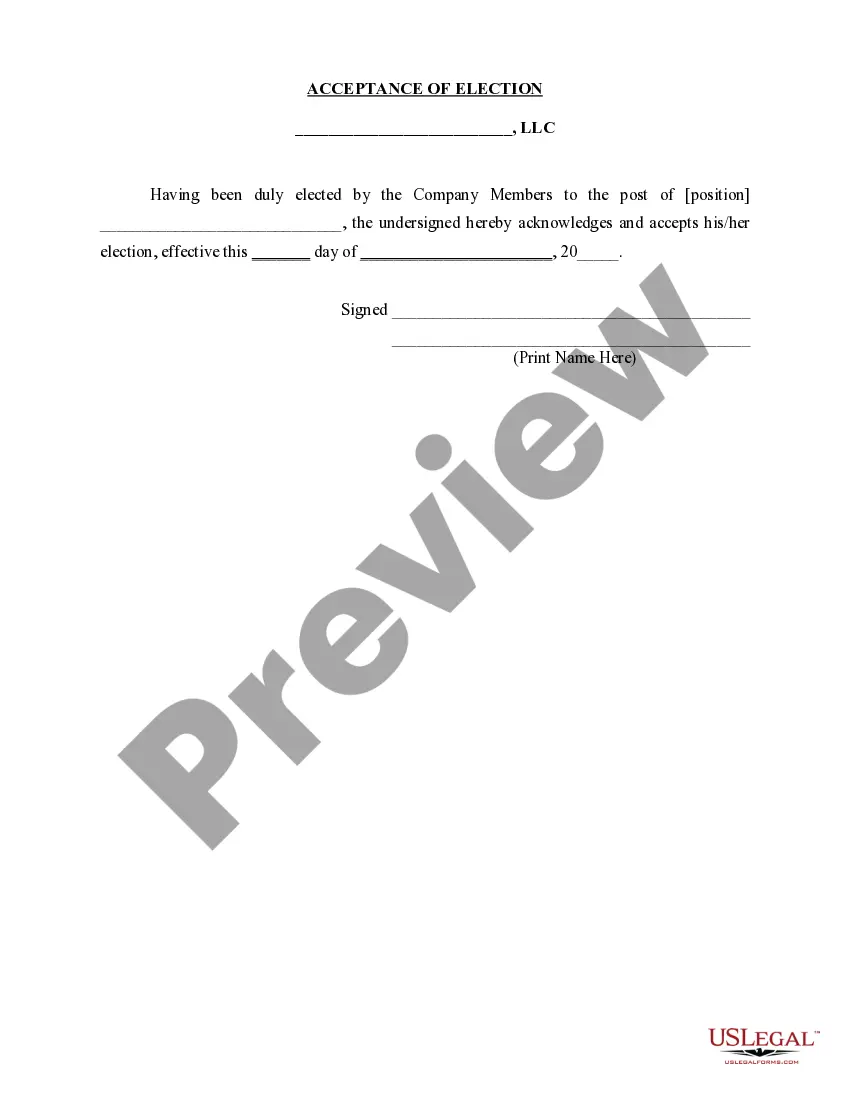

Arizona Acceptance of Election in a Limited Liability Company LLC

Description

How to fill out Acceptance Of Election In A Limited Liability Company LLC?

US Legal Forms - one of the biggest libraries of authorized varieties in the States - provides a wide array of authorized file templates you are able to acquire or produce. Using the web site, you can find thousands of varieties for enterprise and person functions, categorized by categories, states, or keywords.You can find the newest types of varieties just like the Arizona Acceptance of Election in a Limited Liability Company LLC in seconds.

If you currently have a subscription, log in and acquire Arizona Acceptance of Election in a Limited Liability Company LLC from your US Legal Forms library. The Obtain button will show up on each develop you perspective. You have access to all formerly acquired varieties within the My Forms tab of your respective bank account.

If you want to use US Legal Forms the first time, listed below are simple directions to get you started out:

- Ensure you have chosen the proper develop to your area/county. Click on the Preview button to analyze the form`s content material. Browse the develop information to actually have chosen the right develop.

- If the develop does not suit your demands, utilize the Research field towards the top of the monitor to obtain the the one that does.

- When you are satisfied with the form, confirm your selection by visiting the Get now button. Then, opt for the costs program you like and supply your accreditations to register for an bank account.

- Process the deal. Utilize your charge card or PayPal bank account to complete the deal.

- Select the format and acquire the form on your own device.

- Make adjustments. Fill up, revise and produce and sign the acquired Arizona Acceptance of Election in a Limited Liability Company LLC.

Each format you added to your money does not have an expiration day and is yours forever. So, if you want to acquire or produce one more version, just visit the My Forms area and then click around the develop you will need.

Get access to the Arizona Acceptance of Election in a Limited Liability Company LLC with US Legal Forms, one of the most comprehensive library of authorized file templates. Use thousands of professional and status-specific templates that meet your organization or person needs and demands.

Form popularity

FAQ

If your amended federal return was filed as a paper return, or if electronic filing is unavailable, mail Arizona Form 120S to: Arizona Department of Revenue PO Box 29079 Phoenix, AZ 85038-9079 ? If the S Corporation was required to make its tax payments for the 2022 taxable year by electronic funds transfer (EFT), it ...

Arizona originally adopted TPT in 1933 when the rate for selling tangible personal property at retail was 2 percent. That rate is currently 5.6 percent. On top of the state TPT, there may be one or more local TPTs, as well as one or more special district taxes, each of which can range between 0 percent and 5.6 percent.

The elective tax is 9.3% of the entity's qualified net income, which is the sum of the pro rata or distributive share and guaranteed payments of each qualified taxpayers' income subject to California personal income tax.

Checking Arizona LLC Status After filing Articles of Organization to form a new LLC, you can check to see whether these documents have been approved and/or verify that your business information is listed correctly by searching for your business name on the Arizona Corporation Commission's (ACC) database.

PTE ELECTION How do I make the PTE election? Businesses that are treated as partnerships or S Corporations at the federal level may make the PTE election on a timely filed, original Arizona Income Tax Return (Arizona Form 165 ? partnerships; Arizona Form 120S ? S Corporations), including extensions.

Businesses that perform the following activities are subject to TPT and must be licensed. retail sales. restaurants/bars. hotel/motel (transient lodging) commercial lease. amusements. personal property rentals. contracting. severance (metal mining)

ALL EMPLOYEES - ARIZONA STATE WITHHOLDING HAS BEEN UPDATED TO THE DEFAULT RATE 2.0% Any existing additional dollar amounts an employee had chosen to be withheld will not be changed.

No, LLCs are not required to file annual reports. Pursuant to Arizona law, only Corporations are required to file annual reports, on or before their prescribed due date.