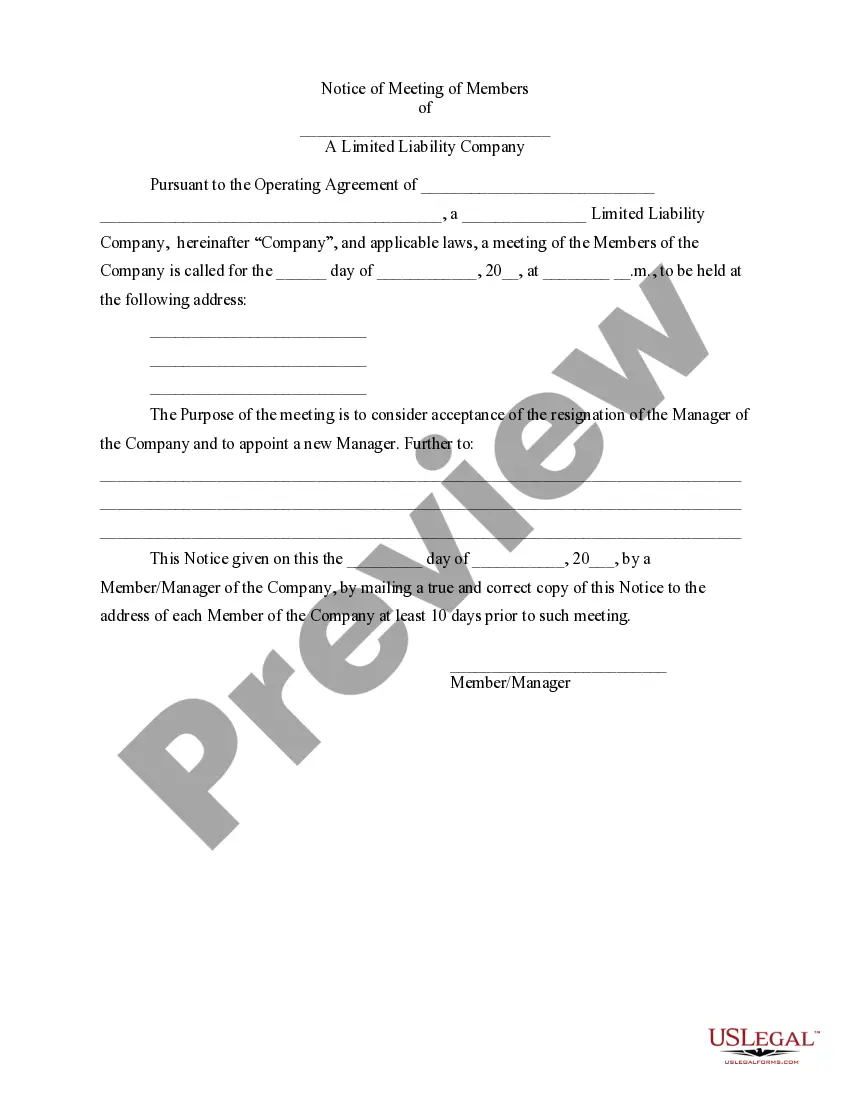

Arizona Notice of Meeting of LLC Members To Consider the Resignation of the Manager of the Company and Appoint a New Manager

Description

How to fill out Notice Of Meeting Of LLC Members To Consider The Resignation Of The Manager Of The Company And Appoint A New Manager?

Are you currently in the position where you need paperwork for either business or personal reasons every day.

There are numerous legal document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms provides a vast array of form templates, including the Arizona Notice of Meeting of LLC Members to Consider the Resignation of the Manager of the Company and Appoint a New Manager, which are designed to comply with state and federal requirements.

You can find all the document templates you have purchased in the My documents section. You can obtain another copy of the Arizona Notice of Meeting of LLC Members to Consider the Resignation of the Manager of the Company and Appoint a New Manager at any time if needed. Just click on the desired form to download or print the document template.

Utilize US Legal Forms, which has one of the most extensive selections of legal forms, to save time and avoid mistakes. The service offers professionally crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are currently familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Arizona Notice of Meeting of LLC Members to Consider the Resignation of the Manager of the Company and Appoint a New Manager template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for your specific city/state.

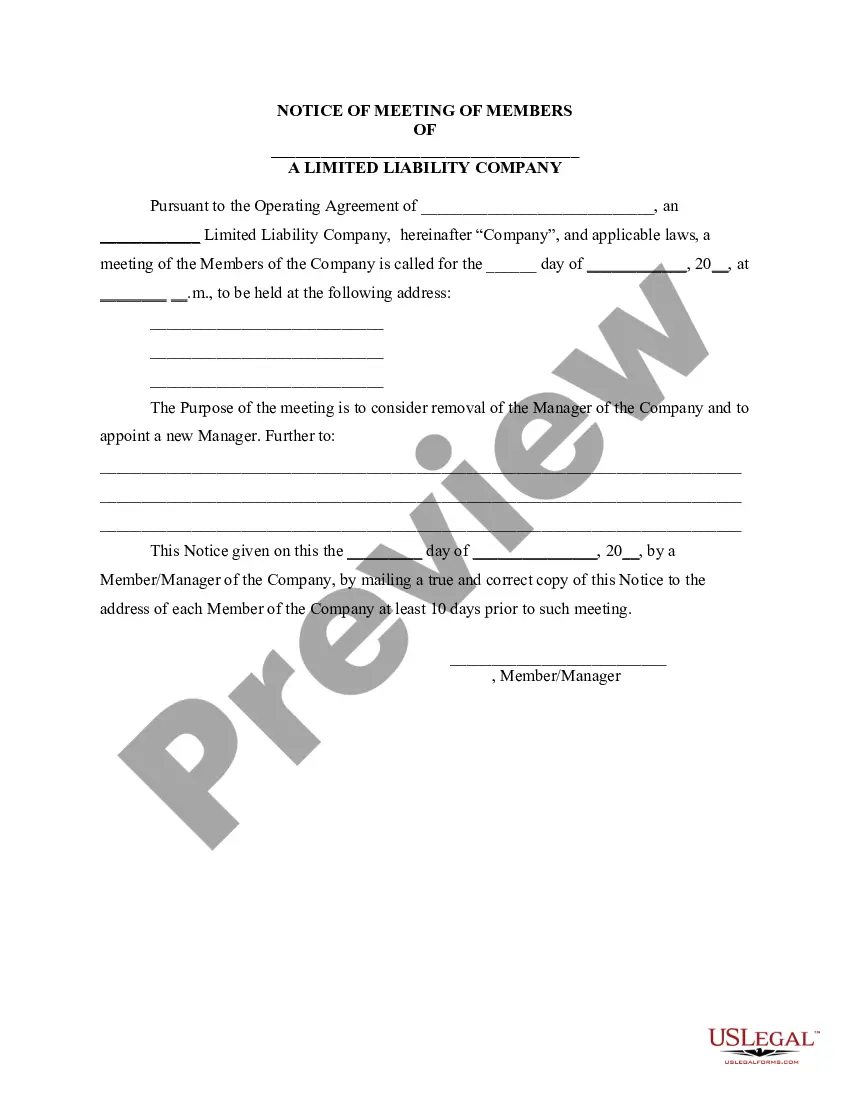

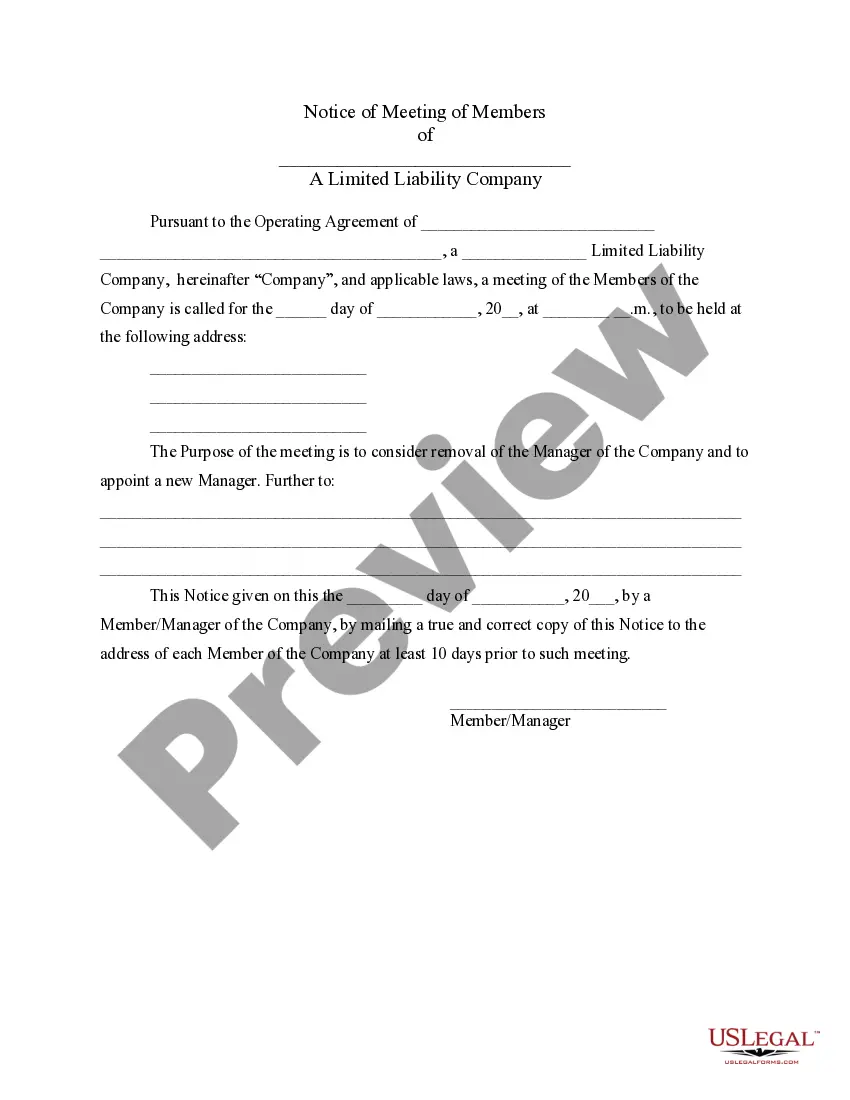

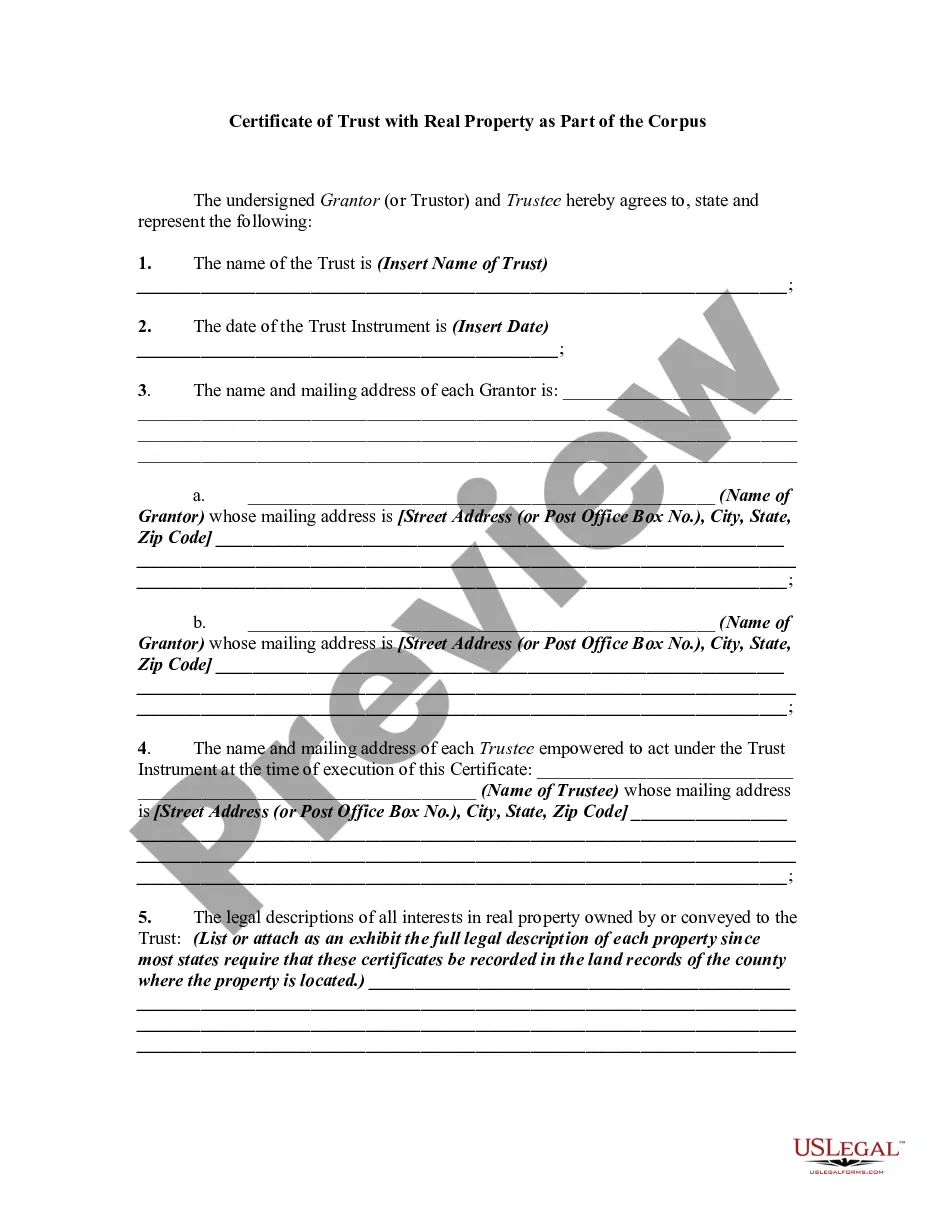

- Use the Preview button to view the form.

- Review the details to confirm you have chosen the correct form.

- If the form is not what you are looking for, use the Search field to find the form that matches your needs and requirements.

- If you find the correct form, click Buy now.

- Choose the pricing plan you need, fill in the required information to create your account, and pay for your order using PayPal or a credit card.

- Select a convenient file format and download your copy.

Form popularity

FAQ

"Piercing the corporate veil" refers to a situation in which courts put aside limited liability and hold a corporation's shareholders or directors personally liable for the corporation's actions or debts. Veil piercing is most common in close corporations.

A member of the LLC should have an ethical responsibility to meet the obligations of the firm. They should have duty of care.

Generally, shareholders are not personally liable for the debts of the corporation. Creditors can only collect on their debts by going after the assets of the corporation. Shareholders will usually only be on the hook if they cosigned or personally guaranteed the corporation's debts.

Those LLC members who operate the business owe the fiduciary duties of loyalty and reasonable care to the non-managing LLC owners. Depending upon your state, LLC members may be able to revise, broaden, or eliminate these fiduciary duties by contract or under the conditions of their LLC operating agreement.

Owners of an LLC are called members. Most states do not restrict ownership, so members may include individuals, corporations, other LLCs and foreign entities.

LLC owners are referred to as members, and ownership can include only one member or many members, with members comprising individual people, other business entities or both.

LLC owners are generally called members. Many states don't restrict ownership, meaning anyone can be a member including individuals, corporations, foreigners, foreign entities, and even other LLCs.

A limited liability company (LLC) is a legal business entity that provides some liability protection (like a corporation) and other features similar to a partnership. The owners of an LLC are called members, and LLCs can have several different types of owners, including some other business types.

The main reason people form LLCs is to avoid personal liability for the debts of a business they own or are involved in. By forming an LLC, only the LLC is liable for the debts and liabilities incurred by the businessnot the owners or managers.