Title: Arizona Section 262 of the Delaware General Corporation Law: A Comprehensive Overview Introduction: Arizona Section 262, part of the Delaware General Corporation Law, encompasses provisions related to appraisal rights and procedures for dissenting stockholders in mergers or consolidations. This article will delve into the details of Arizona Section 262, highlighting its key features, significance, and potential variations. Key Elements of Arizona Section 262: 1. Appraisal Rights: — Appraisal rights grant dissenting stockholders the right to have their shares independently appraised in the event of certain corporate actions, mainly mergers or consolidations. — This provision aims to safeguard minority shareholders' interests and ensure they receive fair value for their shares. 2. Exercise of Appraisal Rights: — Under Arizona Section 262, stockholders seeking appraisal rights must assert dissent before the proposed corporate action is voted upon. — Dissent can be expressed in writing, specifically detailing the decision to seek appraisal rights, and delivered to the corporation prior to the vote. — Following a properly asserted dissent, the stockholder must abstain from voting in favor of the contemplated action. 3. Appraisal Proceedings: — Appraisal proceedings involve an independent valuation of the shares held by dissenting stockholders. — After stockholders assert dissent, the corporation shall notify them about the appraisal rights available, instructions for demanding appraisal, and key deadlines. 4. Determination of Fair Value: — The court determines the "fair value" of the stockholder's shares, considering all relevant factors, including market prices, asset values, financial statements, and future prospects. — Fair value commonly refers to the inherent worth of the shares, beyond mere market price. Types of Arizona Section 262 (Delaware General Corporation Law): While Arizona Section 262 primarily concerns appraisal rights, it is worth noting that variations and amendments may exist based on specific legal stipulations. Some notable types might include: 1. Arizona Section 262(e): — This provision focuses on the treatment of shareholders who failed to properly assert their appraisal rights in a timely manner. — It typically restricts the ability of late-comers to participate in appraisal proceedings, barring them from claiming appraisal rights after the corporate action is completed. 2. Arizona Section 262(h): — Section 262(h) addresses the withdrawal or termination of appraisal rights. — It details the circumstances under which stockholders who initially asserted their appraisal rights can withdraw or abandon such rights. Conclusion: Arizona Section 262 of the Delaware General Corporation Law encompasses crucial provisions ensuring dissenting stockholders are fairly compensated during mergers or consolidations. Understanding the nuances of this section, such as appraisal rights, proper assertion, appraisal procedures, and determination of fair value, is vital for shareholders seeking to protect their interests. While variations like sections 262(e) and 262(h) may exist, these serve to further refine and clarify specific aspects related to appraisal rights.

Arizona Section 262 of the Delaware General Corporation Law

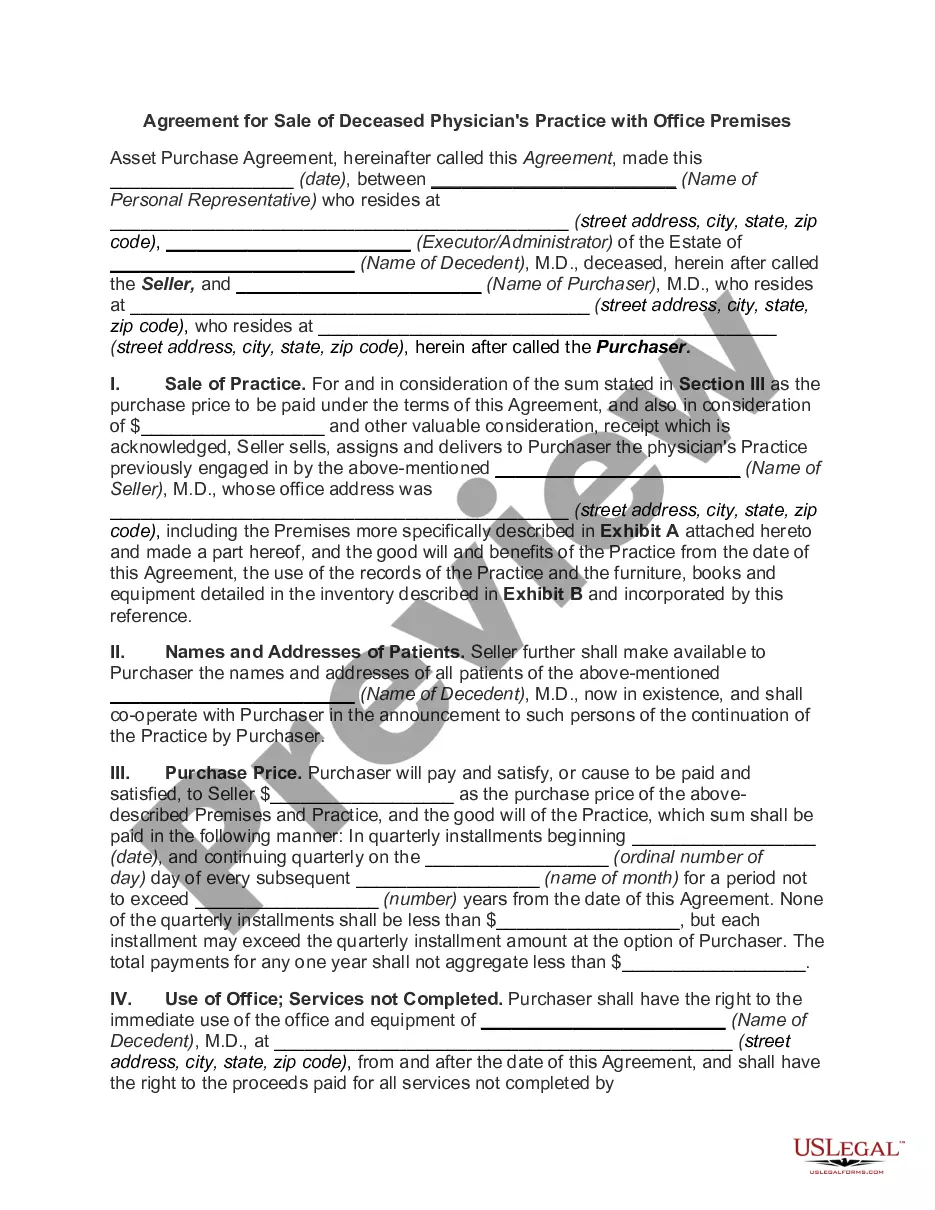

Description

How to fill out Arizona Section 262 Of The Delaware General Corporation Law?

You are able to spend hrs on the web trying to find the legal document web template which fits the federal and state requirements you want. US Legal Forms gives a huge number of legal types which can be analyzed by pros. It is simple to obtain or printing the Arizona Section 262 of the Delaware General Corporation Law from my service.

If you have a US Legal Forms bank account, you are able to log in and then click the Obtain option. Next, you are able to comprehensive, modify, printing, or sign the Arizona Section 262 of the Delaware General Corporation Law. Each legal document web template you acquire is yours eternally. To get one more backup associated with a acquired develop, proceed to the My Forms tab and then click the related option.

If you work with the US Legal Forms web site for the first time, adhere to the easy directions below:

- Initially, make sure that you have chosen the right document web template for the state/city of your choice. See the develop outline to make sure you have picked out the correct develop. If available, utilize the Review option to search with the document web template too.

- If you want to find one more edition from the develop, utilize the Search area to get the web template that meets your requirements and requirements.

- After you have identified the web template you would like, just click Purchase now to move forward.

- Choose the costs prepare you would like, key in your credentials, and sign up for your account on US Legal Forms.

- Comprehensive the financial transaction. You can use your bank card or PayPal bank account to pay for the legal develop.

- Choose the file format from the document and obtain it in your device.

- Make alterations in your document if required. You are able to comprehensive, modify and sign and printing Arizona Section 262 of the Delaware General Corporation Law.

Obtain and printing a huge number of document themes utilizing the US Legal Forms Internet site, which provides the biggest variety of legal types. Use expert and state-specific themes to deal with your organization or person demands.