Arizona Proposal to amend articles of incorporation to effect a reverse stock split of common stock and authorize a share dividend on common stock

Description

How to fill out Proposal To Amend Articles Of Incorporation To Effect A Reverse Stock Split Of Common Stock And Authorize A Share Dividend On Common Stock?

If you have to comprehensive, download, or produce authorized file layouts, use US Legal Forms, the largest selection of authorized forms, which can be found on the Internet. Use the site`s simple and practical research to get the papers you want. A variety of layouts for company and personal uses are categorized by types and says, or search phrases. Use US Legal Forms to get the Arizona Proposal to amend articles of incorporation to effect a reverse stock split of common stock and authorize a share dividend on common stock within a few clicks.

If you are already a US Legal Forms customer, log in for your profile and click on the Down load key to have the Arizona Proposal to amend articles of incorporation to effect a reverse stock split of common stock and authorize a share dividend on common stock. Also you can gain access to forms you earlier downloaded inside the My Forms tab of your own profile.

Should you use US Legal Forms initially, follow the instructions under:

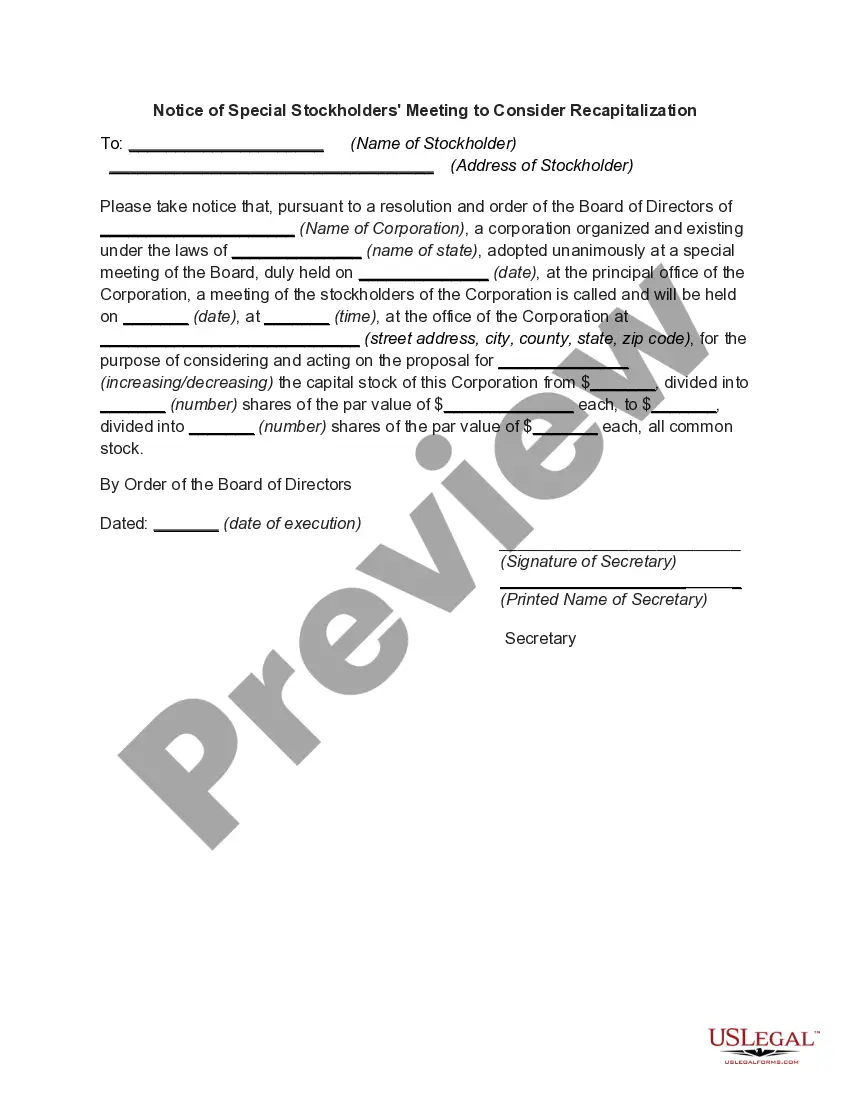

- Step 1. Make sure you have chosen the form to the proper town/nation.

- Step 2. Utilize the Review method to check out the form`s information. Don`t forget about to read the description.

- Step 3. If you are not satisfied with all the type, use the Lookup discipline on top of the monitor to find other versions of your authorized type template.

- Step 4. After you have found the form you want, go through the Buy now key. Choose the rates prepare you like and add your references to sign up for the profile.

- Step 5. Process the transaction. You should use your credit card or PayPal profile to accomplish the transaction.

- Step 6. Choose the file format of your authorized type and download it on the product.

- Step 7. Comprehensive, change and produce or indicator the Arizona Proposal to amend articles of incorporation to effect a reverse stock split of common stock and authorize a share dividend on common stock.

Every authorized file template you acquire is your own for a long time. You might have acces to each and every type you downloaded within your acccount. Click the My Forms portion and select a type to produce or download once again.

Remain competitive and download, and produce the Arizona Proposal to amend articles of incorporation to effect a reverse stock split of common stock and authorize a share dividend on common stock with US Legal Forms. There are millions of expert and state-distinct forms you can utilize for your personal company or personal needs.

Form popularity

FAQ

One way is to buy shares of the company before the reverse split occurs with the plan to sell them soon afterwards. This can be profitable if the company's stock price increases after the split. Another way to make money from a reverse stock split is to short sell the stock of the company.

The number of outstanding shares of Common Stock will be decreased as a result of a Reverse Stock Split, but the number of authorized shares of Common Stock will not be so decreased.

Key Takeaways. A company performs a reverse stock split to boost its stock price by decreasing the number of shares outstanding. A reverse stock split has no immediate effect on the company's value, as its market capitalization remains the same after it's executed.

What is the impact of the reverse stock split on stock options and warrants? Answer. An adjustment will be made to the Company's stock options and warrants based on the split ratio. Warrant holders do not need to submit their warrants for exchange.

Reverse stock split The holder of an option contract will have the same number of contracts with an increase in strike price based on the reverse split value. The option contract will now represent a reduced number of shares based on the reverse stock split value.

The other statements are true. If there is a reverse stock split, the market price per share will be increased and the number of outstanding shares will be reduced.

Reverse stock splits work the same way as regular stock splits but in reverse. A reverse split takes multiple shares from investors and replaces them with fewer shares. The new share price is proportionally higher, leaving the total market value of the company unchanged.

Reverse stock splits work the same way as regular stock splits but in reverse. A reverse split takes multiple shares from investors and replaces them with fewer shares. The new share price is proportionally higher, leaving the total market value of the company unchanged.