Arizona Tax Sharing Agreement

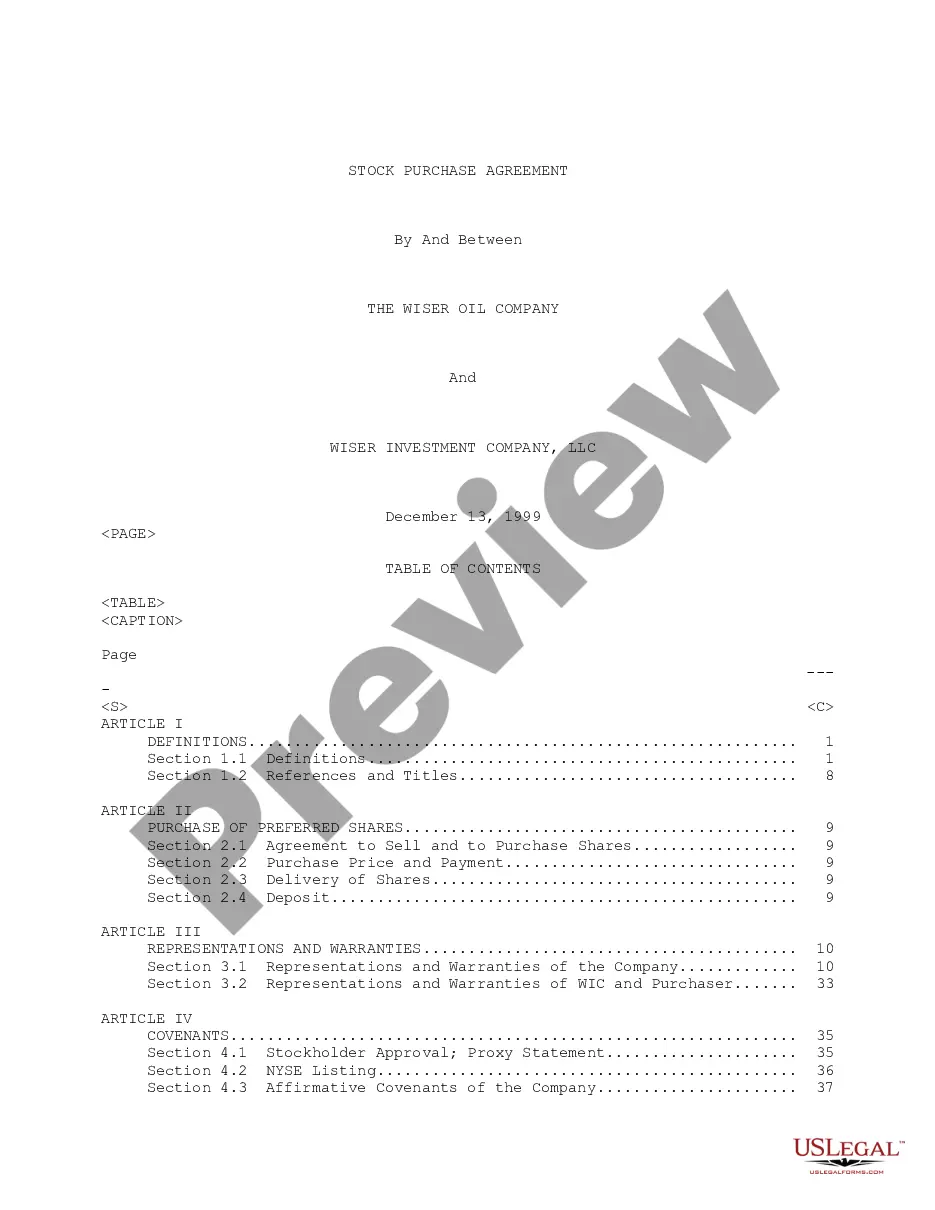

Description

How to fill out Tax Sharing Agreement?

US Legal Forms - one of many greatest libraries of lawful kinds in America - gives a wide range of lawful record templates you are able to down load or printing. Using the website, you can get a large number of kinds for organization and individual purposes, categorized by classes, states, or keywords and phrases.You can get the most up-to-date models of kinds such as the Arizona Tax Sharing Agreement in seconds.

If you have a subscription, log in and down load Arizona Tax Sharing Agreement through the US Legal Forms catalogue. The Acquire option can look on every single kind you see. You have access to all in the past saved kinds inside the My Forms tab of your respective account.

If you wish to use US Legal Forms initially, listed here are basic directions to get you started off:

- Ensure you have picked the best kind to your city/state. Select the Review option to check the form`s information. Browse the kind description to actually have chosen the appropriate kind.

- When the kind doesn`t match your specifications, take advantage of the Lookup area near the top of the monitor to get the one that does.

- When you are content with the form, verify your option by visiting the Acquire now option. Then, opt for the prices program you favor and supply your qualifications to sign up on an account.

- Approach the deal. Make use of your credit card or PayPal account to perform the deal.

- Select the file format and down load the form on the system.

- Make alterations. Complete, change and printing and indicator the saved Arizona Tax Sharing Agreement.

Every single format you added to your bank account does not have an expiry particular date and it is yours eternally. So, if you want to down load or printing yet another copy, just check out the My Forms area and click on in the kind you need.

Obtain access to the Arizona Tax Sharing Agreement with US Legal Forms, the most comprehensive catalogue of lawful record templates. Use a large number of professional and state-particular templates that fulfill your organization or individual demands and specifications.

Form popularity

FAQ

Year-End Gift and Estate Tax Planning: Gift/Estate Tax Exemption: Starting in 2023, each U.S. citizen can take advantage of a lifetime exemption of $12.92 million to protect transfers from estate and gift tax. The tax rate for these transfers is 40%. For married couples, the exemption is doubled to $25.84 million.

Tax Sharing and Allocation Agreements are contracts that describe and coordinate the allocation of tax responsibility and benefits among the named parties for a particular transaction or for a specific taxable period. Depending on the context, they may be called different names.

Broadly, tax sharing agreements: prevent joint and several liability arising by ?reasonably? allocating the group's income tax liability to group members.

The agreement calculates and allocates the tax consequences attributable to a specific member or group that are reported in a consolidated return. A TSA happens when two or more corporations are consolidated or combined into a single tax filing.

Standard deduction increase: For tax year 2023, the standard deduction increased to $13,850 for single filers and $27,700 for married couples filing jointly. Tax brackets increase: Income tax brackets went up in 2023 to account for inflation.

Increase In Tax Deductions Tax deductions lower the amount of taxable income. Standard deductions for single filers are increasing from $12,950 in 2022 to $13,850 in 2023. Married couples filing jointly will go from $25,900 in 2022 to $27,700 in 2023, and married filing separately will go from $12,950 to $13,850.

Beginning in 2023, Arizona is doing away with a progressive tax system and instead applying a flat tax rate of 2.5% on taxable income. This tax rate will apply to income earned throughout 2023 that is reported on returns filed in 2024. Arizona Department of Revenue.

In Arizona, partnerships are considered pass-through entities for tax purposes. This means that if you form a partnership, your share of the partnership's income is reported on your personal state and federal tax returns. The partnership itself doesn't pay any taxes on this money, it is considered your personal income.

Arizona does not tax Social Security benefits. However, you may have to pay federal taxes on your Social Security if your income is above a certain threshold. Pensions and tax-deferred retirement accounts are subject to Arizona income tax for retirees.

For states with reciprocity agreements, workers only pay taxes in the state where they live, not the state where they perform the work. As an example, a person who lives in Arizona but works in California would not have to pay state taxes in California, because the two states have a tax reciprocity agreement.