Arizona Trust Agreement Nike Securities, L.P., The Chase Manhattan Bank, BISYS Fund Services Ohio, Inc. and First Trust Advisors, L.P.

Description

How to fill out Trust Agreement Nike Securities, L.P., The Chase Manhattan Bank, BISYS Fund Services Ohio, Inc. And First Trust Advisors, L.P.?

If you wish to complete, obtain, or print legitimate papers web templates, use US Legal Forms, the most important selection of legitimate kinds, that can be found online. Utilize the site`s simple and convenient research to get the papers you need. Numerous web templates for business and individual reasons are categorized by groups and states, or keywords. Use US Legal Forms to get the Arizona Trust Agreement Nike Securities, L.P., The Chase Manhattan Bank, BISYS Fund Services Ohio, Inc. and First Trust Advisors, L.P. within a few click throughs.

In case you are currently a US Legal Forms client, log in in your profile and click on the Down load key to have the Arizona Trust Agreement Nike Securities, L.P., The Chase Manhattan Bank, BISYS Fund Services Ohio, Inc. and First Trust Advisors, L.P.. You can even access kinds you in the past acquired from the My Forms tab of your own profile.

If you work with US Legal Forms for the first time, refer to the instructions under:

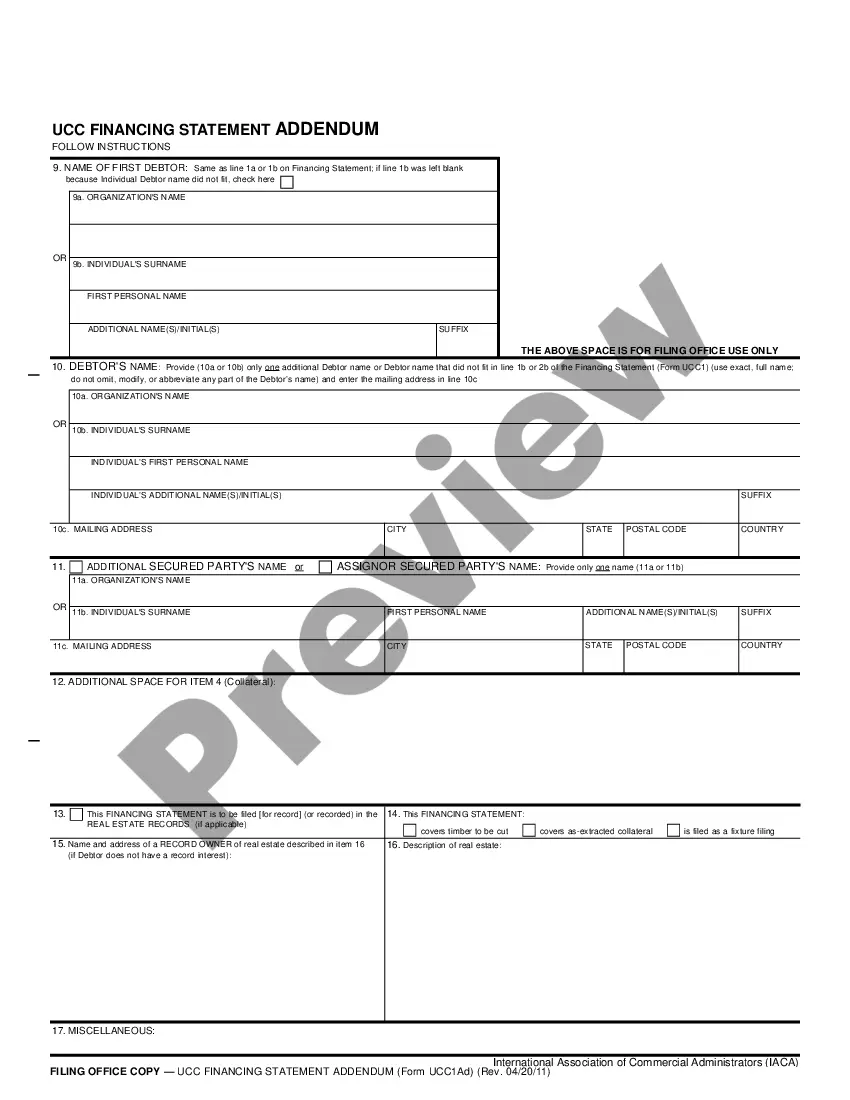

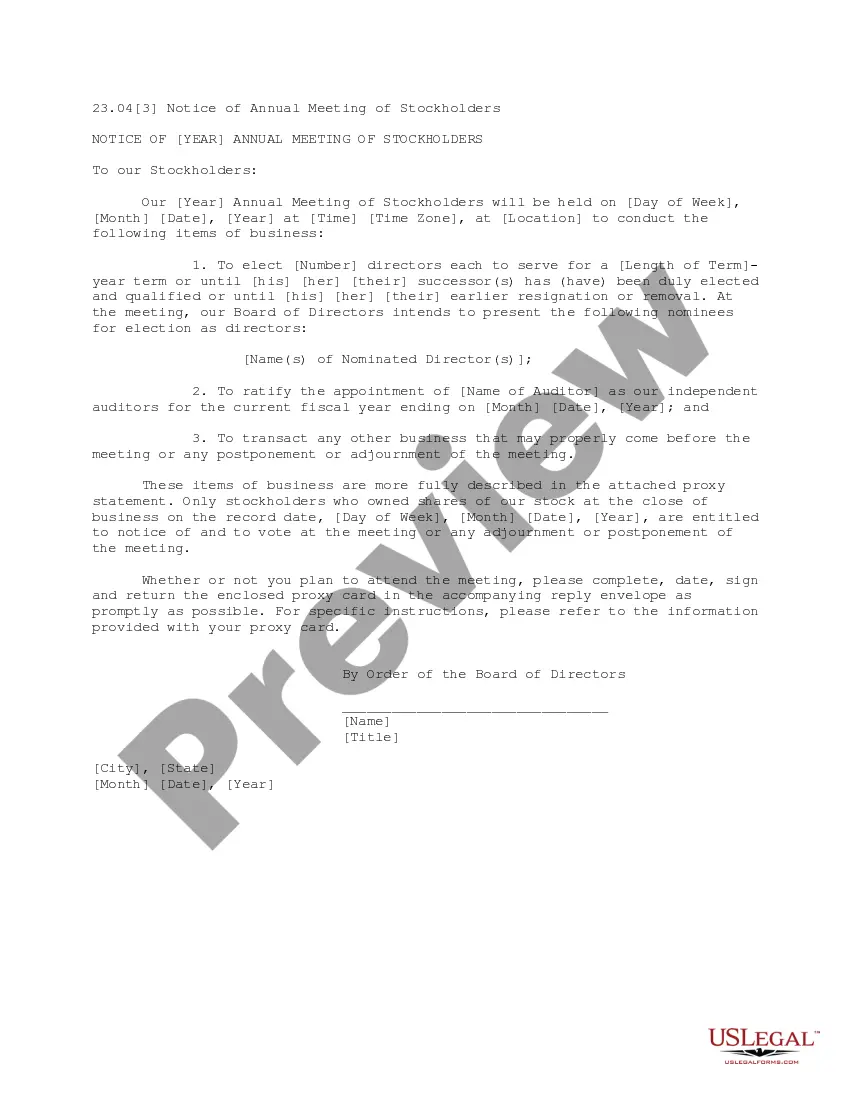

- Step 1. Ensure you have selected the form to the proper city/nation.

- Step 2. Make use of the Preview method to look through the form`s content material. Do not forget to see the explanation.

- Step 3. In case you are not happy together with the develop, utilize the Search industry at the top of the display to locate other models from the legitimate develop format.

- Step 4. Once you have found the form you need, click on the Get now key. Opt for the pricing program you favor and put your accreditations to sign up to have an profile.

- Step 5. Process the financial transaction. You can utilize your Мisa or Ьastercard or PayPal profile to finish the financial transaction.

- Step 6. Pick the format from the legitimate develop and obtain it in your gadget.

- Step 7. Comprehensive, edit and print or indicator the Arizona Trust Agreement Nike Securities, L.P., The Chase Manhattan Bank, BISYS Fund Services Ohio, Inc. and First Trust Advisors, L.P..

Each and every legitimate papers format you buy is your own property permanently. You may have acces to each and every develop you acquired within your acccount. Click the My Forms portion and pick a develop to print or obtain once again.

Contend and obtain, and print the Arizona Trust Agreement Nike Securities, L.P., The Chase Manhattan Bank, BISYS Fund Services Ohio, Inc. and First Trust Advisors, L.P. with US Legal Forms. There are many expert and state-distinct kinds you can use for your business or individual requirements.