Arizona Plan of Reorganization between Ingenuity Capital Trust and Firsthand Funds

Description

How to fill out Plan Of Reorganization Between Ingenuity Capital Trust And Firsthand Funds?

If you wish to complete, down load, or produce legitimate document templates, use US Legal Forms, the greatest collection of legitimate forms, that can be found online. Make use of the site`s simple and easy convenient lookup to get the paperwork you will need. A variety of templates for organization and specific uses are categorized by categories and claims, or keywords and phrases. Use US Legal Forms to get the Arizona Plan of Reorganization between Ingenuity Capital Trust and Firsthand Funds with a couple of mouse clicks.

Should you be currently a US Legal Forms buyer, log in for your accounts and then click the Download option to have the Arizona Plan of Reorganization between Ingenuity Capital Trust and Firsthand Funds. You may also entry forms you in the past downloaded from the My Forms tab of your accounts.

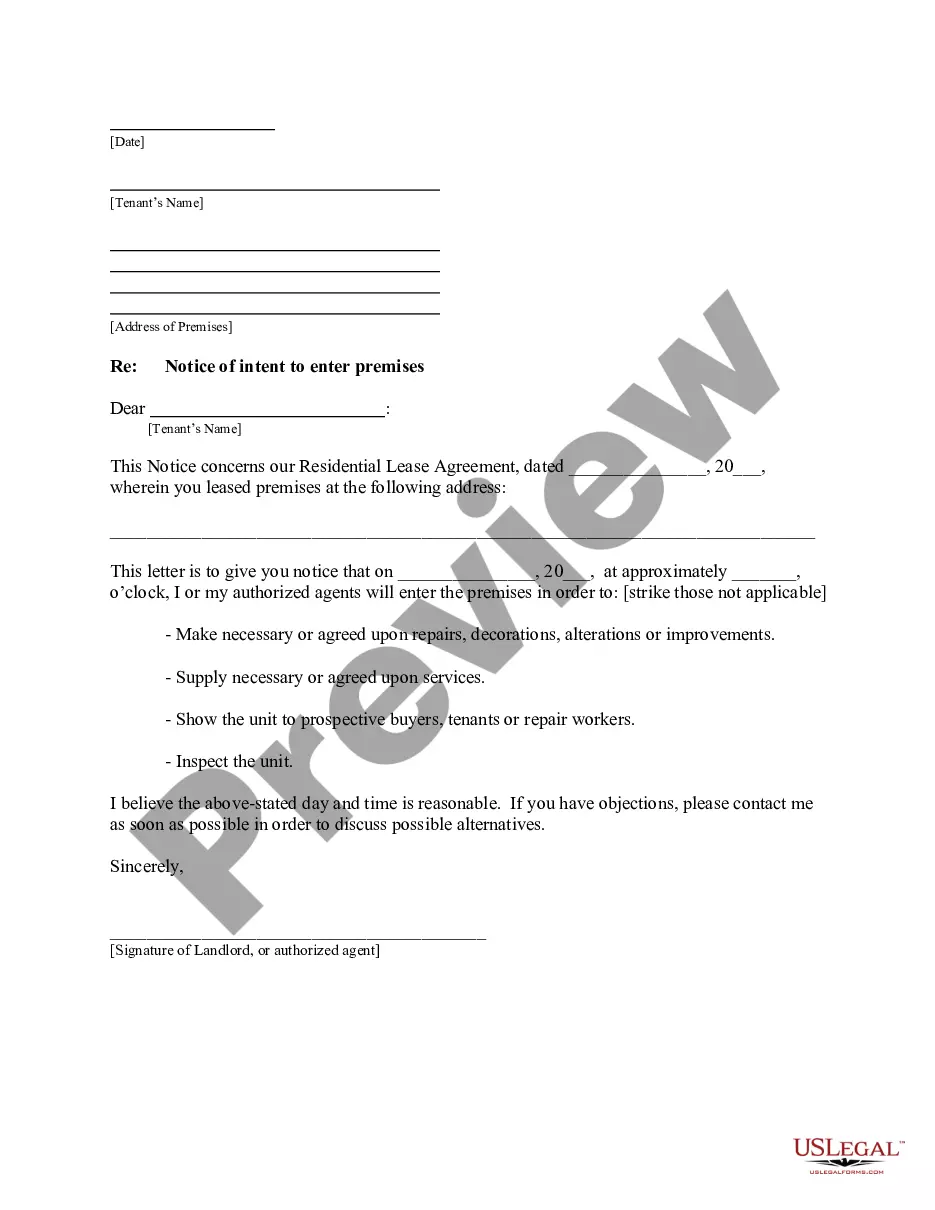

If you are using US Legal Forms the very first time, refer to the instructions under:

- Step 1. Be sure you have selected the form for that proper city/nation.

- Step 2. Make use of the Preview solution to look through the form`s content material. Never neglect to read through the explanation.

- Step 3. Should you be unhappy with all the kind, take advantage of the Research industry near the top of the display screen to discover other models from the legitimate kind format.

- Step 4. When you have found the form you will need, go through the Acquire now option. Pick the rates prepare you like and include your credentials to register on an accounts.

- Step 5. Procedure the purchase. You may use your Мisa or Ьastercard or PayPal accounts to complete the purchase.

- Step 6. Find the file format from the legitimate kind and down load it on the product.

- Step 7. Comprehensive, edit and produce or indication the Arizona Plan of Reorganization between Ingenuity Capital Trust and Firsthand Funds.

Each and every legitimate document format you purchase is the one you have forever. You might have acces to each and every kind you downloaded with your acccount. Click the My Forms segment and select a kind to produce or down load once more.

Remain competitive and down load, and produce the Arizona Plan of Reorganization between Ingenuity Capital Trust and Firsthand Funds with US Legal Forms. There are thousands of skilled and state-specific forms you can utilize for your organization or specific demands.