The Arizona Agreement and Plan of Reorganization and Liquidation by Niagara Share Corp. and Scudder Investment Trust is a legal document that outlines the details and procedures for the reorganization and liquidation of assets between these two entities. This agreement aims to streamline the process of merging or acquiring one company by another, while ensuring a smooth transition and efficient allocation of resources. The Arizona Agreement and Plan of Reorganization and Liquidation signifies a strategic decision made by the companies involved to combine their operations, assets, and shareholders in a coordinated manner. This consolidated approach enables them to maximize synergies, reduce duplications, and enhance overall business performance. The Agreement and Plan of Reorganization and Liquidation may consist of different types, each tailored to suit specific circumstances. Some possible variations of this agreement could include: 1. Merger Agreement: This type of agreement outlines the terms and conditions under which two or more companies merge to form a new single entity. It details the exchange of shares, valuation mechanisms, corporate governance structure, and post-merger integration plans. 2. Acquisition Agreement: In situations where one company acquires another, an Acquisition Agreement is utilized. It specifies the terms of the acquisition, including purchase price, payment methods, due diligence, and closing conditions. 3. Asset Purchase Agreement: This agreement is relevant when one company acquires specific assets or divisions of another company, rather than the entire business. It delineates the assets being acquired, purchase price, transfer of liabilities, and any subsequent obligations. 4. Liquidation Agreement: In cases where a company decides to dissolve and liquidate its assets, a Liquidation Agreement is formulated. It outlines the orderly winding down process, including asset sales, creditor settlements, distribution of remaining proceeds, and final dissolution of the entity. These different types of Arizona Agreement and Plan of Reorganization and Liquidation provide a framework for companies looking to restructure, consolidate, or cease operations in a regulated and organized manner. They serve as essential legal tools to protect the interests of all parties involved, diminish potential disputes, and ensure compliance with applicable laws and regulations.

Arizona Agreement and Plan of Reorganization and Liquidation by Niagara Share Corp. and Scudder Investment Trust

Description

How to fill out Arizona Agreement And Plan Of Reorganization And Liquidation By Niagara Share Corp. And Scudder Investment Trust?

Are you currently inside a situation the place you need papers for both company or personal reasons almost every day? There are plenty of authorized document web templates available on the net, but locating ones you can rely is not effortless. US Legal Forms provides thousands of develop web templates, like the Arizona Agreement and Plan of Reorganization and Liquidation by Niagara Share Corp. and Scudder Investment Trust, that are written to satisfy state and federal requirements.

If you are presently knowledgeable about US Legal Forms website and also have a merchant account, simply log in. Afterward, you are able to obtain the Arizona Agreement and Plan of Reorganization and Liquidation by Niagara Share Corp. and Scudder Investment Trust web template.

Unless you have an profile and want to begin using US Legal Forms, adopt these measures:

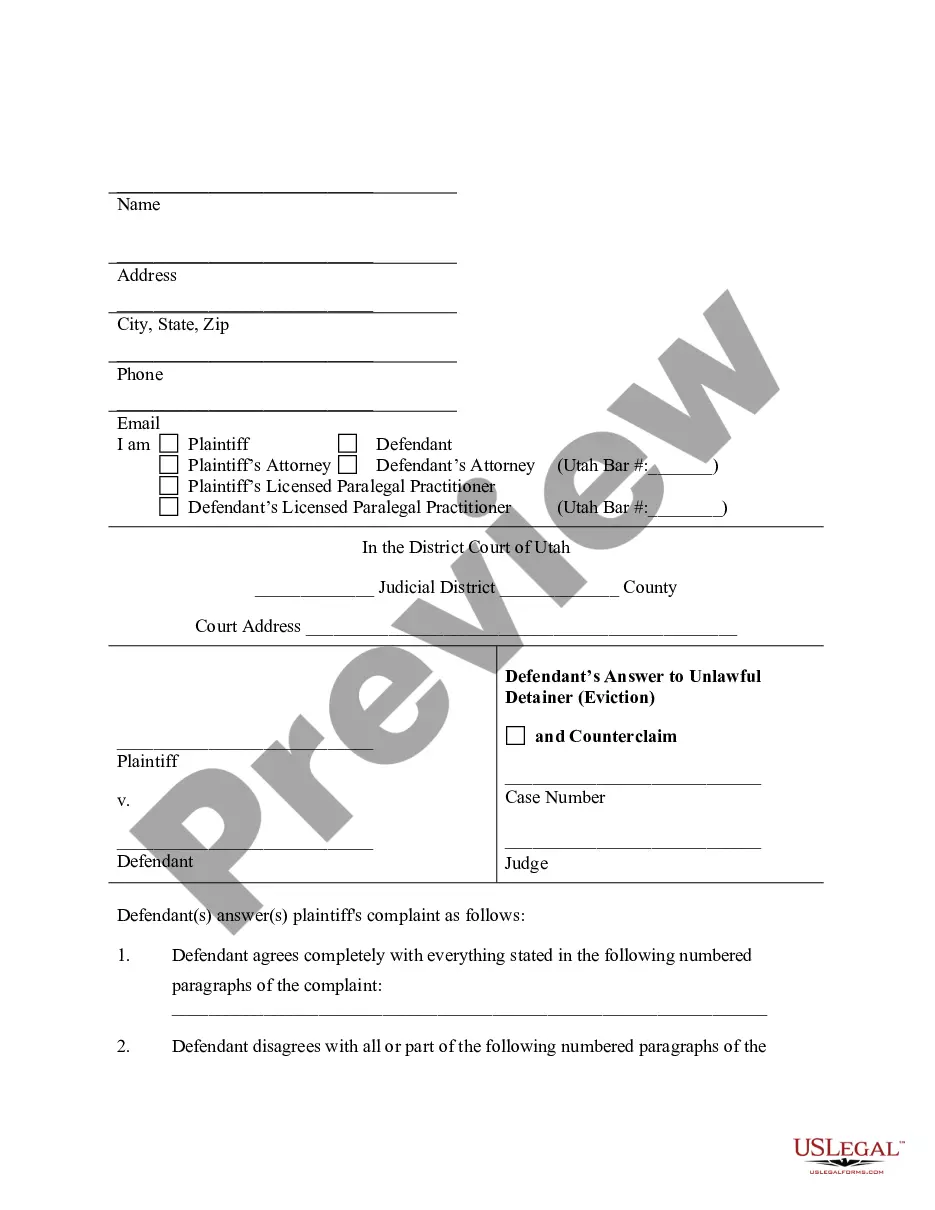

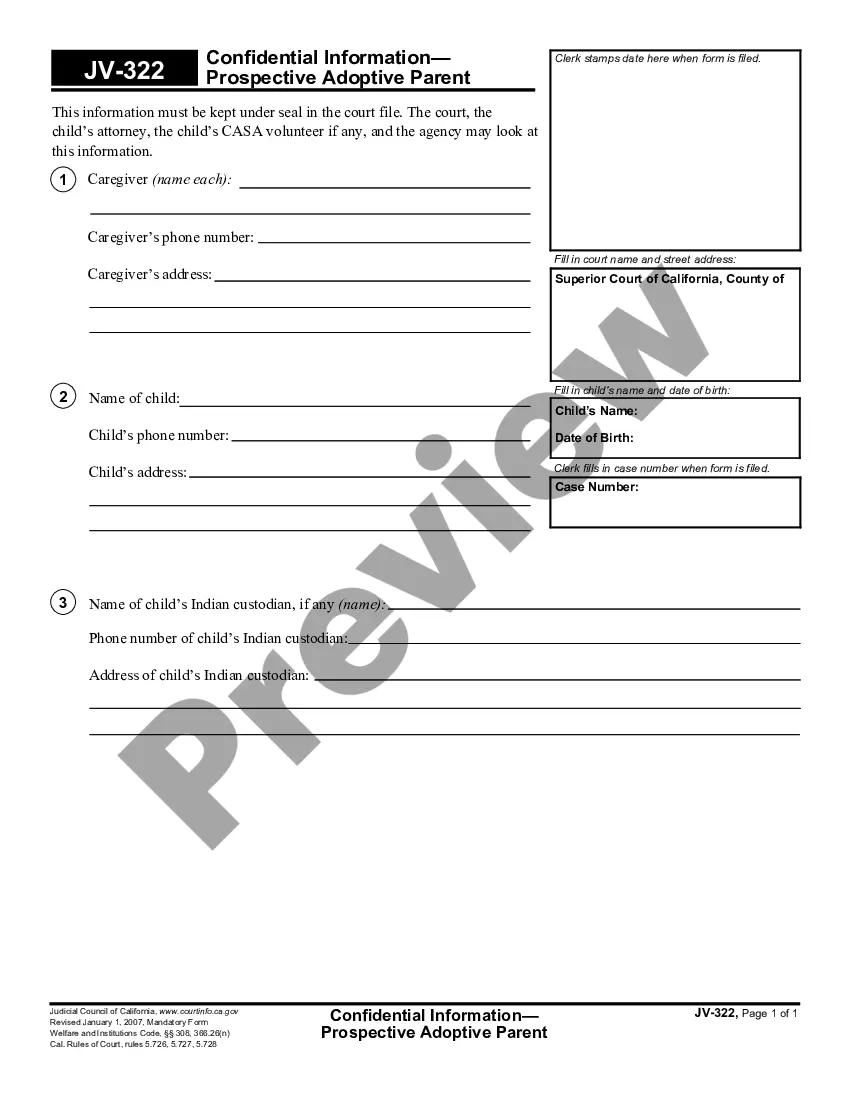

- Discover the develop you require and ensure it is for that appropriate metropolis/region.

- Utilize the Preview switch to examine the form.

- Look at the outline to actually have selected the proper develop.

- In case the develop is not what you`re searching for, use the Lookup discipline to discover the develop that suits you and requirements.

- If you discover the appropriate develop, click on Buy now.

- Pick the prices plan you need, fill in the specified details to produce your money, and buy your order with your PayPal or Visa or Mastercard.

- Select a practical data file file format and obtain your duplicate.

Get each of the document web templates you may have bought in the My Forms menus. You can aquire a further duplicate of Arizona Agreement and Plan of Reorganization and Liquidation by Niagara Share Corp. and Scudder Investment Trust any time, if required. Just select the required develop to obtain or print the document web template.

Use US Legal Forms, probably the most considerable selection of authorized forms, in order to save efforts and stay away from mistakes. The assistance provides expertly manufactured authorized document web templates that you can use for a selection of reasons. Generate a merchant account on US Legal Forms and start making your daily life a little easier.