The Arizona Notice to Creditors and Other Parties in Interest — B 205 is a legal document that serves an important purpose in the probate process. When an individual passes away, their estate is typically administered through a court-supervised process called probate. During this process, any outstanding debts or claims against the deceased's estate need to be addressed, and this is where the Notice to Creditors and Other Parties in Interest — B 205 comes into play. This notice is typically filed by the personal representative or executor of the estate, who is appointed by the court to manage the estate's affairs. The purpose of the notice is to inform potential creditors and other parties who may have an interest in the estate that the individual has passed away and that they have a certain period of time to present their claims or interests. The Arizona Notice to Creditors and Other Parties in Interest — B 205 must contain specific information to be valid. This includes the name of the deceased, their date of death, the name and contact information of the personal representative, and a statement that any claims against the estate must be presented within a certain timeframe, usually four months from the date of the first publication of the notice. There are different types of Notice to Creditors and Other Parties in Interest — B 205 that may be required depending on the circumstances of the estate. These include: 1. General Notice to Creditors: This notice is typically filed in cases where the deceased had significant assets and debts. It serves as a broad notification to all potential creditors and parties with interests in the estate. 2. Special Notice to Creditors: In some situations, the personal representative may need to give special notice to specific creditors who may have a claim against the estate. This could be due to outstanding loans, unpaid taxes, or other financial obligations. 3. Notice to Parties in Interest: Besides creditors, there may be other parties with a legal interest in the estate, such as beneficiaries, heirs, or business partners. The Notice to Parties in Interest provides them with information about the probate process and their rights. It is crucial for the personal representative to ensure proper compliance with the requirements and deadlines outlined in the Arizona Notice to Creditors and Other Parties in Interest — B 205. Failure to file or provide adequate notice can have legal consequences and can affect the distribution of the estate's assets. In conclusion, the Arizona Notice to Creditors and Other Parties in Interest — B 205 is a vital legal document that ensures transparency and fairness in the probate process. It serves to notify potential creditors and parties with interests in the estate to come forward and present their claims within a specified timeframe. By filing the appropriate notice(s) based on the circumstances of the estate, the personal representative helps to protect the deceased's assets and fulfill their legal responsibilities.

Arizona Involuntary Petition Against a Non-Individual

Description

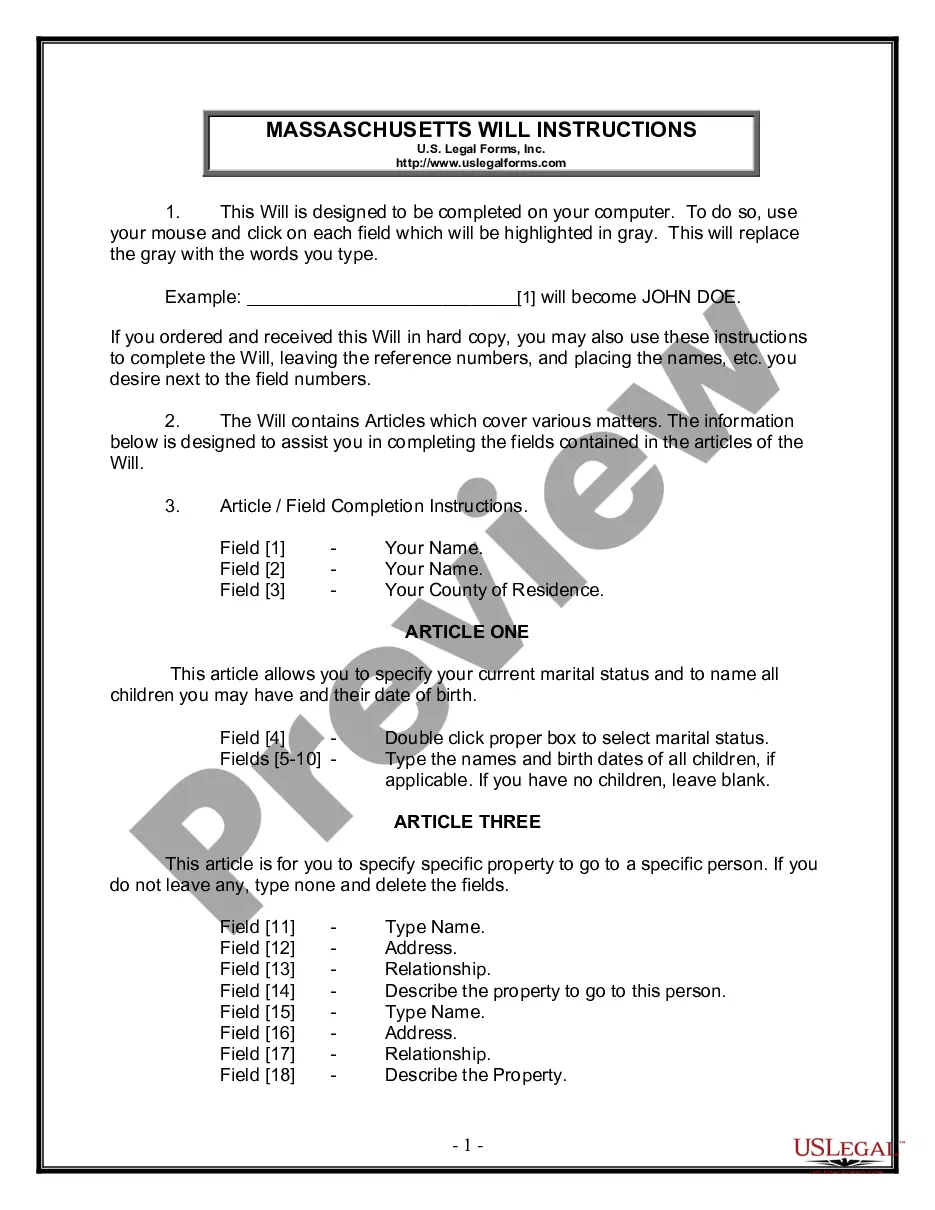

How to fill out Involuntary Petition Against A Non-Individual?

Discovering the right authorized document format can be quite a struggle. Of course, there are a lot of layouts available on the net, but how would you discover the authorized type you need? Use the US Legal Forms internet site. The services provides a large number of layouts, such as the Arizona Notice to Creditors and Other Parties in Interest - B 205, that can be used for enterprise and private requirements. All of the kinds are inspected by pros and meet federal and state demands.

In case you are presently listed, log in in your accounts and click on the Down load button to obtain the Arizona Notice to Creditors and Other Parties in Interest - B 205. Utilize your accounts to check through the authorized kinds you may have ordered previously. Visit the My Forms tab of your respective accounts and get an additional duplicate of the document you need.

In case you are a new customer of US Legal Forms, allow me to share simple directions that you can stick to:

- Very first, make certain you have chosen the right type for the town/state. You may check out the form utilizing the Preview button and read the form outline to make certain it will be the right one for you.

- In case the type will not meet your preferences, utilize the Seach discipline to get the right type.

- Once you are certain that the form would work, click on the Acquire now button to obtain the type.

- Choose the rates plan you desire and type in the needed details. Create your accounts and pay for your order with your PayPal accounts or credit card.

- Select the data file file format and download the authorized document format in your gadget.

- Full, modify and print and signal the attained Arizona Notice to Creditors and Other Parties in Interest - B 205.

US Legal Forms may be the biggest catalogue of authorized kinds for which you will find various document layouts. Use the service to download professionally-manufactured papers that stick to state demands.

Form popularity

FAQ

In Arizona, the timeline for wrapping up a probate has no strict deadline for executors. Ideally, the recommended start date is around 60 days after the individual's passing and done within a reasonable timeframe.

To open probate proceedings, a family member or friend will need to file a petition with the county court. If the family members are in agreement, the court can appoint one of them to serve as the estate's executor or personal representative.

Unless notice has already been given under this section, at the time of appointment a personal representative shall publish a notice to creditors once a week for three successive weeks in a newspaper of general circulation in the county announcing the appointment and the personal representative's address and notifying ...

There may be additional hearings to resolve contests, and the executor will probably need court approval before making major decisions and actions. Informal probate is obviously the quickest and can conclude in 4 ? 6 months. Formal probate may take up to a year or longer.

If creditors don't submit their claims within that time period (which starts at the date of the notice's first publication), they are forever barred from filing a claim. If you received mailed notice of the decedent's death, you can make a claim within 60 days, even if the 4-month period already passed.