Title: Arizona Amendment to the Articles of Incorporation to Eliminate Par Value: A Comprehensive Guide Introduction: The Arizona Amendment to the Articles of Incorporation to eliminate par value is a legal process that allows corporations to revise their existing articles of incorporation by removing the fixed nominal value assigned to their shares. This amendment offers flexibility in determining the worth of shares, thereby benefiting both the corporation and its shareholders. In this comprehensive guide, we will explore the key details, procedure, and significance of this amendment in Arizona. Types of Arizona Amendments to the Articles of Incorporation to Eliminate Par Value: 1. Complete Elimination of Par Value: This amendment nullifies the par value altogether, allowing corporations to establish a more flexible framework for determining the worth of their shares. By removing the par value, corporations have greater freedom to set the initial offering price, making it easier to attract potential investors. 2. Replacement of Par Value with Stated Capital: In this type of amendment, corporations eliminate the traditional concept of par value and introduce the concept of "stated capital." Stated capital represents the amount received from the issuance of shares, reducing the risk of overvaluation or undervaluation of shares. 3. Partial Elimination of Par Value: Some corporations choose to partially eliminate the concept of par value by replacing the fixed nominal value with a range or minimum value. This provides a middle ground, offering some flexibility in share pricing while still providing a reference point for valuation. Procedure for Arizona Amendment to the Articles of Incorporation to Eliminate Par Value: 1. Proposal: The proposed amendment must be submitted to the board of directors, outlining the intended changes. The amendment may be initiated by the board, shareholders, or other stakeholders as permitted under the corporation's bylaws. 2. Shareholder Approval: Typically, the amendment requires approval from the shareholders. The corporation must hold a meeting, either in person or virtually, where shareholders can vote on the proposed amendment. 3. Filing the Amendment: Once approved, the corporation must file the amendment with the Arizona Corporation Commission (ACC). The filing must include a cover sheet, the amended articles of incorporation, and the corresponding filing fee. 4. Certificate of Amendment: Upon successful filing, the ACC will issue a Certificate of Amendment, acknowledging the change to the articles of incorporation. This certificate serves as official documentation of the amendment and should be kept with the corporation's records. Significance and Benefits: 1. Enhanced Flexibility: Eliminating par value provides corporations with greater flexibility in share pricing, allowing them to adjust the value based on market demand and other relevant factors. 2. Attraction for Investors: By eliminating par value or setting a more flexible stated capital, corporations can tailor their pricing to specific investor needs, potentially attracting a wider range of investors and encouraging capital inflow. 3. Simplified Accounting: Eliminating par value reduces complexity in financial reporting and minimizes the risk of overvaluation or undervaluation, making accounting processes more streamlined and transparent. Conclusion: The Arizona Amendment to the Articles of Incorporation to eliminate par value empowers corporations to adapt to changing market dynamics and attract potential investors by providing greater flexibility in share pricing. By choosing the appropriate type of amendment and following the prescribed procedure, corporations can navigate this process smoothly and derive numerous benefits. It is advisable to consult legal professionals to ensure compliance with all regulations and to best serve the corporation's stakeholders.

Arizona Amendment to the articles of incorporation to eliminate par value

Description

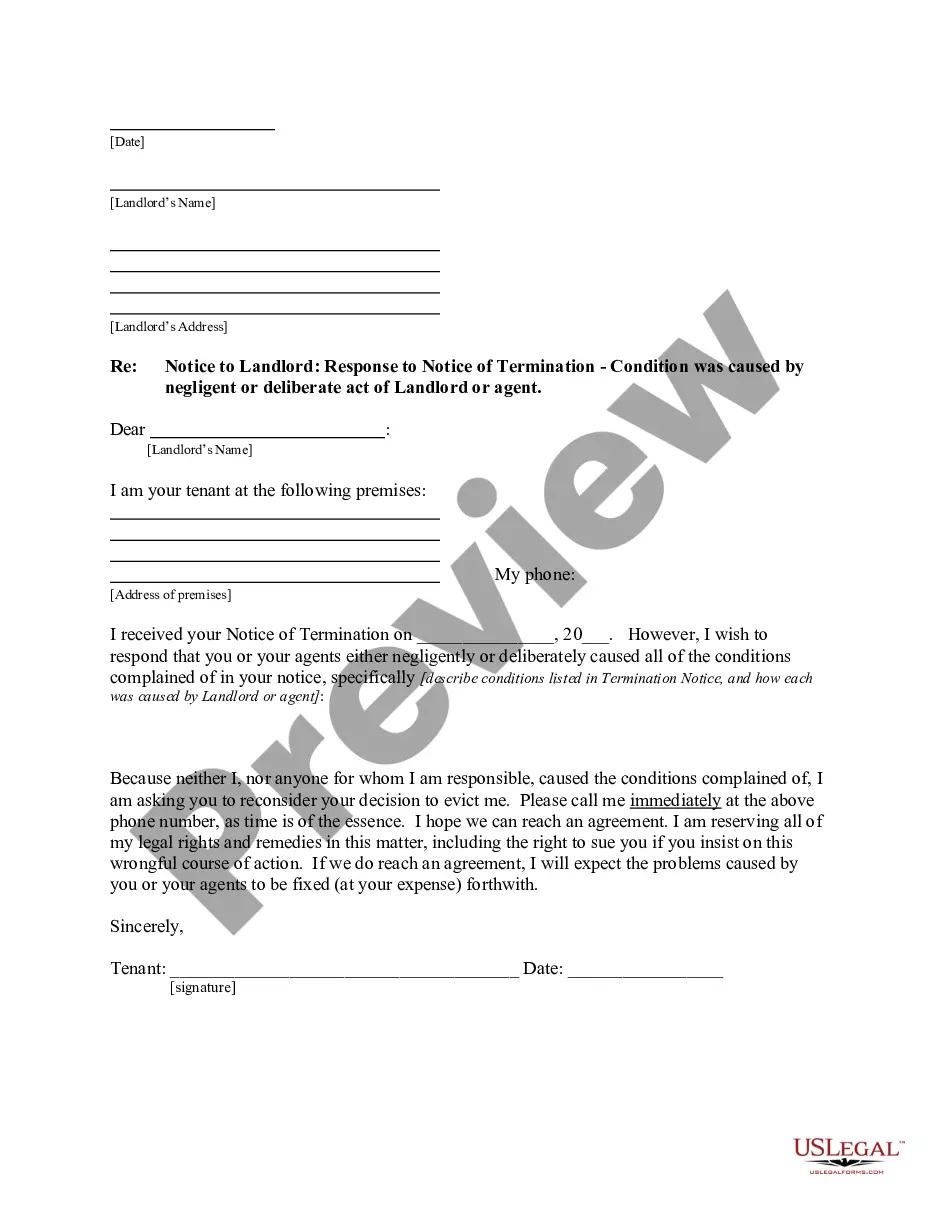

How to fill out Arizona Amendment To The Articles Of Incorporation To Eliminate Par Value?

You may spend hours on the web attempting to find the legitimate record web template which fits the state and federal needs you require. US Legal Forms supplies a huge number of legitimate forms that are evaluated by experts. It is simple to download or printing the Arizona Amendment to the articles of incorporation to eliminate par value from the support.

If you currently have a US Legal Forms profile, you may log in and then click the Download key. After that, you may full, modify, printing, or indication the Arizona Amendment to the articles of incorporation to eliminate par value. Each and every legitimate record web template you purchase is your own forever. To obtain yet another copy associated with a purchased develop, visit the My Forms tab and then click the corresponding key.

If you work with the US Legal Forms web site the very first time, follow the straightforward recommendations beneath:

- Very first, make certain you have selected the best record web template for that state/metropolis of your liking. Look at the develop outline to make sure you have chosen the right develop. If available, make use of the Review key to look through the record web template at the same time.

- If you wish to find yet another version of your develop, make use of the Look for discipline to find the web template that fits your needs and needs.

- After you have identified the web template you want, just click Get now to carry on.

- Select the rates strategy you want, type in your qualifications, and sign up for a merchant account on US Legal Forms.

- Total the deal. You can utilize your bank card or PayPal profile to purchase the legitimate develop.

- Select the formatting of your record and download it to the product.

- Make changes to the record if needed. You may full, modify and indication and printing Arizona Amendment to the articles of incorporation to eliminate par value.

Download and printing a huge number of record web templates making use of the US Legal Forms site, which offers the most important selection of legitimate forms. Use professional and condition-distinct web templates to take on your organization or individual needs.