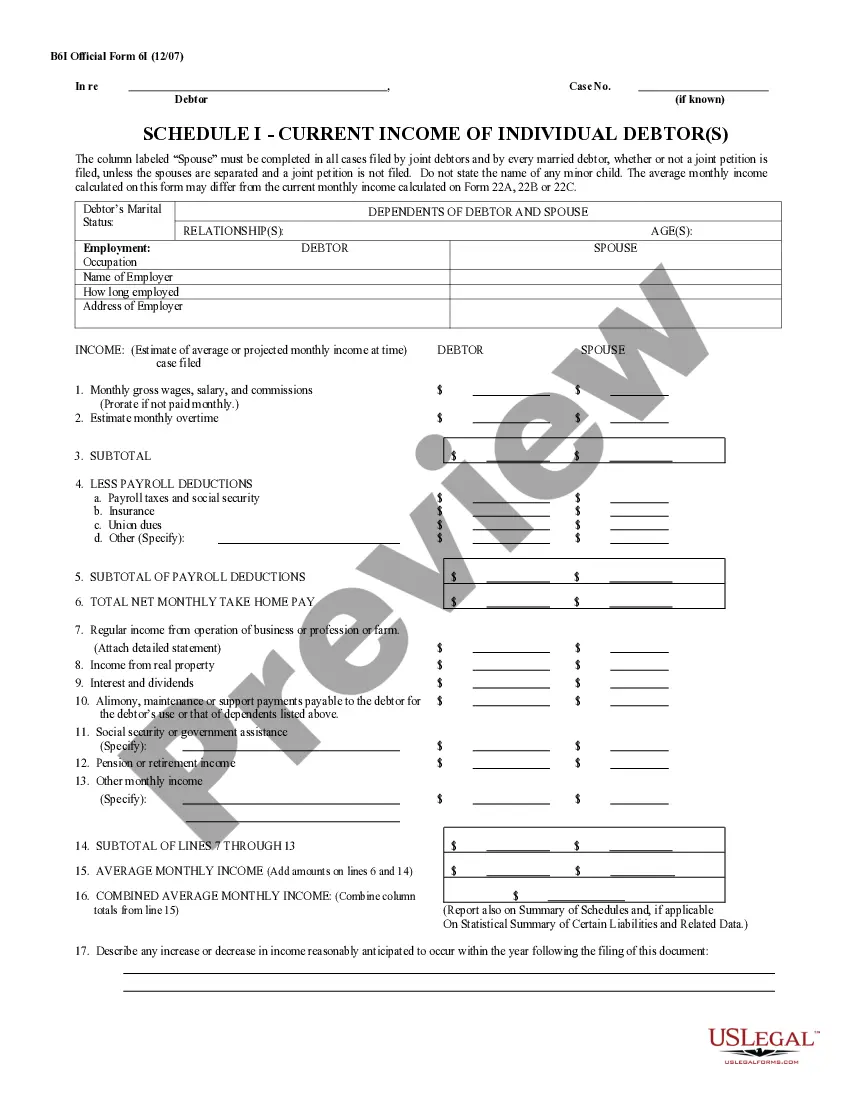

Arizona Summary of Schedules - Form 6CONTSUM - Post 2005

Description

How to fill out Summary Of Schedules - Form 6CONTSUM - Post 2005?

US Legal Forms - one of the greatest libraries of authorized forms in the States - delivers a wide array of authorized papers web templates you may download or produce. While using web site, you may get 1000s of forms for business and specific uses, sorted by types, claims, or keywords and phrases.You will find the most up-to-date models of forms just like the Arizona Summary of Schedules - Form 6CONTSUM - Post 2005 within minutes.

If you already possess a subscription, log in and download Arizona Summary of Schedules - Form 6CONTSUM - Post 2005 from your US Legal Forms local library. The Acquire switch will show up on every single kind you perspective. You get access to all in the past downloaded forms in the My Forms tab of the profile.

If you want to use US Legal Forms initially, listed here are simple directions to help you get started off:

- Make sure you have selected the best kind for your city/area. Select the Preview switch to check the form`s content. Browse the kind outline to actually have chosen the appropriate kind.

- In case the kind does not match your demands, take advantage of the Search industry towards the top of the screen to find the one which does.

- If you are pleased with the shape, confirm your option by visiting the Acquire now switch. Then, opt for the rates strategy you want and supply your qualifications to register for the profile.

- Method the transaction. Use your Visa or Mastercard or PayPal profile to finish the transaction.

- Pick the file format and download the shape in your device.

- Make changes. Fill up, modify and produce and sign the downloaded Arizona Summary of Schedules - Form 6CONTSUM - Post 2005.

Every template you included in your money does not have an expiration date and is also yours permanently. So, if you want to download or produce an additional backup, just proceed to the My Forms portion and click on the kind you require.

Obtain access to the Arizona Summary of Schedules - Form 6CONTSUM - Post 2005 with US Legal Forms, one of the most extensive local library of authorized papers web templates. Use 1000s of professional and condition-certain web templates that meet your organization or specific needs and demands.

Form popularity

FAQ

Key Takeaways. Debtors are individuals or businesses that owe money, whether to banks or other individuals. Debtors are often called borrowers if the money owed is to a bank or financial institution, however, they are called issuers if the debt is in the form of securities.

This is an Official Bankruptcy Form. Official Bankruptcy Forms are approved by the Judicial Conference and must be used under Bankruptcy Rule 9009. Declaration About an Individual Debtor's Schedules - U.S. Courts uscourts.gov ? forms ? individual-debtors uscourts.gov ? forms ? individual-debtors