The Arizona Declaration under penalty of perjury on behalf of a corporation or partnership — Form — - Pre and Post 2005 is an essential document required for corporations and partnerships operating in the state of Arizona. This declaration is used to declare certain information under the penalty of perjury, ensuring that all provided details are accurate and truthful. Here is a detailed description of the form, including its purpose, requirements, and differences PRE and post-2005: Purpose: The Arizona Declaration under penalty of perjury on behalf of a corporation or partnership — Form — - Pre and Post 2005 serves as a legal affirmation by the individual signing the document that the information provided on behalf of the corporation or partnership is accurate and true to the best of their knowledge. It helps maintain transparency and accountability in business operations. Requirements: 1. Identification: The declaration form requires the identification of the corporation or partnership for which the declaration is being made. This includes the legal name, address, and contact information. 2. Authorized Representative: The form necessitates the identification of the individual signing the declaration on behalf of the corporation or partnership. It includes their name, title, address, and contact information. 3. Specifics of Investigation: The declaration may require details regarding any investigations or inquiries conducted to ensure the accuracy of the provided information. This is to ensure that due diligence has been carried out before submitting the declaration. 4. Accuracy of Information: The declaring must specify that they have reviewed all the information included in the declaration and, to the best of their knowledge, it is accurate and complete. Differences PRE and Post-2005: Although the general purpose and requirements of the declaration remain the same, there might be some variations between the PRE and post-2005 versions. Pre-2005: Prior to 2005, the form might not have been as detailed, and the requirements could have been more streamlined. The specific differences may vary based on the revisions made over time. Post-2005: After 2005, the Arizona Declaration form might have undergone updates to align with any changes in the state's legal requirements. This could include additional fields for electronic signatures, incorporation dates, and other relevant information. It is important to note that the exact variations in the declaration form PRE and post-2005 cannot be specified without access to the specific versions of the forms from that period. These differences may also be subject to change in the future as per state regulations. Additional Types: There are no specific variations or multiple types of Arizona Declaration under penalty of perjury on behalf of a corporation or partnership — Form 2 mentioned. However, it is essential to stay updated with the latest state requirements and consult legal professionals or the Arizona Corporation Commission for any changes or specific form types related to business declarations and compliance. Keywords: Arizona, Declaration under penalty of perjury, corporation, partnership, Form 2, PRE and Post 2005, legal document, transparency, accountability, accuracy, authorized representative, investigations, due diligence, revisions, electronic signatures, incorporation dates, Arizona Corporation Commission, compliance.

Arizona Declaration under penalty of perjury on behalf of a corporation or partnership - Form 2 - Pre and Post 2005

Description

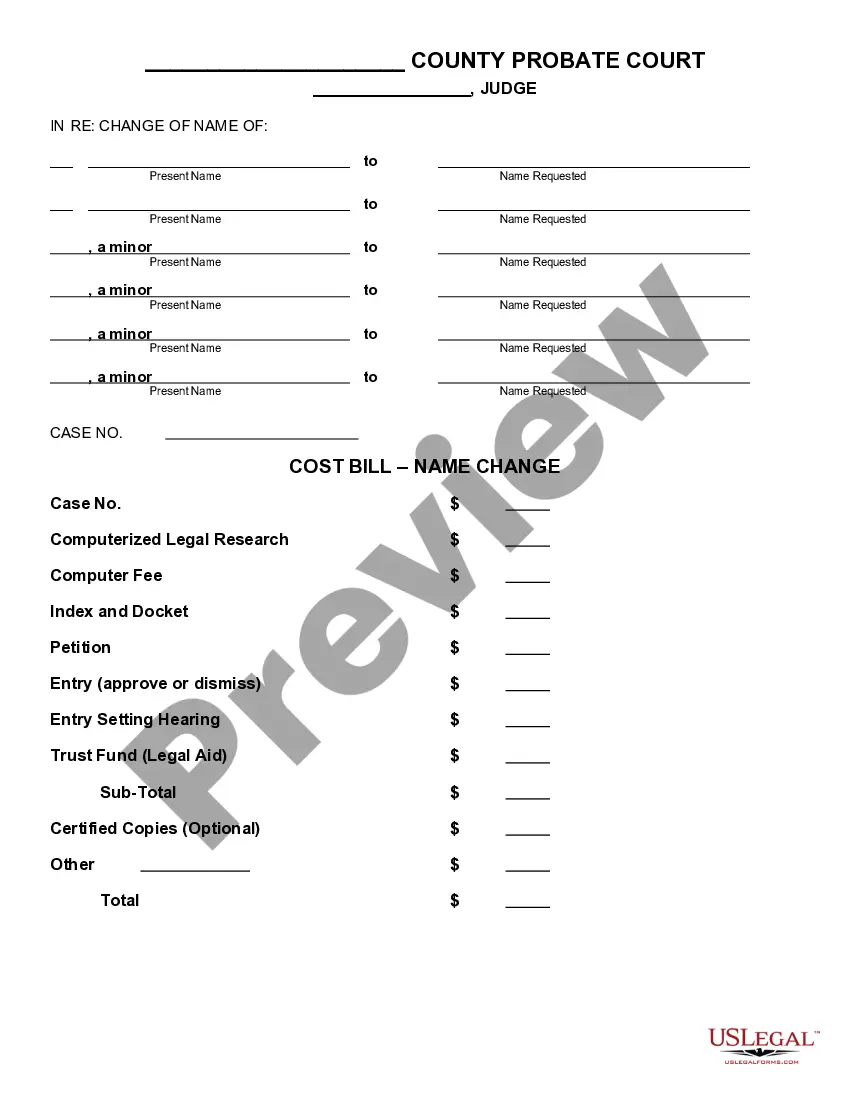

How to fill out Arizona Declaration Under Penalty Of Perjury On Behalf Of A Corporation Or Partnership - Form 2 - Pre And Post 2005?

Are you currently within a situation that you need files for sometimes enterprise or specific purposes virtually every day time? There are a lot of lawful document templates available online, but discovering ones you can rely is not simple. US Legal Forms gives thousands of form templates, much like the Arizona Declaration under penalty of perjury on behalf of a corporation or partnership - Form 2 - Pre and Post 2005, that are created to satisfy federal and state demands.

If you are previously familiar with US Legal Forms site and get an account, basically log in. Afterward, it is possible to download the Arizona Declaration under penalty of perjury on behalf of a corporation or partnership - Form 2 - Pre and Post 2005 template.

Should you not provide an bank account and want to begin using US Legal Forms, follow these steps:

- Obtain the form you require and make sure it is for your right city/county.

- Make use of the Preview key to review the shape.

- Browse the information to ensure that you have chosen the proper form.

- In case the form is not what you are searching for, use the Research field to find the form that suits you and demands.

- When you discover the right form, click Get now.

- Pick the pricing plan you desire, submit the required details to create your money, and purchase an order making use of your PayPal or charge card.

- Pick a hassle-free document formatting and download your backup.

Find all of the document templates you may have bought in the My Forms menus. You may get a extra backup of Arizona Declaration under penalty of perjury on behalf of a corporation or partnership - Form 2 - Pre and Post 2005 whenever, if required. Just select the needed form to download or printing the document template.

Use US Legal Forms, by far the most comprehensive assortment of lawful forms, in order to save time and stay away from errors. The support gives appropriately manufactured lawful document templates which can be used for a variety of purposes. Make an account on US Legal Forms and start producing your daily life a little easier.