The Arizona Deferred Compensation Investment Account Plan, also known as the Arizona DC Plan, is a valuable retirement savings option available to employees in the state of Arizona. This plan is designed to help employees save and invest for their future retirement needs while enjoying various tax advantages. The Arizona Deferred Compensation Investment Account Plan allows employees to contribute a portion of their pre-tax earnings to a retirement account, thereby reducing their taxable income. This feature enables participants to grow their retirement savings more efficiently. Contributions made to the plan can be allocated into various investment options, including mutual funds, stocks, and bonds, tailored to the participant's risk tolerance and investment objectives. One of the key benefits of the plan is the ability to defer taxes on both contributions and earnings until a participant withdraws the funds during retirement. This tax-deferred growth provides an opportunity for individuals to accumulate more savings over time, potentially resulting in a more secure retirement future. Additionally, the Arizona Deferred Compensation Investment Account Plan offers a range of investment options to suit different preferences. Some available options may include target-date funds, which gradually reallocate investments based on the participant's expected retirement date, allowing for a more balanced and diversified portfolio. Participants can also choose from actively managed funds or index funds, each offering distinct investment strategies. Moreover, the Arizona DC Plan may include additional features such as a loan provision, which allows participants to borrow from their account balance for certain financial needs, such as education expenses or purchasing a primary residence. This flexibility can be highly beneficial during times of unforeseen financial challenges or extraordinary life events. While the Arizona Deferred Compensation Investment Account Plan is primarily focused on retirement savings, it is important to note that there may be other types of deferred compensation plans available to employees. These could include employer-provided deferred compensation plans, which may offer different contribution limits or matching contributions from the employer. Additionally, some employees may have access to plans specific to their occupation or industry, further tailoring the investment options or plan design to their specific needs. In conclusion, the Arizona Deferred Compensation Investment Account Plan is a robust retirement savings option offering employees in Arizona the opportunity to grow their savings efficiently while enjoying potential tax advantages. It provides a range of investment options, flexibility, and potential long-term growth, empowering individuals to take control of their retirement future.

Arizona Deferred Compensation Investment Account Plan

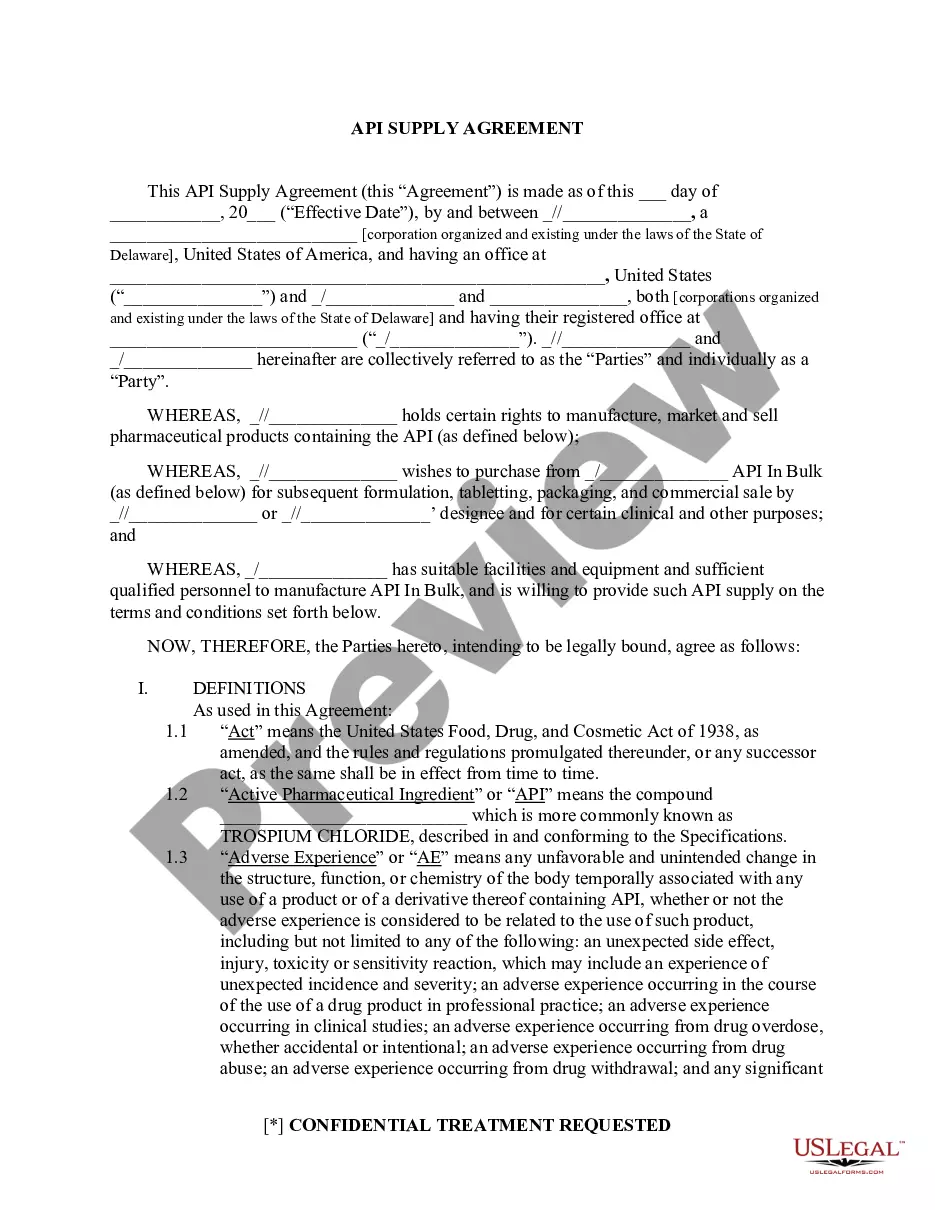

Description

How to fill out Arizona Deferred Compensation Investment Account Plan?

If you wish to complete, down load, or print legal file themes, use US Legal Forms, the greatest collection of legal types, that can be found on the web. Use the site`s easy and hassle-free lookup to find the files you want. A variety of themes for company and personal reasons are categorized by groups and claims, or search phrases. Use US Legal Forms to find the Arizona Deferred Compensation Investment Account Plan in a number of clicks.

Should you be already a US Legal Forms customer, log in in your profile and then click the Down load switch to get the Arizona Deferred Compensation Investment Account Plan. You can even access types you earlier acquired from the My Forms tab of your own profile.

If you use US Legal Forms the very first time, follow the instructions beneath:

- Step 1. Be sure you have selected the form for the proper area/land.

- Step 2. Utilize the Preview choice to look through the form`s articles. Don`t overlook to see the explanation.

- Step 3. Should you be unhappy together with the type, take advantage of the Search discipline on top of the monitor to locate other versions from the legal type web template.

- Step 4. Once you have found the form you want, go through the Buy now switch. Pick the prices strategy you prefer and add your qualifications to sign up for an profile.

- Step 5. Approach the transaction. You may use your bank card or PayPal profile to accomplish the transaction.

- Step 6. Find the structure from the legal type and down load it in your gadget.

- Step 7. Comprehensive, modify and print or sign the Arizona Deferred Compensation Investment Account Plan.

Each legal file web template you get is your own property eternally. You might have acces to every single type you acquired within your acccount. Click on the My Forms section and choose a type to print or down load yet again.

Remain competitive and down load, and print the Arizona Deferred Compensation Investment Account Plan with US Legal Forms. There are thousands of expert and status-specific types you can use for your personal company or personal requirements.