An Arizona Escrow Agreement is a legally binding contract established between The Trident Group, Inc., the Finger Security holders, Stuart Schloss, and Bankers Trust Co. This agreement serves as a safeguard for all parties involved in a financial transaction, providing a secure and controlled environment for the BS crowed funds or assets until specific conditions are met or obligations fulfilled. In this particular scenario, The Trident Group, Inc. is the depositor of the assets or funds that will be held in escrow. The Finger Security holders are the beneficiaries of this escrow arrangement, possibly referring to shareholders or investors in the Finger sector. Stuart Schloss may serve as the designated escrow agent who oversees the fulfillment of the agreement's terms and conditions. Bankers Trust Co. acts as the neutral third-party entity responsible for holding and administering the BS crowed assets or funds. The Arizona Escrow Agreement involves various key aspects to ensure the smooth execution of the transaction. These may include the identification of the BS crowed assets or funds, the duration of the escrow period, specific conditions that must be met for the release of the BS crowed assets, and the responsibilities and liabilities of each party involved. Different types of Arizona Escrow Agreements may exist depending on the specific nature of the transaction or parties involved. These could include: 1. Asset Purchase Escrow Agreement: If this agreement is related to the acquisition of assets by The Trident Group, Inc., it may outline the conditions under which the funds will be released to the sellers, ensuring that all necessary legal documents and requirements have been fulfilled. 2. Stock Purchase Escrow Agreement: In the case of acquiring stocks or shares from the Finger Security holders, this agreement could clarify the terms for releasing the BS crowed funds to the selling party, such as the resolution of any outstanding legal disputes or regulatory compliance. 3. Merger & Acquisition Escrow Agreement: If the purpose of this escrow arrangement is to facilitate a merger or acquisition involving The Trident Group, Inc. and Finger Security holders, the details of the agreement might encompass the exchange of funds, assets, or stocks according to specified conditions, timelines, and regulatory approvals. Regardless of the specific type, an Arizona Escrow Agreement is designed to protect the interests of all parties engaged in the transaction, ensuring transparency, compliance with legal requirements, and a smooth transfer of assets or funds upon meeting predetermined conditions.

Arizona Escrow Agreement between The TriZetto Group, Inc., the Finserv Securityholders, Stuart Schloss and Bankers Trust Co.

Description

How to fill out Escrow Agreement Between The TriZetto Group, Inc., The Finserv Securityholders, Stuart Schloss And Bankers Trust Co.?

Finding the right legitimate record format might be a battle. Obviously, there are a lot of templates available on the net, but how would you get the legitimate type you require? Use the US Legal Forms website. The assistance gives 1000s of templates, such as the Arizona Escrow Agreement between The TriZetto Group, Inc., the Finserv Securityholders, Stuart Schloss and Bankers Trust Co., that can be used for enterprise and personal requires. Each of the forms are checked by pros and fulfill federal and state specifications.

Should you be previously listed, log in to the account and click the Download switch to have the Arizona Escrow Agreement between The TriZetto Group, Inc., the Finserv Securityholders, Stuart Schloss and Bankers Trust Co.. Use your account to look from the legitimate forms you might have ordered earlier. Check out the My Forms tab of your respective account and get an additional copy of your record you require.

Should you be a whole new user of US Legal Forms, listed below are basic recommendations that you should adhere to:

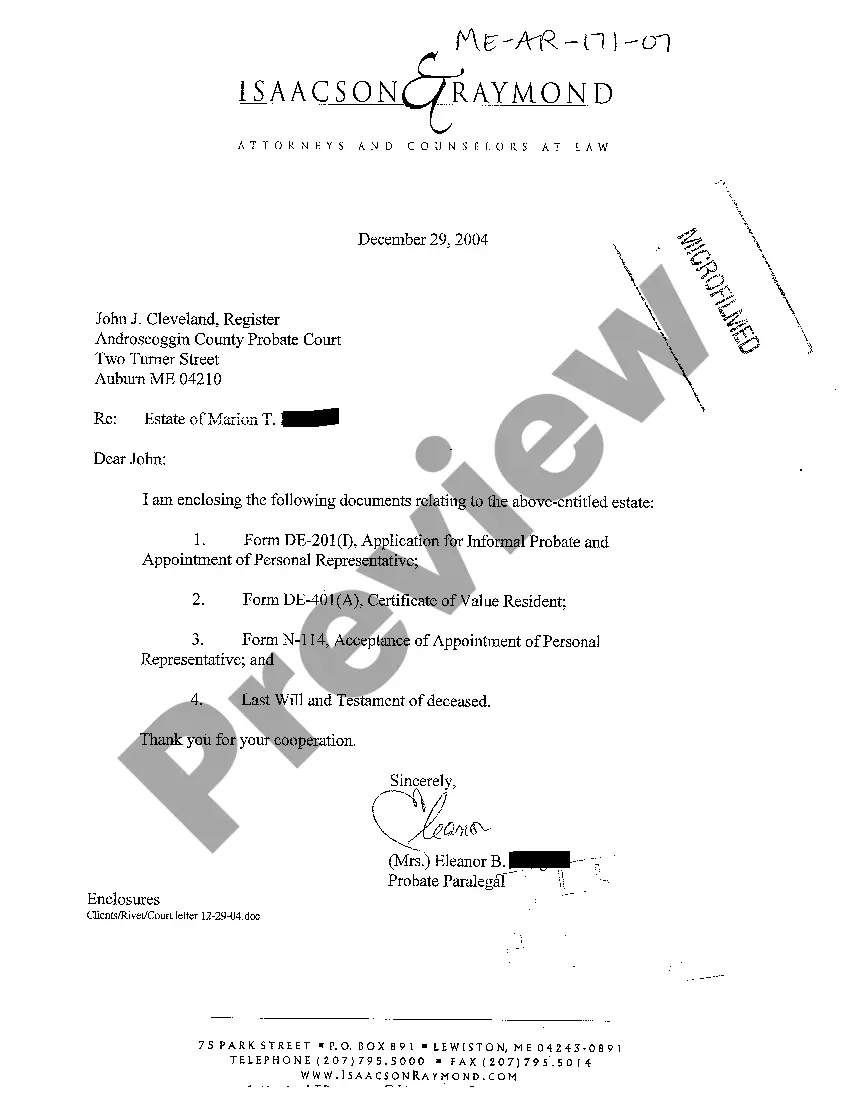

- Very first, make sure you have selected the proper type for your personal city/state. It is possible to look over the form using the Preview switch and read the form explanation to make sure it is the best for you.

- In the event the type does not fulfill your expectations, utilize the Seach area to obtain the appropriate type.

- Once you are certain that the form is acceptable, go through the Purchase now switch to have the type.

- Choose the costs prepare you want and type in the required details. Build your account and pay money for your order making use of your PayPal account or charge card.

- Choose the data file structure and acquire the legitimate record format to the system.

- Complete, modify and print and indication the attained Arizona Escrow Agreement between The TriZetto Group, Inc., the Finserv Securityholders, Stuart Schloss and Bankers Trust Co..

US Legal Forms is the most significant collection of legitimate forms for which you can see various record templates. Use the service to acquire professionally-made papers that adhere to status specifications.