Title: Request a Free Copy of Your Credit Report: Arizona Letter to Experian — A Comprehensive Guide for Denied Credit Applicants Introduction: If you have been denied credit and want to investigate the reasons behind it, one crucial step is to obtain a free copy of your credit report. Experian, formerly known as TRY, is one of the major credit reporting agencies that can provide you with this report. In Arizona, specific guidelines have been established for requesting this free copy. This article will provide a detailed description of what the Arizona letter to Experian formerlyYR— - requesting a free copy of your credit report based on denial of credit entails, while also mentioning any potential variations of such letters. Key Keywords: Arizona, letter, Experian, TRY, requesting, free copy, credit report, denial of credit Content: 1. Understanding the Purpose of the Arizona Letter: — Detail the significance of requesting a free copy of your credit report after being denied credit. — Emphasize the importance of investigating the causes behind the credit denial. — Explain how the letteExpediaia— - formerly TRY - can help in obtaining the necessary information. 2. Format of the Arizona Letter to Experian: — Begin with a formal salutation, addressing Experian as the designated credit reporting agency. — Clearly state your intention to request a free copy of your credit report. — Provide your personal information, including full name, address, contact details, and Social Security number. — Mention the denial of credit incident, including the name of the creditor and the date of denial. — Express your rights as a consumer under the Fair Credit Reporting Act (FCRA) and the Fair and Accurate Credit Transactions Act (FACT). — State the purpose of the letter and specify that it is being sent in accordance with Arizona state regulations. 3. Documentation and Attachments: — Encourage the inclusion of supporting documents if available, such as denial letters or any relevant correspondence. — Emphasize that these documents can help Experian assess the accuracy of their credit reporting. 4. Alternative Arizona Letters to Experian — based on Denial of Credit— - If there are no specific variations, state that the content outlined above applies to all cases in Arizona. — If applicable, mention any specialized letter formats required by Arizona state law, depending on the nature of credit denial (e.g., mortgage, car loan, credit card). 5. Closing the Letter: — Express gratitude for their attention and prompt handling of your request. — Provide your contact information once again for ease of communication. — Politely request confirmation of receipt and an estimated timeframe for receiving your free credit report. — Sign the letter with your full name. Conclusion: Crafting a thorough and concise letter to Experian formerlyYR— - is essential for successfully requesting a free copy of your credit report in Arizona. By following the guidelines and including all the necessary details, you are taking a proactive step towards understanding and improving your creditworthiness.

Arizona Letter to Experian - formerly TRW - Requesting Free Copy of Your Credit Report based on Denial of Credit

Description

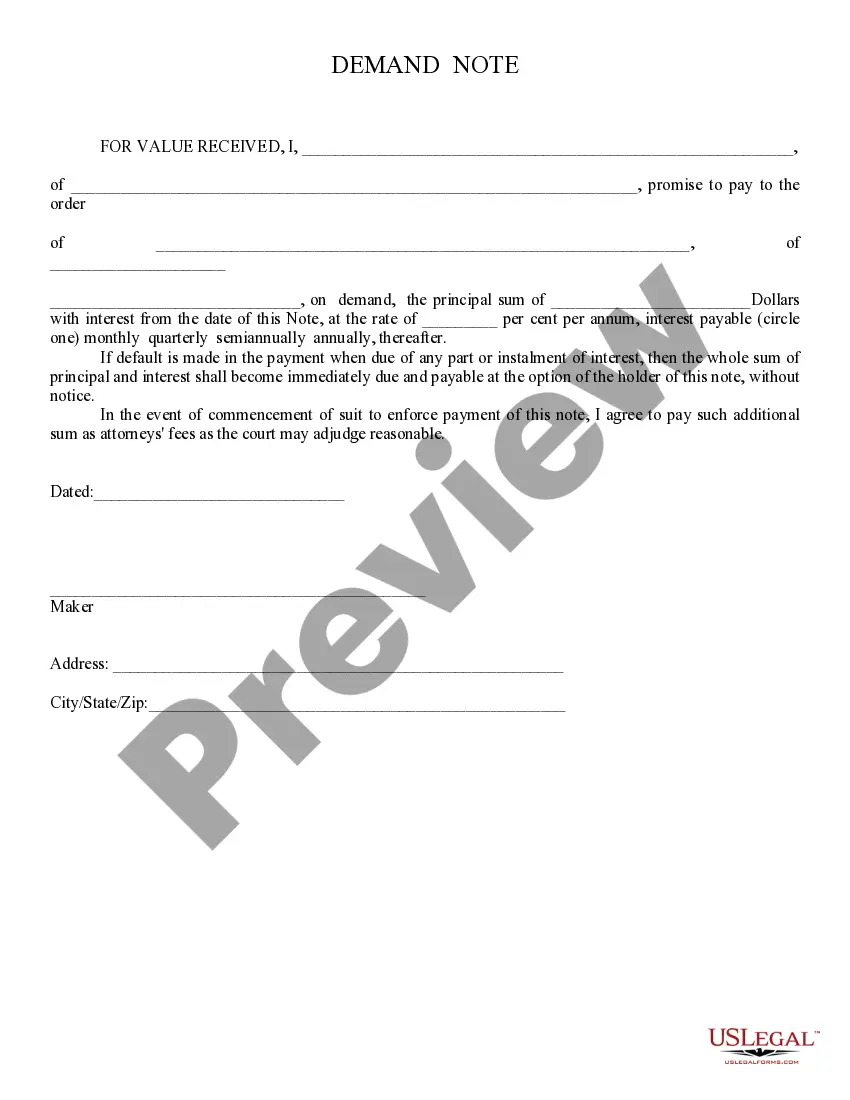

How to fill out Arizona Letter To Experian - Formerly TRW - Requesting Free Copy Of Your Credit Report Based On Denial Of Credit?

Choosing the best legitimate papers format can be quite a have difficulties. Of course, there are plenty of themes accessible on the Internet, but how can you find the legitimate develop you want? Make use of the US Legal Forms internet site. The services delivers a huge number of themes, such as the Arizona Letter to Experian - formerly TRW - Requesting Free Copy of Your Credit Report based on Denial of Credit, that you can use for enterprise and personal requirements. All the varieties are checked out by professionals and meet state and federal requirements.

If you are presently listed, log in to your account and click the Download switch to find the Arizona Letter to Experian - formerly TRW - Requesting Free Copy of Your Credit Report based on Denial of Credit. Utilize your account to check from the legitimate varieties you might have purchased previously. Check out the My Forms tab of your account and acquire yet another version of your papers you want.

If you are a brand new end user of US Legal Forms, listed below are basic instructions for you to stick to:

- Initial, ensure you have chosen the correct develop for your town/state. You are able to look over the shape while using Review switch and look at the shape description to ensure this is basically the right one for you.

- In the event the develop does not meet your preferences, utilize the Seach industry to obtain the appropriate develop.

- When you are certain the shape is proper, select the Acquire now switch to find the develop.

- Opt for the costs plan you want and type in the essential information. Create your account and buy the transaction making use of your PayPal account or bank card.

- Opt for the data file formatting and download the legitimate papers format to your system.

- Comprehensive, edit and printing and signal the obtained Arizona Letter to Experian - formerly TRW - Requesting Free Copy of Your Credit Report based on Denial of Credit.

US Legal Forms is definitely the greatest collection of legitimate varieties where you can discover numerous papers themes. Make use of the service to download appropriately-made papers that stick to state requirements.