The Arizona Eligible Directors' Stock Option Plan of Kyle Electronics is a comprehensive program designed to offer stock options to the eligible directors of the company. This compensation plan provides an opportunity for directors to acquire ownership in Kyle Electronics, aligning their interests with the success of the company. Under the Arizona Eligible Directors' Stock Option Plan, directors are granted the right to purchase a specified number of shares of Kyle Electronics at a predetermined price, often referred to as the exercise price. These stock options typically have a vesting period, during which directors must remain actively serving on the board of directors to earn the right to exercise their options. The exact terms and conditions of the Arizona Eligible Directors' Stock Option Plan may vary depending on the specific version implemented by Kyle Electronics. It is essential to review the plan documents provided by the company to fully understand the details and eligibility criteria of the program. There can be different types or variations of the Arizona Eligible Directors' Stock Option Plan offered by Kyle Electronics, which may include: 1. Incentive Stock Options (SOS): These options may provide tax advantages for directors if certain requirements set by the Internal Revenue Service (IRS) are met. SOS are subject to stricter rules, such as a maximum exercise price and a required holding period before selling the shares. 2. Non-Qualified Stock Options (Nests): Unlike SOS, Nests do not qualify for favorable tax treatment. Directors receiving Nests have more flexibility in terms of pricing and holding periods. 3. Performance-Based Stock Options: In some cases, Kyle Electronics may include performance-based criteria in the stock option plan. Directors may be required to achieve specific financial, operational, or strategic goals before exercising their options. The Arizona Eligible Directors' Stock Option Plan of Kyle Electronics acts as a valuable tool in attracting and retaining talented directors. By providing an opportunity to share in the company's success, Kyle Electronics strives to incentivize directors to work towards achieving the company's long-term objectives. Please consult with legal and financial professionals for personalized advice specific to your situation.

Arizona Eligible Directors' Stock Option Plan of Wyle Electronics

Description

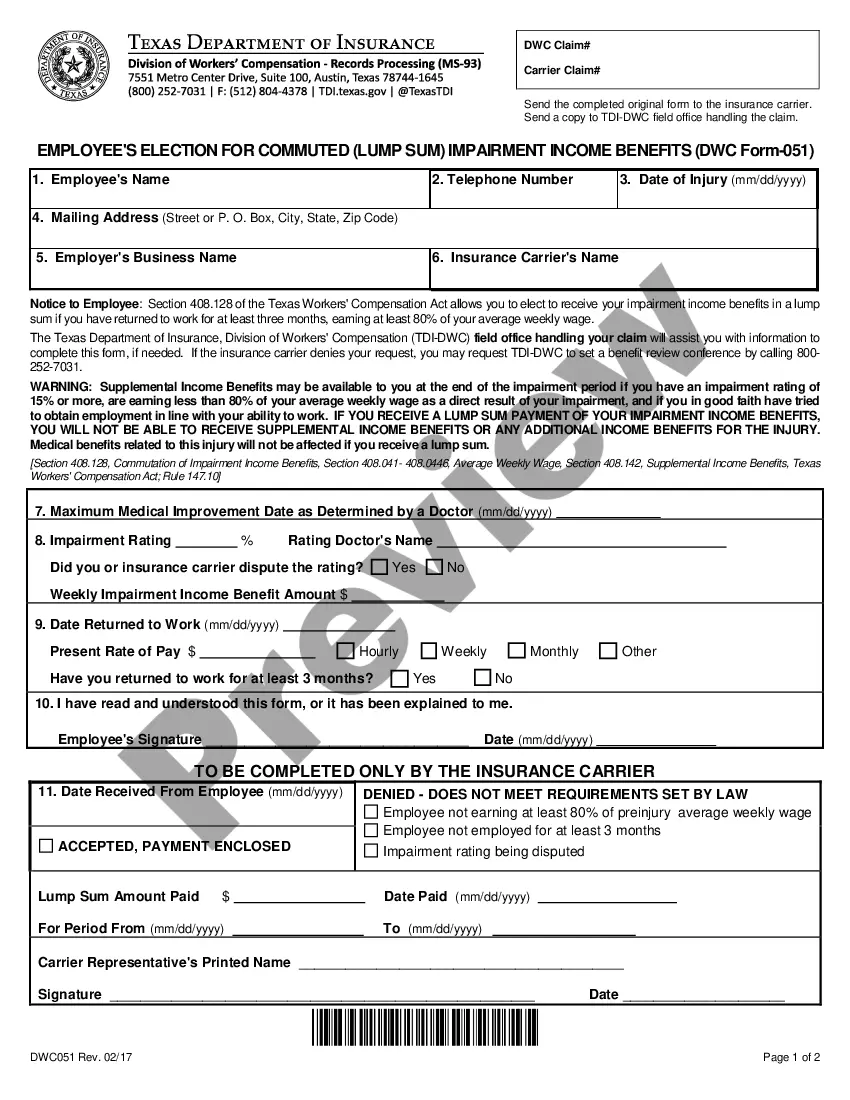

How to fill out Arizona Eligible Directors' Stock Option Plan Of Wyle Electronics?

You are able to devote hours online trying to find the legal record format that fits the state and federal demands you will need. US Legal Forms gives a large number of legal varieties which are analyzed by pros. It is simple to down load or printing the Arizona Eligible Directors' Stock Option Plan of Wyle Electronics from my services.

If you currently have a US Legal Forms bank account, you may log in and click on the Obtain option. Afterward, you may complete, change, printing, or signal the Arizona Eligible Directors' Stock Option Plan of Wyle Electronics. Every single legal record format you acquire is yours forever. To have an additional version for any acquired kind, visit the My Forms tab and click on the corresponding option.

If you use the US Legal Forms site initially, stick to the simple guidelines under:

- Initially, ensure that you have chosen the proper record format for the state/town that you pick. Read the kind description to ensure you have picked the correct kind. If available, take advantage of the Preview option to search with the record format at the same time.

- If you wish to discover an additional variation of your kind, take advantage of the Research industry to find the format that fits your needs and demands.

- Upon having discovered the format you need, simply click Purchase now to proceed.

- Find the costs strategy you need, enter your credentials, and sign up for an account on US Legal Forms.

- Total the purchase. You may use your credit card or PayPal bank account to fund the legal kind.

- Find the formatting of your record and down load it to your product.

- Make changes to your record if possible. You are able to complete, change and signal and printing Arizona Eligible Directors' Stock Option Plan of Wyle Electronics.

Obtain and printing a large number of record themes while using US Legal Forms website, which offers the most important variety of legal varieties. Use skilled and status-particular themes to tackle your organization or personal demands.