Arizona Personal Guaranty - Guarantee of Lease to Corporation

Description

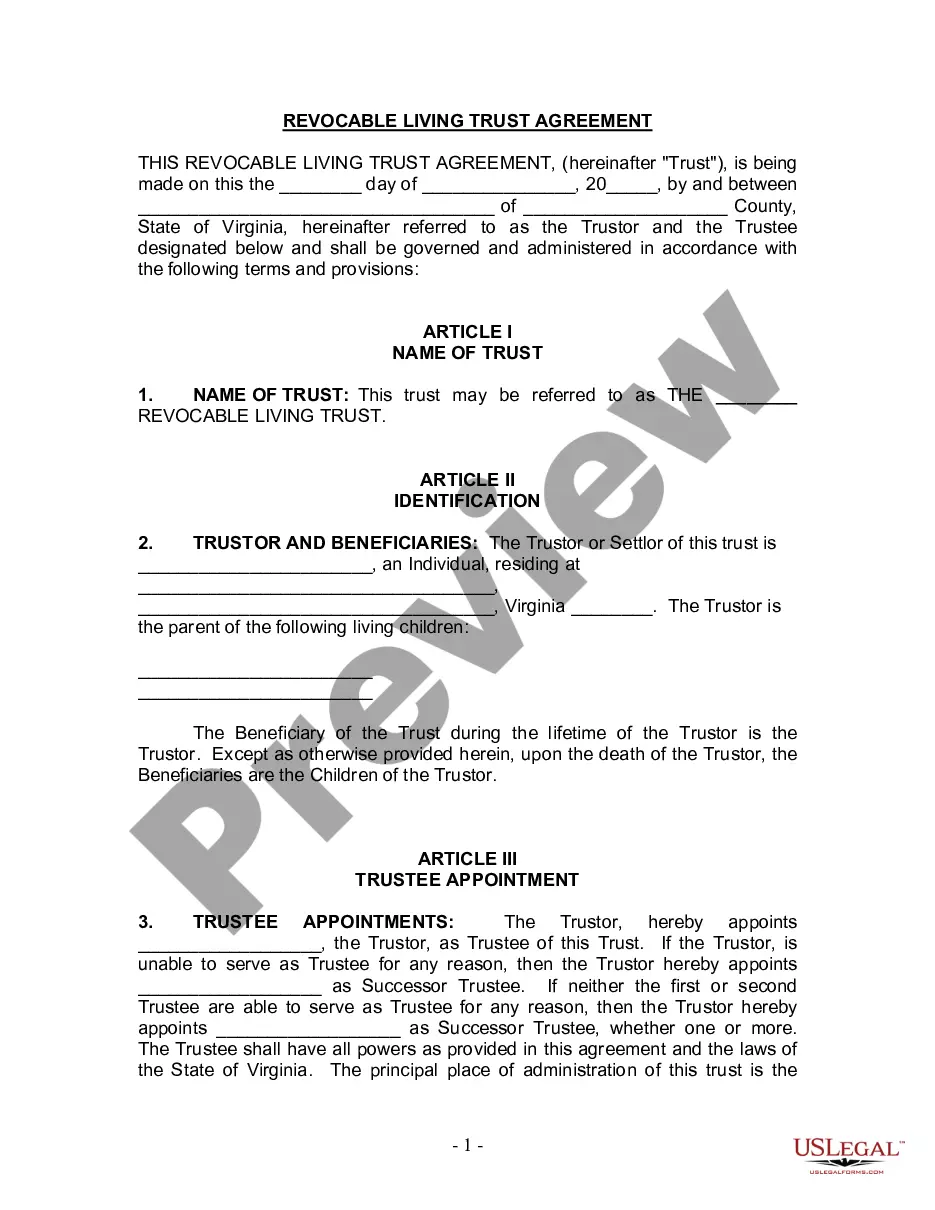

How to fill out Personal Guaranty - Guarantee Of Lease To Corporation?

If you want to full, obtain, or printing authorized file templates, use US Legal Forms, the greatest variety of authorized kinds, which can be found online. Use the site`s simple and easy convenient look for to get the paperwork you will need. Various templates for business and personal functions are categorized by types and suggests, or search phrases. Use US Legal Forms to get the Arizona Personal Guaranty - Guarantee of Lease to Corporation with a handful of mouse clicks.

In case you are presently a US Legal Forms customer, log in for your profile and click on the Acquire option to get the Arizona Personal Guaranty - Guarantee of Lease to Corporation. Also you can access kinds you previously delivered electronically inside the My Forms tab of your own profile.

If you are using US Legal Forms the first time, refer to the instructions below:

- Step 1. Be sure you have selected the form to the right city/country.

- Step 2. Take advantage of the Preview option to look over the form`s content. Don`t neglect to learn the information.

- Step 3. In case you are unsatisfied with all the develop, utilize the Look for field towards the top of the monitor to find other versions from the authorized develop template.

- Step 4. After you have identified the form you will need, click on the Purchase now option. Pick the costs program you prefer and add your references to sign up to have an profile.

- Step 5. Process the financial transaction. You may use your bank card or PayPal profile to finish the financial transaction.

- Step 6. Choose the formatting from the authorized develop and obtain it on your system.

- Step 7. Complete, change and printing or indication the Arizona Personal Guaranty - Guarantee of Lease to Corporation.

Each and every authorized file template you acquire is yours permanently. You may have acces to each and every develop you delivered electronically within your acccount. Click the My Forms section and pick a develop to printing or obtain yet again.

Contend and obtain, and printing the Arizona Personal Guaranty - Guarantee of Lease to Corporation with US Legal Forms. There are millions of specialist and express-certain kinds you can use for the business or personal demands.

Form popularity

FAQ

The difference between corporate and personal guarantors is quite simple: a personal guarantor is an individual who agrees to take on the obligations of a debt for a debtor, whereas a corporate guarantor is a corporation that takes on payment responsibilities.

A corporate guaranty is one usually signed by a parent or more developed affiliated company. It is a comfort to a landlord to have an extra set of assets to go after should its tenant default.

A corporate guarantee is an agreement in which one party, called the guarantor, takes on the payments or responsibilities of a debt if the debtor defaults on the loan.

To be enforceable as a personal guaranty, the signatory must sign the guaranty in his or her personal capacity and not as the president or CEO of the company receiving the loan, which is its own legal entity, separate and apart from the people that run and operate it.

Is a personal guarantee legally binding? Yes as soon as a personal guarantee is in writing and signed by the guarantor, then it becomes an enforceable contract. In the event of a company's insolvency, the individual will be given a timeframe to pay the outstanding payment.

A personal guarantee can be enforced the same way as any debt. If the business owner does not pay, the creditor can bring a lawsuit to receive a judgment and levy the owner's personal assets to cover the debt. The exact terms of a personal guarantee specify a creditor's options under the guarantee.

7 Ways to Avoid a Personal GuaranteeBuy insurance.Raise the interest rate.Increase Reporting.Increased the Frequency of Payments.Add a Fidelity Certificate.Limit the Guarantee Time Period.Use Other Collateral.

A personal guarantee is a guarantee given by an individual rather than a company. The liability to honour the guarantee is personal to you. There's no protection from a company. This means that all of your personal assets are on the line.

A personal guarantee is a provision a lender puts in a business loan agreement that requires owners to be personally responsible for their company's debt in case of default. Lenders often ask for personal guarantees because they have concerns over the credit history, age or financial stability of your business.

Your personal guarantee may be unenforceable due to circumstances outside of your contract. This may include being misled by the creditor, if a key fact was omitted from the contract, co-guarantor issues, suspicions of fraud, or if the facility provided by the bank changed significantly since you signed the guarantee.