The Arizona Plan of Liquidation is a comprehensive and well-structured document that outlines the process by which a business or organization dissolves its assets, settles its debts, and distributes remaining funds or assets to shareholders or stakeholders. This plan is created with the objective of efficiently and effectively winding down operations and bringing closure to the entity. Key aspects of the Arizona Plan of Liquidation include the identification and valuation of all assets, the establishment of a timeline for the liquidation process, the determination of priority for debt repayment, and the allocation of remaining assets among shareholders or stakeholders. It serves as a guiding framework to ensure a fair and equitable distribution of resources while adhering to legal requirements and obligations. There are different types of Arizona Plans of Liquidation, tailored to specific circumstances and objectives. These may include: 1. Voluntary Liquidation: When a business entity decides to dissolve voluntarily due to various reasons. This plan is initiated by the company itself and can be either a Members' Voluntary Liquidation (MVP) if the company is solvent, or a Creditors' Voluntary Liquidation (CVL) if it is insolvent. 2. Court-Ordered Liquidation: In cases where a business fails to meet its obligations or faces legal actions from creditors, the court may intervene and order a liquidation process. The Arizona Plan of Liquidation under such circumstances would be formulated in accordance with the court's directives and oversight. 3. Creditors’ Liquidation: When a company is unable to repay its debts, its creditors can file a petition for liquidation. In this scenario, the Arizona Plan of Liquidation reflects the interests of the creditors, prioritizing debt repayment and maximizing their recovery. 4. Dissolution of Non-Profit Organizations: Non-profit organizations may also need to undergo a liquidation process when they cease operations or achieve their intended goals. The Arizona Plan of Liquidation for non-profits is formulated to ensure the proper allocation of remaining assets to other charitable organizations or for specific purposes stated in the organization's mission. 5. Third-Party Liquidation: In some cases, a business may hire a professional liquidator or a licensed insolvency practitioner to manage the liquidation process. These third-party experts assist in developing the Arizona Plan of Liquidation and ensure compliance with legal requirements and best practices in asset liquidation. In summary, the Arizona Plan of Liquidation is a crucial document that outlines the step-by-step process of winding down a business or organization, settling debts, and distributing remaining assets. By following this plan, stakeholders can navigate through the liquidation process smoothly, ensuring fairness, and complying with legal obligations.

Arizona Plan of Liquidation

Description

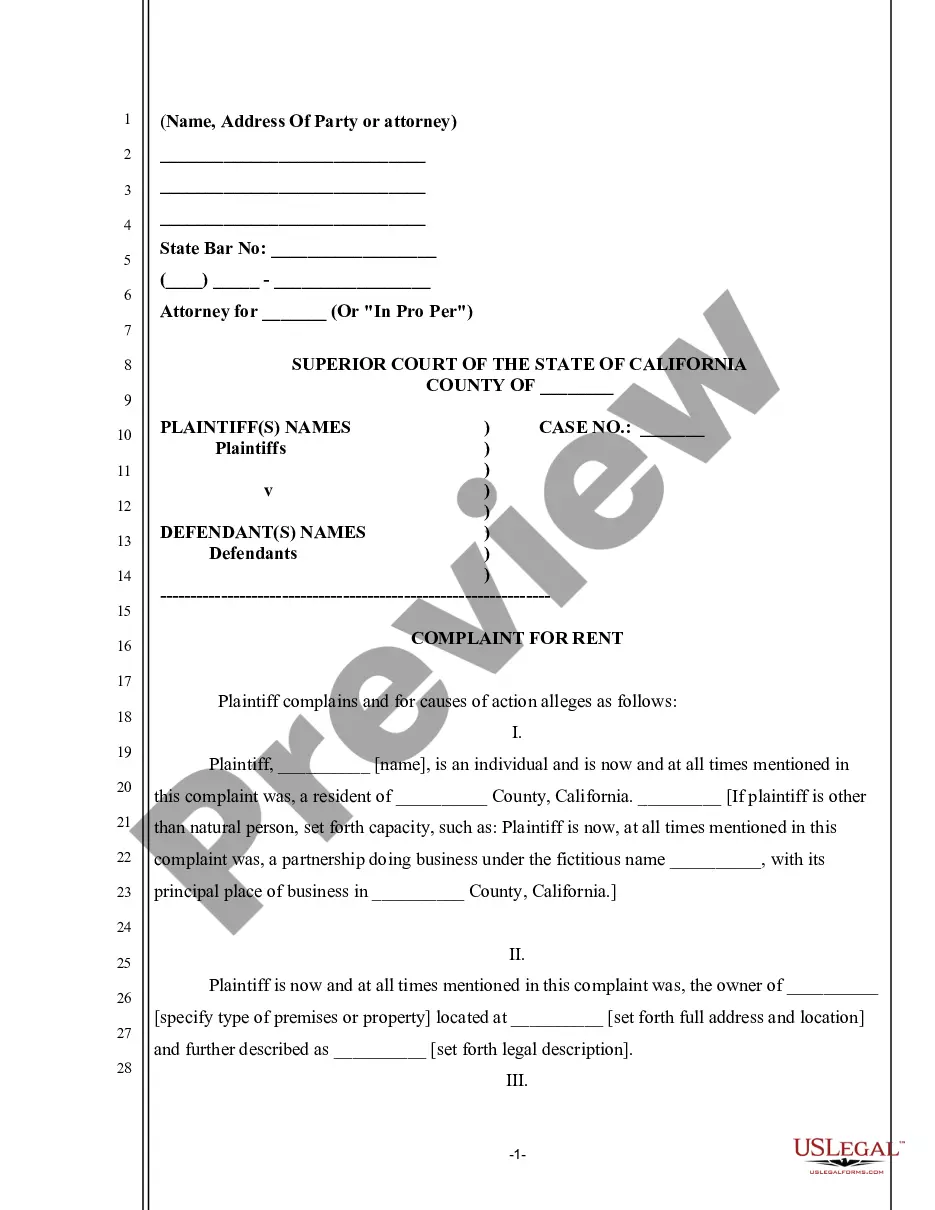

How to fill out Arizona Plan Of Liquidation?

You may invest hrs on the Internet searching for the legal record web template that suits the state and federal demands you need. US Legal Forms supplies a large number of legal forms that happen to be examined by specialists. You can actually down load or print out the Arizona Plan of Liquidation from your assistance.

If you have a US Legal Forms profile, you can log in and click the Acquire key. Next, you can total, revise, print out, or indicator the Arizona Plan of Liquidation. Every single legal record web template you acquire is your own property permanently. To have yet another duplicate of the obtained develop, proceed to the My Forms tab and click the corresponding key.

If you work with the US Legal Forms web site the very first time, keep to the straightforward guidelines listed below:

- Very first, be sure that you have selected the right record web template for the state/city that you pick. Browse the develop explanation to ensure you have selected the correct develop. If offered, take advantage of the Preview key to search from the record web template too.

- If you want to find yet another edition of the develop, take advantage of the Search industry to get the web template that meets your requirements and demands.

- Once you have located the web template you desire, click Acquire now to proceed.

- Choose the pricing plan you desire, type in your credentials, and sign up for a merchant account on US Legal Forms.

- Comprehensive the deal. You should use your charge card or PayPal profile to cover the legal develop.

- Choose the formatting of the record and down load it in your device.

- Make adjustments in your record if required. You may total, revise and indicator and print out Arizona Plan of Liquidation.

Acquire and print out a large number of record templates while using US Legal Forms site, which provides the biggest collection of legal forms. Use professional and express-distinct templates to take on your company or personal needs.

Form popularity

FAQ

Checking Arizona LLC Status After filing Articles of Organization to form a new LLC, you can check to see whether these documents have been approved and/or verify that your business information is listed correctly by searching for your business name on the Arizona Corporation Commission's (ACC) database.

Oregon Corporation Dissolution Step 1: The Corporate Resolution. The first step in dissolution is drafting the proper corporate resolution. ... Step 2: File Articles of Dissolution. ... Step 3: File Form 966. ... Step 4: Plan of Liquidation (Optional) ... Step 5: Notice (Optional)

To reinstate your Arizona LLC, there's no reinstatement application to fill out. Instead, you'll need to correct the problem that led to administrative dissolution, file the proper paperwork, and pay the $100 reinstatement fee.

To withdraw or cancel your foreign LLC in Arizona, file two copies of Form LL: 0009, Cancellation of Application for Registration with the Arizona Corporations Commission. The form is available online (see link below). The form is also in your account when you sign up for Arizona statutory agent service.

How do you dissolve an Arizona Limited Liability Company? To dissolve your LLC in Arizona, you submit the completed Form LL: 0020 Articles of Termination to the Arizona Corporation Commission (ACC) by mail, fax, or in person. Arizona has a cover sheet that should be included with filings.

The Arizona Corporation Commission's mission is to ensure safe, reliable, and affordable utility services; have railroad and pipeline systems that are operated and maintained in a safe manner; grow Arizona's economy as we help local entrepreneurs achieve their dream of starting a business; modernize an efficient, ...

Unless formally terminated or unless the Articles of Organization contain a termination date, an Arizona limited liability company will exist ?forever.? Unlike an Arizona corporation, an Arizona LLC does not have to file an annual report with the Arizona Corporation Commission or pay the ACC an annual fee.

No, LLCs are not required to file annual reports. Pursuant to Arizona law, only Corporations are required to file annual reports, on or before their prescribed due date.