Arizona Stock Option Agreement of Hayes Wheels International, Inc. - general form

Description

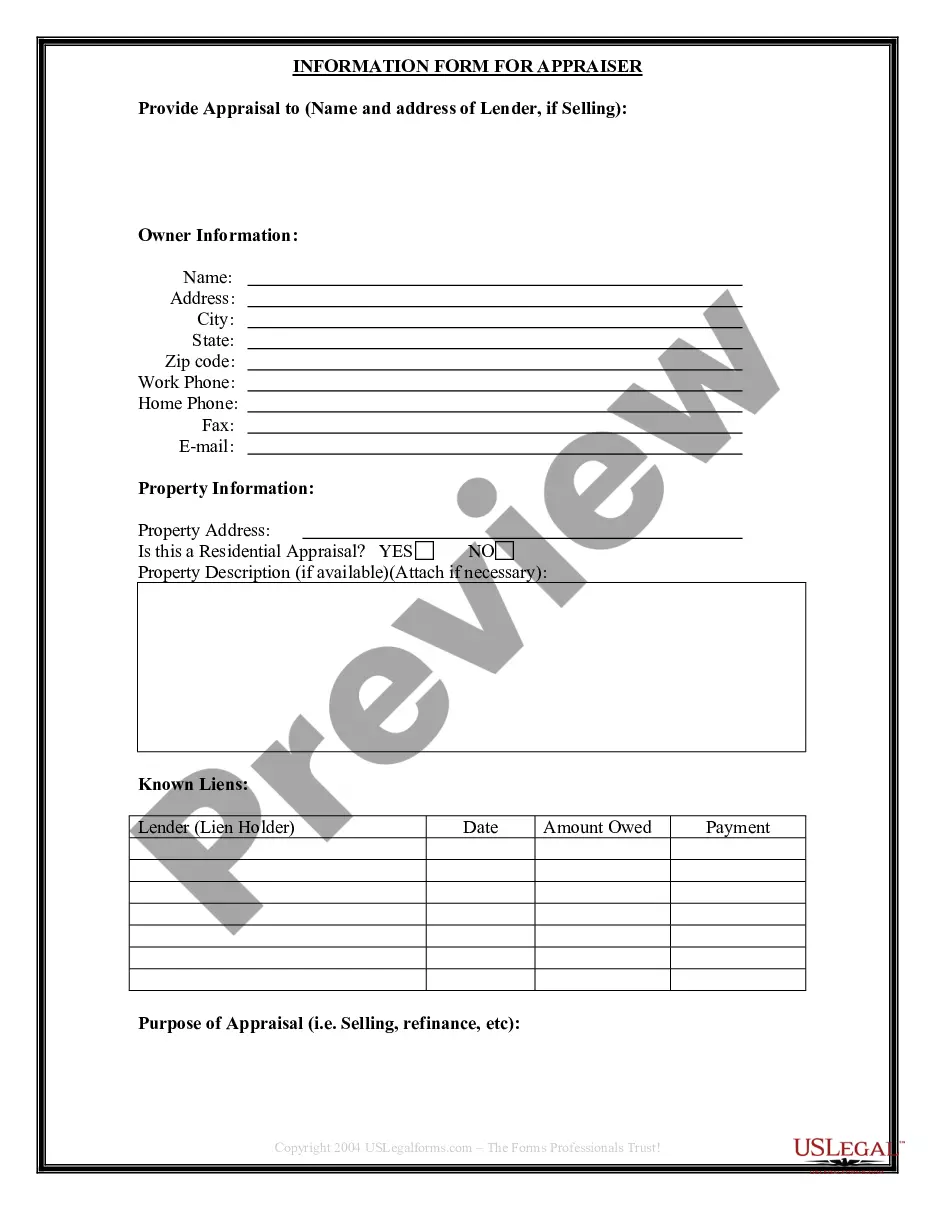

How to fill out Stock Option Agreement Of Hayes Wheels International, Inc. - General Form?

US Legal Forms - one of several greatest libraries of authorized forms in the United States - offers a wide array of authorized file web templates you can obtain or produce. Utilizing the web site, you may get thousands of forms for organization and person reasons, categorized by categories, suggests, or search phrases.You can get the newest models of forms just like the Arizona Stock Option Agreement of Hayes Wheels International, Inc. - general form in seconds.

If you already possess a registration, log in and obtain Arizona Stock Option Agreement of Hayes Wheels International, Inc. - general form from the US Legal Forms catalogue. The Download switch can look on each and every develop you look at. You have access to all earlier downloaded forms in the My Forms tab of your account.

If you want to use US Legal Forms initially, here are basic instructions to help you get started off:

- Be sure to have picked the best develop for your personal metropolis/state. Click the Preview switch to review the form`s content. See the develop information to ensure that you have selected the correct develop.

- When the develop does not suit your demands, make use of the Research area near the top of the monitor to get the one that does.

- When you are pleased with the shape, affirm your decision by clicking the Buy now switch. Then, choose the costs plan you prefer and offer your qualifications to register for the account.

- Approach the deal. Utilize your charge card or PayPal account to finish the deal.

- Pick the structure and obtain the shape on the gadget.

- Make changes. Fill out, edit and produce and indicator the downloaded Arizona Stock Option Agreement of Hayes Wheels International, Inc. - general form.

Each web template you included in your bank account does not have an expiration particular date and is your own property forever. So, if you wish to obtain or produce an additional copy, just check out the My Forms area and click on about the develop you need.

Gain access to the Arizona Stock Option Agreement of Hayes Wheels International, Inc. - general form with US Legal Forms, probably the most substantial catalogue of authorized file web templates. Use thousands of specialist and express-particular web templates that satisfy your company or person needs and demands.