Title: Understanding the Arizona Registration Rights Agreement between Alexander and Alexander Services, Inc. and Purchasers Introduction: The Arizona Registration Rights Agreement is a legally binding contract that outlines the rights and obligations of Alexander and Alexander Services, Inc. (referred to as the "Company") and the Purchasers concerning the registration of securities issued by the Company. This detailed description aims to shed light on the main elements and types of such agreements. Key Keywords: Arizona Registration Rights Agreement, Alexander and Alexander Services, Inc., Purchasers, securities, registration. I. Purpose of the Agreement: The primary goal of the agreement is to grant the Purchasers (investors or stockholders) the right to request that the Company registers their securities with the relevant regulatory authorities. This ensures that the securities can be publicly traded and sold in compliance with federal and state securities laws. II. Key Elements of the Agreement: 1. Grant of Registration Rights: The Agreement specifies the conditions under which the Company will grant registration rights to the Purchasers. 2. Termination of Registration Rights: Terms regarding the termination of registration rights may be outlined, such as the expiration date or certain triggering events. 3. Demand Rights: The Purchasers may have the right to demand registration of their securities under certain circumstances, such as when a specific threshold is reached. 4. Piggyback Rights: The Agreement may entitle the Purchasers to include their securities in registrations initiated by the Company. 5. Registration Expenses: The Agreement often addresses the allocation of expenses related to the registration process, such as filing fees and legal costs. III. Types of Arizona Registration Rights Agreements: 1. Unlimited Shelf Registration Rights Agreement: This type of agreement allows the Purchasers to freely register their securities for an unlimited period without restrictions on the number or timing of registrations. 2. Demand Registration Rights Agreement: Here, the Purchasers can require the Company to register their securities upon request, subject to certain criteria and conditions. 3. Piggyback Registration Rights Agreement: This agreement allows the Purchasers to participate in the registration process initiated by the Company for its own securities, ensuring they have the opportunity to sell their securities alongside the Company. 4. Delayed Registration Rights Agreement: In this type of agreement, the registration of the Purchasers' securities is postponed until specific conditions or events occur, as negotiated between the parties. 5. Short-Form Registration Rights Agreement: Usually utilized in private offerings, this agreement streamlines the registration process, allowing the Purchasers to achieve quicker registration of their securities. Conclusion: The Arizona Registration Rights Agreement creates a framework that governs the registration process of securities issued by Alexander and Alexander Services, Inc. By granting registration rights to the Purchasers, this agreement ensures compliance with securities laws and enables the public trading and sale of the securities. By understanding the different types of agreements available, both the Company and the Purchasers can negotiate terms that suit their respective needs and objectives.

Arizona Registration Rights Agreement between Alexander and Alexander Services, Inc. and Purchasers

Description

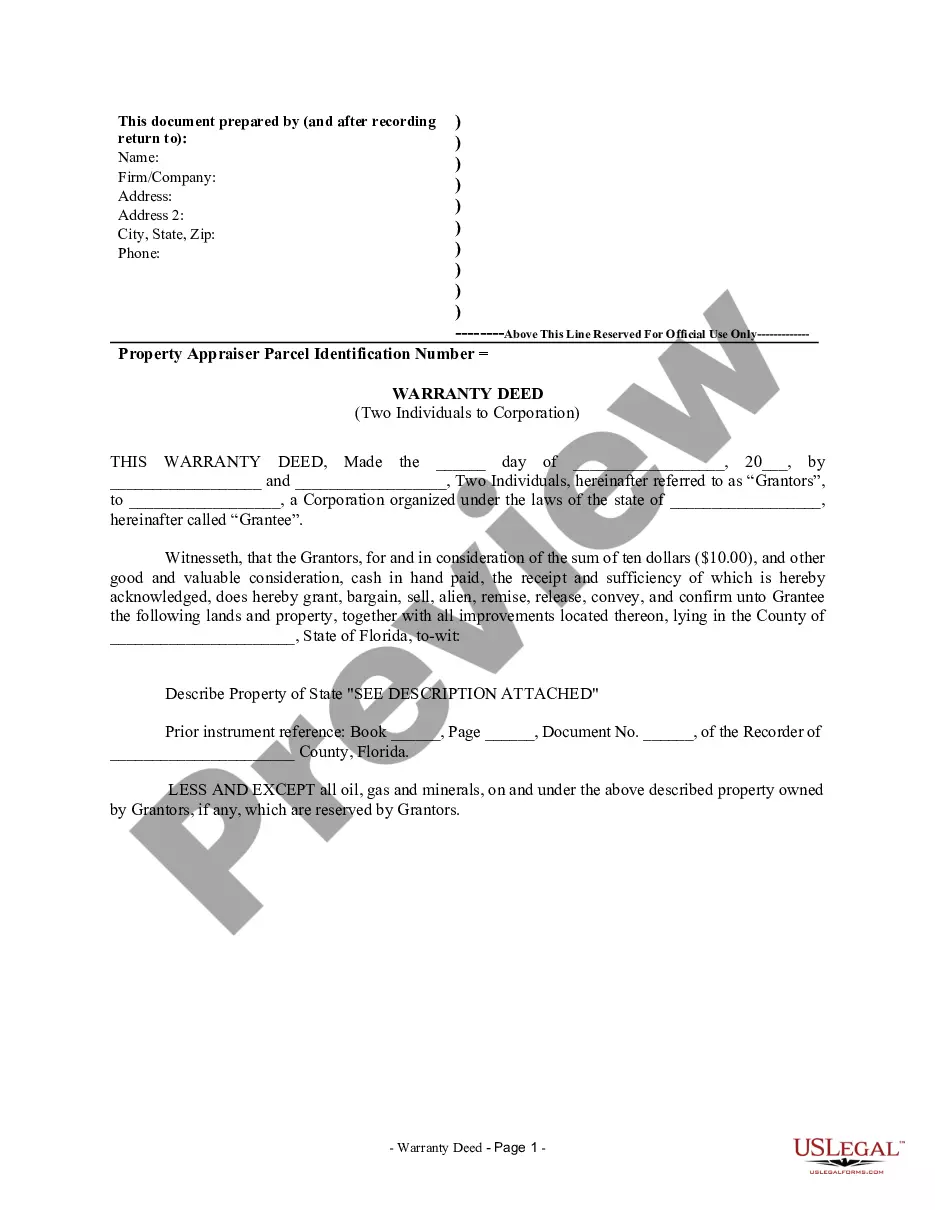

How to fill out Arizona Registration Rights Agreement Between Alexander And Alexander Services, Inc. And Purchasers?

Finding the right authorized document design can be quite a struggle. Of course, there are a variety of web templates accessible on the Internet, but how can you discover the authorized type you require? Take advantage of the US Legal Forms internet site. The assistance delivers 1000s of web templates, for example the Arizona Registration Rights Agreement between Alexander and Alexander Services, Inc. and Purchasers, that can be used for enterprise and private needs. All the kinds are examined by pros and meet up with state and federal demands.

Should you be presently registered, log in in your profile and click the Obtain switch to find the Arizona Registration Rights Agreement between Alexander and Alexander Services, Inc. and Purchasers. Utilize your profile to search through the authorized kinds you possess bought formerly. Go to the My Forms tab of your own profile and have yet another copy in the document you require.

Should you be a fresh user of US Legal Forms, here are simple recommendations so that you can comply with:

- Initially, make sure you have selected the correct type to your town/area. You are able to check out the form utilizing the Review switch and browse the form explanation to ensure it will be the right one for you.

- In the event the type is not going to meet up with your preferences, take advantage of the Seach field to get the right type.

- When you are certain the form is proper, click the Acquire now switch to find the type.

- Pick the rates strategy you would like and type in the required details. Make your profile and pay for the order utilizing your PayPal profile or Visa or Mastercard.

- Select the data file structure and obtain the authorized document design in your product.

- Full, revise and print out and indicator the acquired Arizona Registration Rights Agreement between Alexander and Alexander Services, Inc. and Purchasers.

US Legal Forms is the most significant collection of authorized kinds for which you can discover a variety of document web templates. Take advantage of the company to obtain professionally-manufactured paperwork that comply with state demands.