Arizona Confirmation of Orally Accepted Employment Offer from Applicant to Company - Exempt or Nonexempt Positions

Description

How to fill out Confirmation Of Orally Accepted Employment Offer From Applicant To Company - Exempt Or Nonexempt Positions?

Are you presently in the placement the place you need files for both company or individual functions just about every time? There are tons of lawful papers templates available on the Internet, but finding kinds you can trust isn`t straightforward. US Legal Forms delivers 1000s of kind templates, much like the Arizona Confirmation of Orally Accepted Employment Offer from Applicant to Company - Exempt or Nonexempt Positions, that happen to be composed in order to meet state and federal requirements.

Should you be currently knowledgeable about US Legal Forms website and also have your account, basically log in. Following that, you can obtain the Arizona Confirmation of Orally Accepted Employment Offer from Applicant to Company - Exempt or Nonexempt Positions web template.

If you do not offer an account and would like to start using US Legal Forms, abide by these steps:

- Obtain the kind you need and make sure it is for that right town/region.

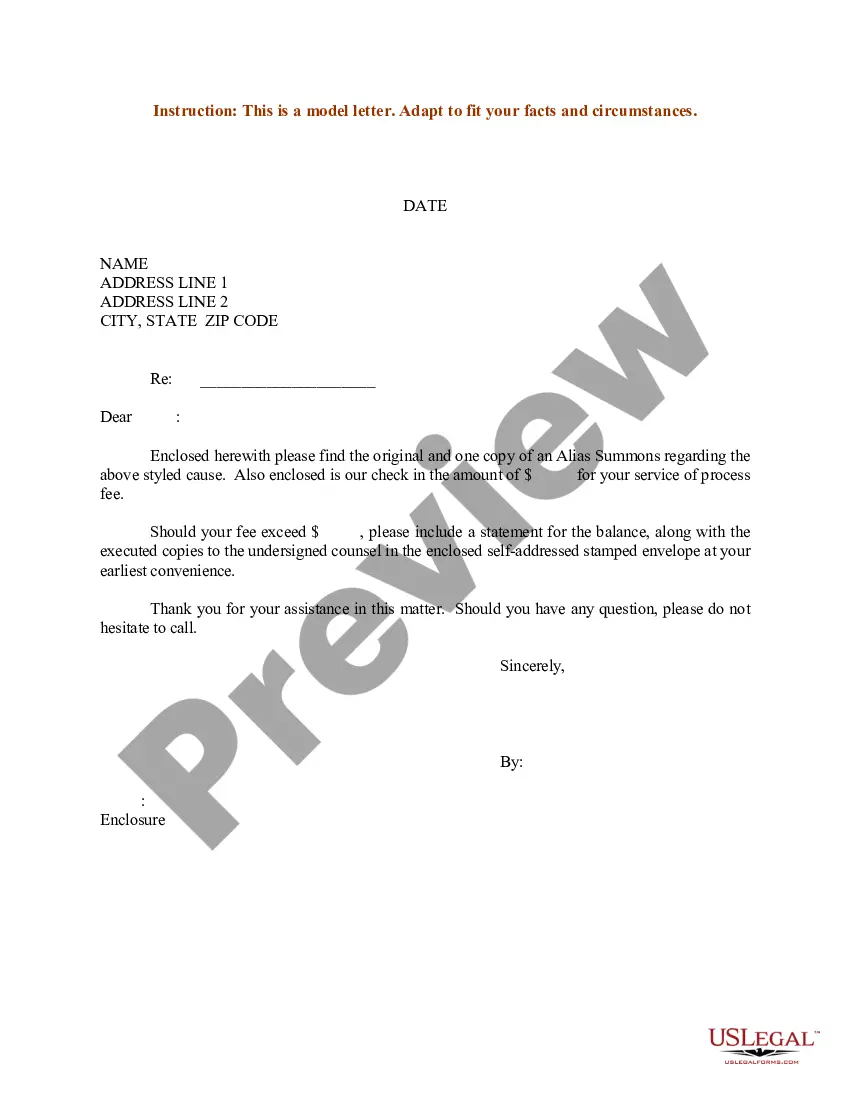

- Take advantage of the Preview switch to analyze the form.

- Read the information to actually have chosen the proper kind.

- In the event the kind isn`t what you are looking for, make use of the Lookup industry to discover the kind that meets your requirements and requirements.

- If you get the right kind, just click Get now.

- Choose the prices strategy you desire, fill in the necessary information and facts to produce your bank account, and purchase the transaction utilizing your PayPal or charge card.

- Select a hassle-free file format and obtain your backup.

Get all of the papers templates you may have bought in the My Forms food list. You can get a additional backup of Arizona Confirmation of Orally Accepted Employment Offer from Applicant to Company - Exempt or Nonexempt Positions whenever, if necessary. Just go through the required kind to obtain or printing the papers web template.

Use US Legal Forms, by far the most substantial selection of lawful varieties, in order to save efforts and stay away from mistakes. The service delivers appropriately produced lawful papers templates which can be used for an array of functions. Produce your account on US Legal Forms and begin creating your daily life a little easier.

Form popularity

FAQ

Exempt employees are paid on a salary basis and are excluded from overtime payment. Nonexempt employees who are paid hourly must report hours worked and are paid overtime for each hour worked over 40 hours per week.

Under this new 2019 DOL ruling, the standard salary threshold for exempt-level workers would increase to $35,568 per year, or $684 per week. In comparison, the prior threshold was $23,660 per year and $455 per week. The salary level increase may seem large to certain business owners.

Exempt positions are excluded from minimum wage, overtime regulations, and other rights and protections afforded nonexempt workers. Employers must pay a salary rather than an hourly wage for a position for it to be exempt.

Key Takeaways. An exempt employee is an employee who does not receive overtime pay or qualify for minimum wage. Exempt employees are paid a salary rather than by the hour, and their work is executive or professional in nature.

With few exceptions, to be exempt an employee must (a) be paid at least $23,600 per year ($455 per week), and (b) be paid on a salary basis, and also (c) perform exempt job duties. These requirements are outlined in the FLSA Regulations (promulgated by the U.S. Department of Labor).

The FLSA includes these job categories as exempt: professional, administrative, executive, outside sales, and computer-related. The details vary by state, but if an employee falls in the above categories, is salaried, and earns a minimum of $684 per week or $35,568 annually, then they are considered exempt.

Exempt employees refer to workers in the United States who are not entitled to overtime pay. This simply implies that employers of exempt employees are not bound by law to pay them for any extra hours of work. The federal standard for work hours in the United States is 40 hours per workweek.

An exempt employee is not entitled overtime pay by the Fair Labor Standards Act (FLSA). These salaried employees receive the same amount of pay per pay period, even if they put in overtime hours. A nonexempt employee is eligible to be paid overtime for work in excess of 40 hours per week, per federal guidelines.

An exempt employee is not entitled to overtime pay according to the Fair Labor Standards Act (FLSA). To be exempt, you must earn a minimum of $684 per week in the form of a salary. Non-exempt employees must be paid overtime and are protected by FLSA regulations.

Pros of hiring exempt employeesYou don't have to pay overtime. When you hire exempt employees, you won't pay overtime no matter how many hours these employees work per week.You can assume they're more experienced.You can give them more responsibility.