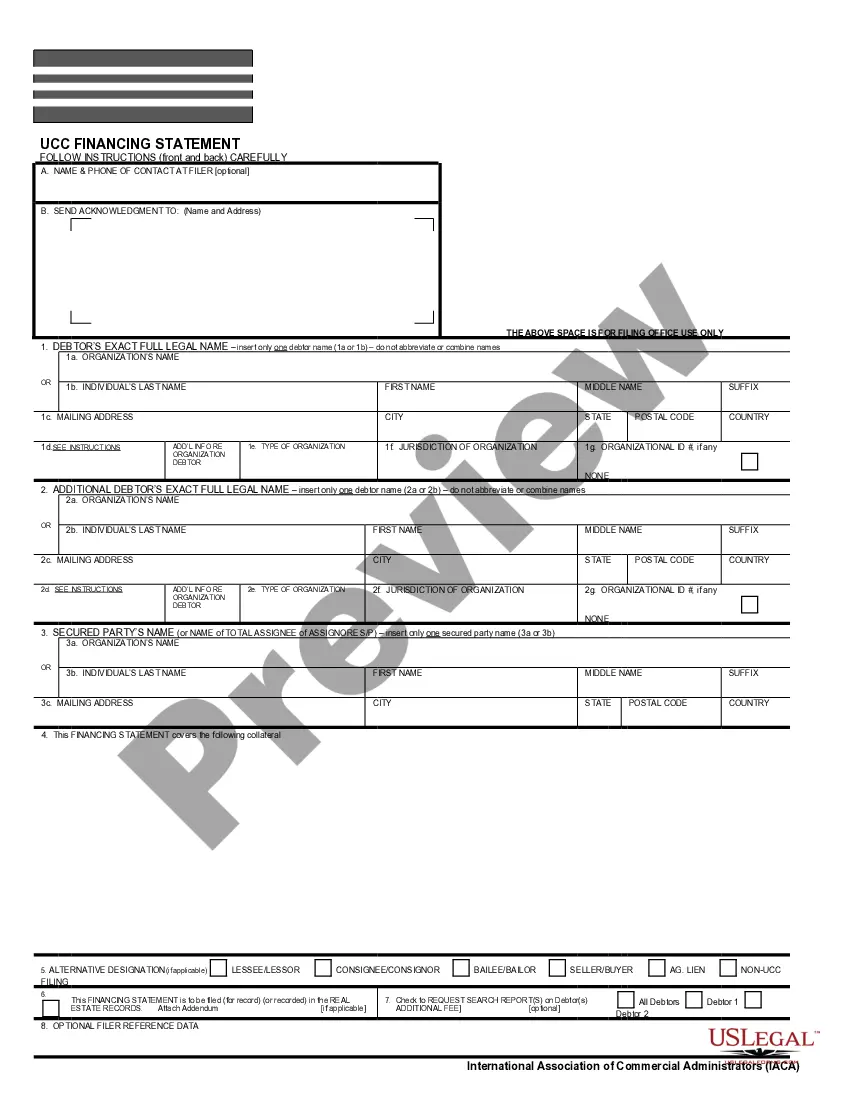

"Construction Loan Agreements and Variations" is a American Lawyer Media form. This form is to be used as a construction loan agreement.

Arizona Construction Loan Agreements and Variations

Description

How to fill out Construction Loan Agreements And Variations?

Are you within a situation the place you need to have papers for both organization or person uses virtually every time? There are a lot of authorized record themes available on the net, but getting ones you can rely is not simple. US Legal Forms gives a huge number of type themes, such as the Arizona Construction Loan Agreements and Variations, that happen to be published to meet state and federal specifications.

Should you be already informed about US Legal Forms web site and have an account, just log in. Next, you are able to down load the Arizona Construction Loan Agreements and Variations template.

Unless you come with an account and would like to begin to use US Legal Forms, follow these steps:

- Discover the type you want and ensure it is for the appropriate town/county.

- Take advantage of the Preview button to examine the form.

- Browse the information to ensure that you have chosen the appropriate type.

- In the event the type is not what you are looking for, utilize the Lookup industry to obtain the type that suits you and specifications.

- If you discover the appropriate type, just click Acquire now.

- Choose the costs program you desire, fill out the necessary information to make your account, and purchase the transaction using your PayPal or bank card.

- Pick a handy paper file format and down load your backup.

Discover all of the record themes you have purchased in the My Forms food selection. You can get a extra backup of Arizona Construction Loan Agreements and Variations anytime, if possible. Just click on the needed type to down load or print out the record template.

Use US Legal Forms, one of the most comprehensive selection of authorized kinds, to save time as well as avoid blunders. The service gives expertly created authorized record themes that you can use for a variety of uses. Produce an account on US Legal Forms and commence creating your daily life easier.

Form popularity

FAQ

There are 10 basic provisions that should be in a loan agreement. Identity of the parties. The names of the lender and borrower need to be stated. ... Date of the agreement. ... Interest rate. ... Repayment terms. ... Default provisions. ... Signatures. ... Choice of law. ... Severability.

How to make a family loan agreement The amount borrowed and how it will be used. Repayment terms, including payment amounts, frequency and when the loan will be repaid in full. The loan's interest rate. ... If the loan can be repaid early without penalty, and how much interest will be saved by early repayment.

Understanding the Important Clauses in a Loan Agreement #1: Fluctuation Of Interest Rates Clause: ... #2: 'Default' Definition Clause: ... #3: Security Cover Clause: ... #4: Disbursement Clause: ... #5: Force Majeure Clause: ... #6: Reset Clause: ... #7: Prepayment Clause: ... #8: Other Balances Set Off Clause:

The purpose for which funds may be used. Loan funding mechanics, and applicable interest. Repayment obligations. Representations, warranties and undertakings.

A loan agreement should be structured to include information about the borrower and the lender, the loan amount, and repayment terms, including interest charges and a timeline for repaying the loan. It should also spell out penalties for late payments or default and should be clear about expectations between parties.

Categorizing loan agreements by type of facility usually results in two primary categories: term loans, which are repaid in set installments over the term, or. revolving loans (or overdrafts) where up to a maximum amount can be withdrawn at any time, and interest is paid from month to month on the drawn amount.

What a personal loan agreement should include Legal names and address of both parties. Names and address of the loan cosigner (if applicable). Amount to be borrowed. Date the loan is to be provided. Repayment date. Interest rate to be charged (if applicable). Annual percentage rate (if applicable).

A credit agreement is a legally binding contract documenting the terms of a loan, made between a borrower and a lender. A credit agreement is used with many types of credit, including home mortgages, credit cards, and auto loans. Credit agreements can sometimes be renegotiated under certain circumstances.