In Arizona, property claimed as exempt refers to assets or possessions that individuals can safeguard against being taken by creditors or in bankruptcy proceedings under the Arizona Exemption Laws. Schedule C, Form 6C, is the official document used to list and declare these exempt properties. Introduced after 2005, this form outlines the various types of assets that can be claimed as exempt, ensuring that individuals can retain a certain amount of property necessary for their well-being during financial distress. There are several types of property that can be claimed as exempt under Schedule C, Form 6C, post-2005. Here are some key examples: 1. Homestead Exemption: A homestead refers to an individual's primary residence. Under Arizona law, homeowners can claim up to $150,000 of their homestead value as exempt. This exemption serves to protect a person's principal place of residence. 2. Personal Property Exemptions: Schedule C allows individuals to claim exemptions for various personal property items, such as clothing, furniture, appliances, and electronics. The exemption limits vary for each item, ensuring that individuals can retain essential possessions. 3. Vehicle Exemption: Arizonans can claim an exemption of up to $6,000 for one motor vehicle. This exemption is particularly beneficial for individuals who heavily rely on their vehicle for transportation to work or other necessary activities. 4. Retirement Funds: Some retirement funds, such as IRAs and 401(k)s, can also be claimed as exempt under Schedule C. This exemption protects individuals' future income during challenging financial situations. 5. Tools of Trade or Professional Equipment: Individuals who depend on specific tools or equipment for their trade or profession can claim exemptions for these items as well. This provision allows them to continue their work and maintain their livelihood even in times of financial hardship. 6. Health Aids: Schedule C allows for exemptions on various health aids and devices that are necessary for an individual's well-being, including wheelchairs, hearing aids, and prosthetic devices. It's important to note that while these exemptions provide protection for certain assets, there are limits and conditions associated with each exemption. Seeking legal advice or consulting official resources like the Arizona Exemption Laws is necessary to fully understand the eligibility criteria and limitations associated with each type of exempt property. Overall, the Arizona Property Claimed as Exempt — Schedule — - Form 6C - Post 2005 is a vital tool that enables individuals to safeguard specific assets during difficult financial situations. By understanding and utilizing these exemptions, Arizonans can retain a portion of their property to support their well-being and maintain a level of stability in challenging times.

Arizona Property Claimed as Exempt - Schedule C - Form 6C - Post 2005

Description

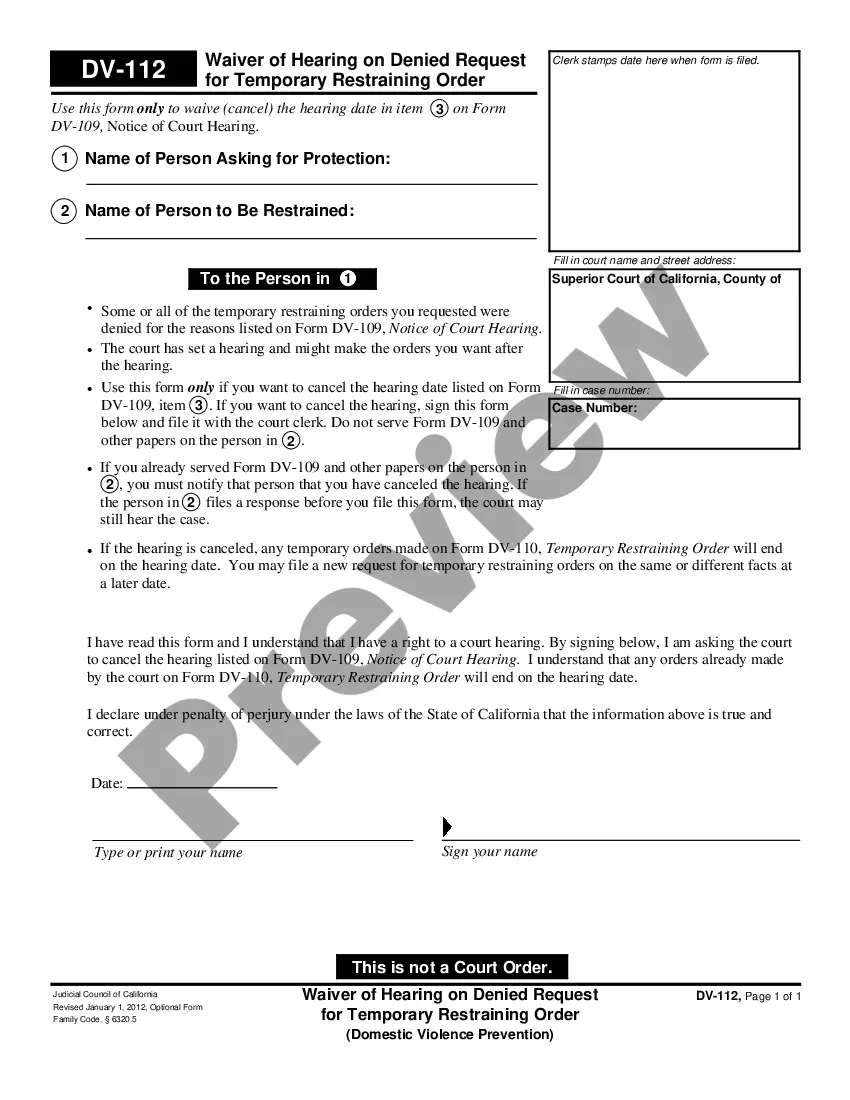

How to fill out Arizona Property Claimed As Exempt - Schedule C - Form 6C - Post 2005?

US Legal Forms - one of many greatest libraries of legal kinds in the USA - delivers a wide array of legal record web templates you are able to acquire or produce. While using website, you will get thousands of kinds for business and individual purposes, categorized by groups, says, or keywords and phrases.You can find the most up-to-date versions of kinds like the Arizona Property Claimed as Exempt - Schedule C - Form 6C - Post 2005 in seconds.

If you already have a subscription, log in and acquire Arizona Property Claimed as Exempt - Schedule C - Form 6C - Post 2005 in the US Legal Forms collection. The Download button can look on every single type you perspective. You gain access to all formerly delivered electronically kinds from the My Forms tab of your respective profile.

If you wish to use US Legal Forms initially, here are easy guidelines to help you get started:

- Make sure you have selected the proper type for your city/region. Select the Preview button to analyze the form`s content. Read the type description to actually have selected the correct type.

- If the type does not satisfy your demands, make use of the Look for area near the top of the screen to find the one who does.

- If you are satisfied with the form, validate your option by visiting the Purchase now button. Then, opt for the pricing plan you like and supply your qualifications to sign up to have an profile.

- Method the financial transaction. Make use of your bank card or PayPal profile to accomplish the financial transaction.

- Pick the file format and acquire the form in your device.

- Make modifications. Fill out, edit and produce and signal the delivered electronically Arizona Property Claimed as Exempt - Schedule C - Form 6C - Post 2005.

Every single format you included with your money does not have an expiration day and is also your own eternally. So, if you would like acquire or produce an additional duplicate, just proceed to the My Forms segment and click around the type you will need.

Get access to the Arizona Property Claimed as Exempt - Schedule C - Form 6C - Post 2005 with US Legal Forms, probably the most comprehensive collection of legal record web templates. Use thousands of specialist and state-certain web templates that satisfy your small business or individual requires and demands.

Form popularity

FAQ

Secured Creditors are creditors that hold a lien on its debtor's property, whether that property is real property or personal property. The lien gives the secured creditor an interest in its debtor's property that provides for the property to be sold to satisfy the debt in cases of default.

Official Form 106Sum is the Summary of Your Assets and Liabilities and Certain Statistical Information. It contains the ?bottom line? kind of information from your schedules. Things like the total value of your property, the total amount of your debts, and information about your income and expenses.

Here's the information you'll need to provide: Exemption system you're using. ... Description of property. ... Schedule A/B line number. ... Current value of the portion you own. ... Amount of exemption you claim. ... Specific laws that allow the exemption. ... Claiming a homestead exemption more than $189,050.

The exempt property may include community, joint or separate property of the judgment debtor. B. If the judgment debtor dies or absconds and leaves a spouse or dependent any property that is exempt under this section, the property remains exempt to the spouse or dependent.

Arizona Homestead Exemption This means that if a debtor's equity (home value ? outstanding amounts owed) is less than $150,000, the home is exempt during chapter 7 bankruptcy.